Why Bitcoin Corrections Are Not the End — They’re the Signal

Every cycle, the market tells the same story.

Most people just don’t know how to read it.

At first glance, pullbacks look scary. Red candles appear, momentum slows, and social media fills with “top is in”narratives. But when you zoom out and study market structure, a different picture emerges — one of controlled corrections and calculated continuation.

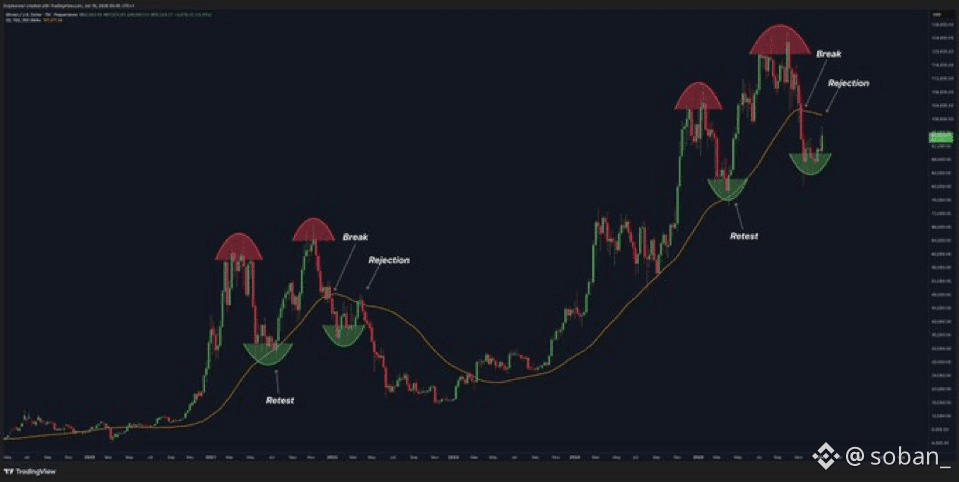

The chart above captures this perfectly.

📉 Break, Reject, Retest — The Market’s Favorite Pattern

Notice how price doesn’t collapse after a rejection. Instead, it follows a disciplined sequence:

Break above a key level

Rejection that shakes out late buyers

Retest of structure or moving average support

Continuation to new highs

This pattern has repeated multiple times across the chart — and each time, the retest acted as a launchpad, not a breakdown.

Markets don’t move in straight lines.

They move in phases designed to test patience.

🧠 Why This Structure Matters

Healthy bull markets correct upwards, not downwards.

These pullbacks:

Reset leverage

Cool down momentum

Force emotional traders out

Meanwhile, price continues to respect higher-timeframe support, signaling that the trend remains intact.

Calling a bear market during this phase is like calling winter in the middle of summer — it ignores structure.

💧 Liquidity First, Expansion Later

Each rejection visible on the chart swept liquidity before the next leg higher. This is not random behavior. It’s how large participants position themselves without chasing price.

Liquidity is taken first.

Expansion comes next.

🚀 What Traders Should Watch Now

Instead of reacting to fear:

Watch how price behaves on retests

Track structure, not emotions

Let confirmation lead decisions

As long as higher lows are protected, pullbacks are part of the trend — not the end of it.

🔍 Final Thought

This chart is a reminder that markets reward patience, context, and discipline.

Corrections are not warnings.

They are invitations — for those who understand structure.

#Bitcoin❗ #CryptoMarket #Marketstructure #liquidity #TradingPsychology