For centuries, gold has been the undisputed king of "hard money." But as we move further into 2026, a fundamental shift is occurring. While gold remains a steady, defensive asset, Bitcoin (BTC) has matured into a superior store of value for the modern age.

Here is why Bitcoin is winning the "Digital Gold" debate.

1. Absolute Scarcity vs. "Maybe" Scarcity

Gold is rare, but its supply is not fixed. If the price of gold skyrockets, mining companies find it profitable to dig deeper or explore new regions, increasing the supply. Even "asteroid mining" is a theoretical future threat to gold’s rarity.

Bitcoin has a mathematical ceiling. There will only ever be 21 million BTC. This supply is governed by code, not by how much effort someone puts into "digging." In a world of infinite money printing, Bitcoin is the only asset with a truly finite supply.

2. Portability and Global Reach

Try moving $1 million worth of gold across an international border. You would need armored transport, security, and massive insurance. It is heavy, conspicuous, and slow.

Bitcoin is weightless. You can carry $1 billion in your pocket on a thumb drive or simply memorize a "seed phrase." You can send it to anyone, anywhere in the world, in minutes for a fraction of the cost. In 2026’s globalized digital economy, gold’s physical weight has become its greatest liability.

3. Verifiability and Purity

To verify that a gold bar is real and 24-karat, you need specialized equipment or a professional appraiser. Counterfeit "gold-plated tungsten" bars are a constant concern in the physical market.

Bitcoin is impossible to fake. Every single satoshi (the smallest unit of BTC) is tracked on a public ledger called the blockchain. Every node in the network instantly verifies the authenticity of a transaction. You don't need to "trust" a jeweler; you trust the math.

4. Divisibility for the Everyday User

Gold is difficult to use for small transactions. Shaving off a tiny flake of gold to buy a coffee is impractical and inaccurate.

Bitcoin is hyper-divisible. One Bitcoin can be divided into 100 million pieces (Satoshis). Whether you are an institutional investor buying $100 million or a student saving $10, Bitcoin scales to fit your needs perfectly.

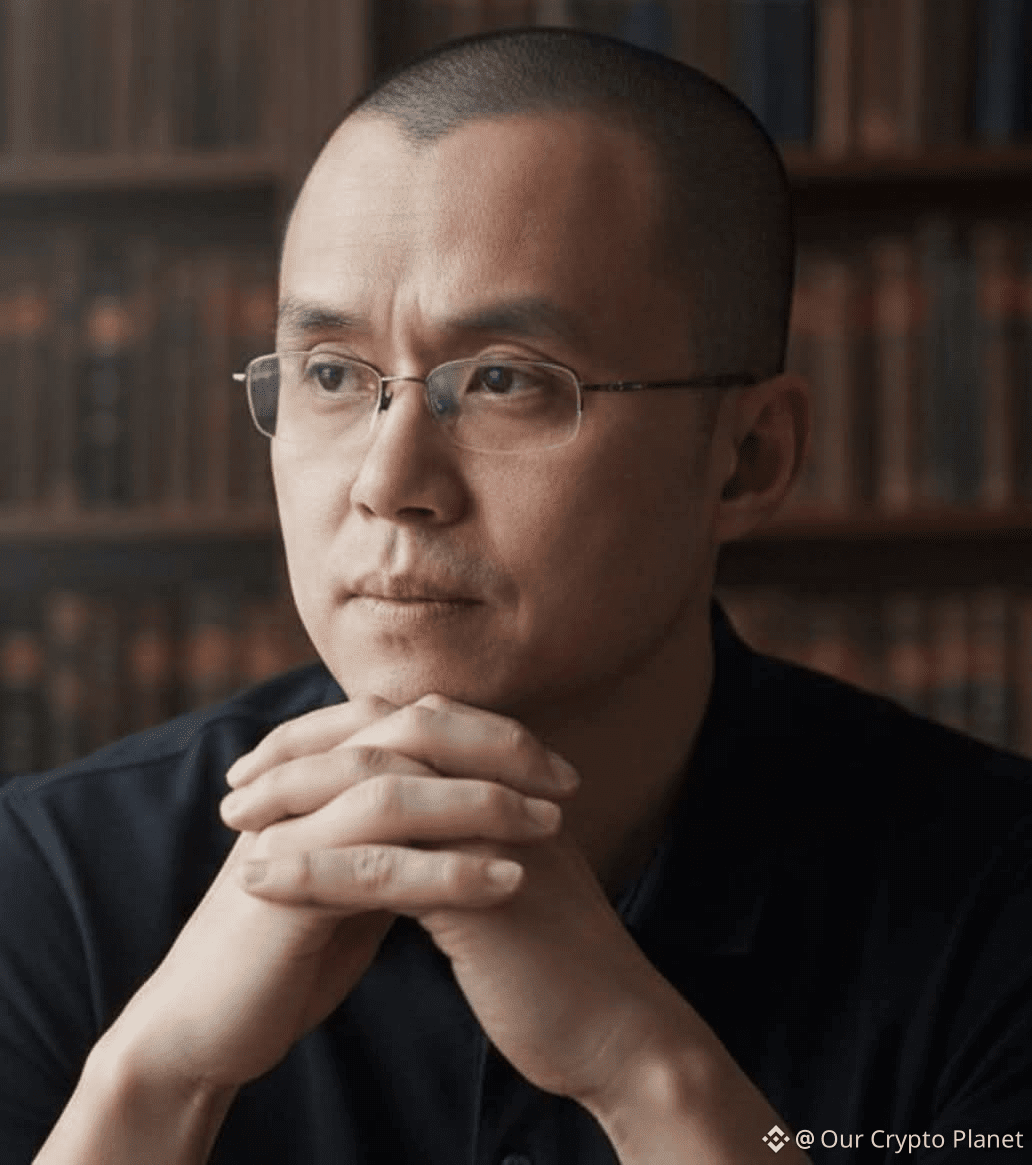

As @CZ Said: "We literally do not know how much gold exists on Earth, but with Bitcoin, we know exactly how much there is and where it is—it is the only truly finite, transparent asset humanity possesses"

Bitcoin vs. Gold: A 2026 Snapshot

The Verdict

Gold is a great "defensive shield" for those looking to preserve wealth exactly as it is. However, for those looking for asymmetric growth and a store of value that fits a digital lifestyle, Bitcoin is the clear winner.

As institutional adoption through ETFs has hit record highs in early 2026, the "Digital Gold" narrative is no longer a theory—it is the market reality.