Executive Summary: Crypto’s 2026 Outlook Based on 2025 Data:

- Follow our account @DrZayed for the latest crypto news.

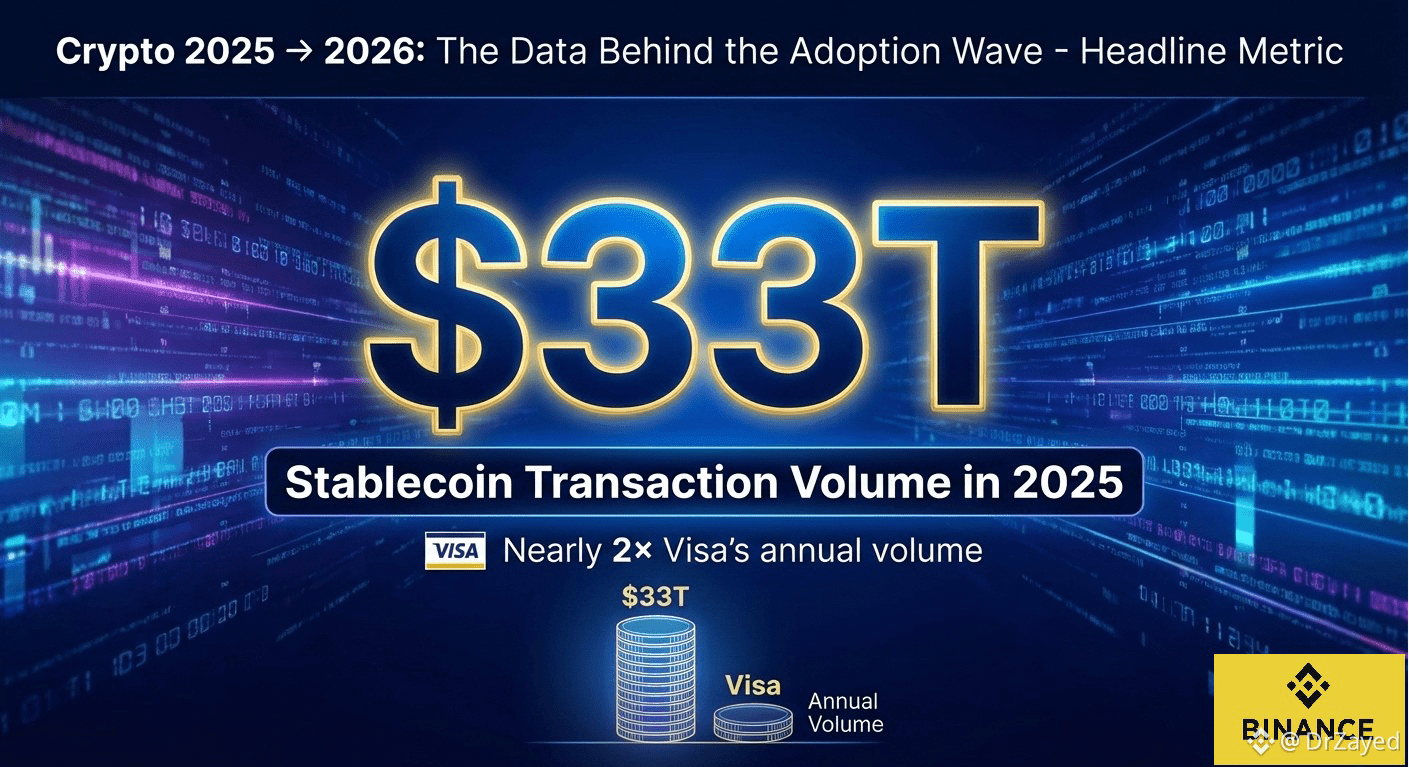

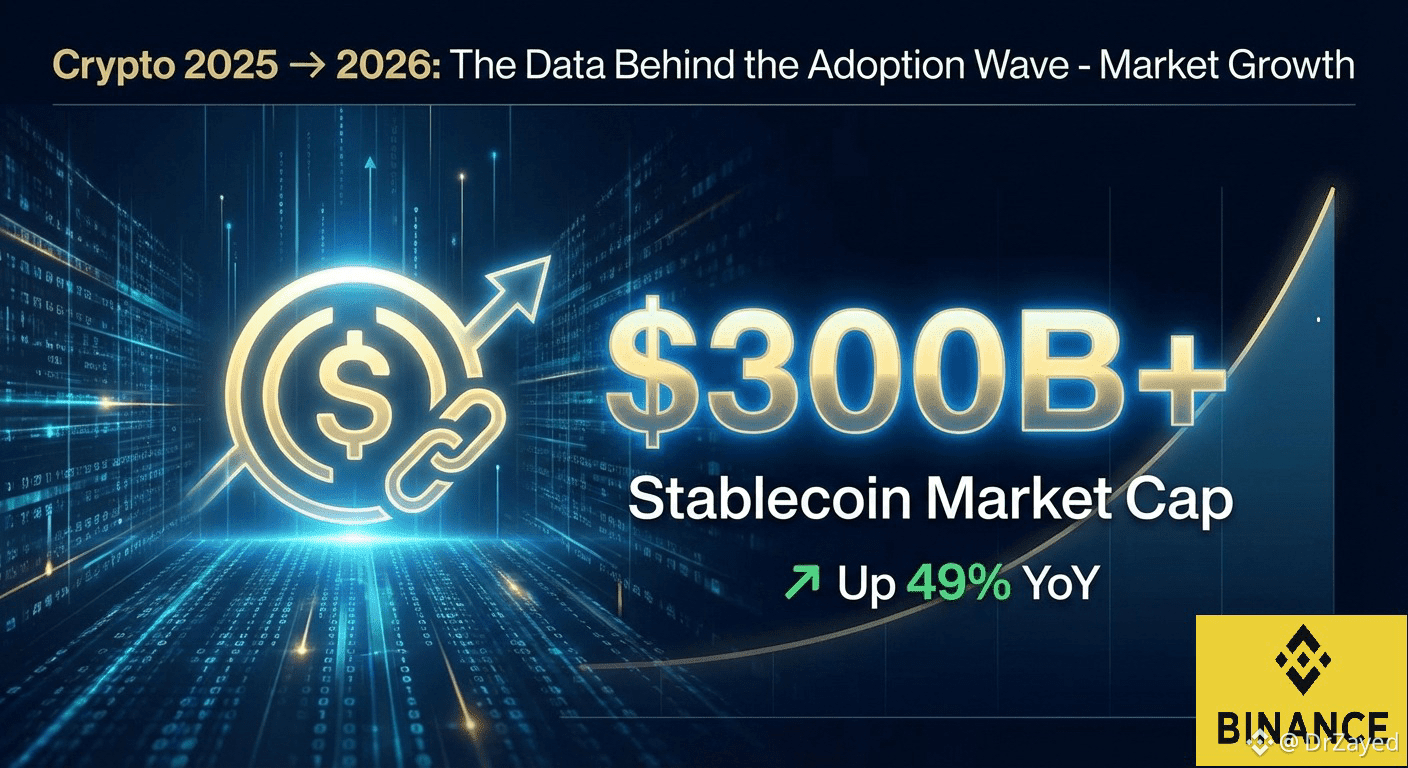

Binance Research’s 2025 analysis reveals a digital asset ecosystem entering a new phase of maturity, driven by real-world usage, sustainable revenue, and macro-level investor behavior. Stablecoins processed $33 trillion in annual volume—nearly double Visa’s throughput—while total stablecoin market cap surpassed $300 billion, growing 49% year-over-year.

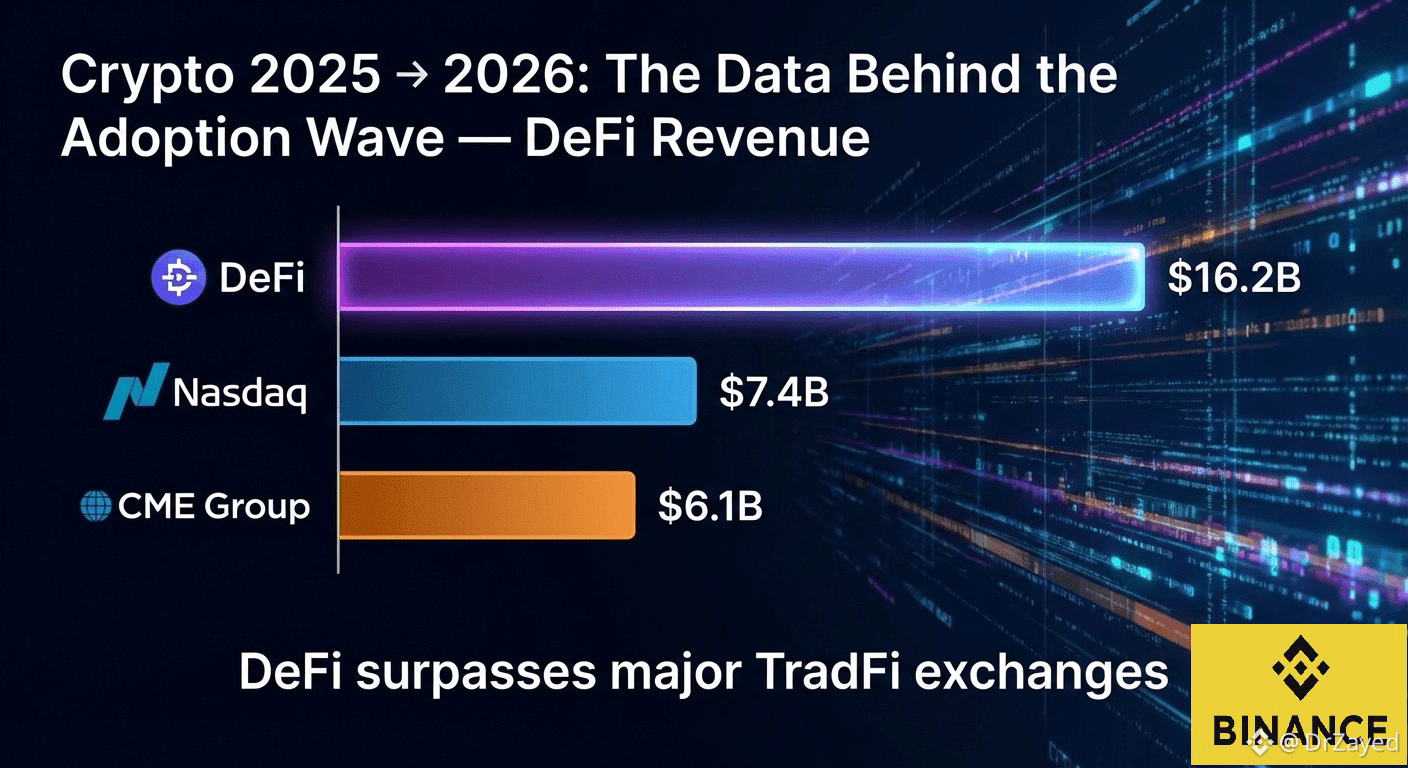

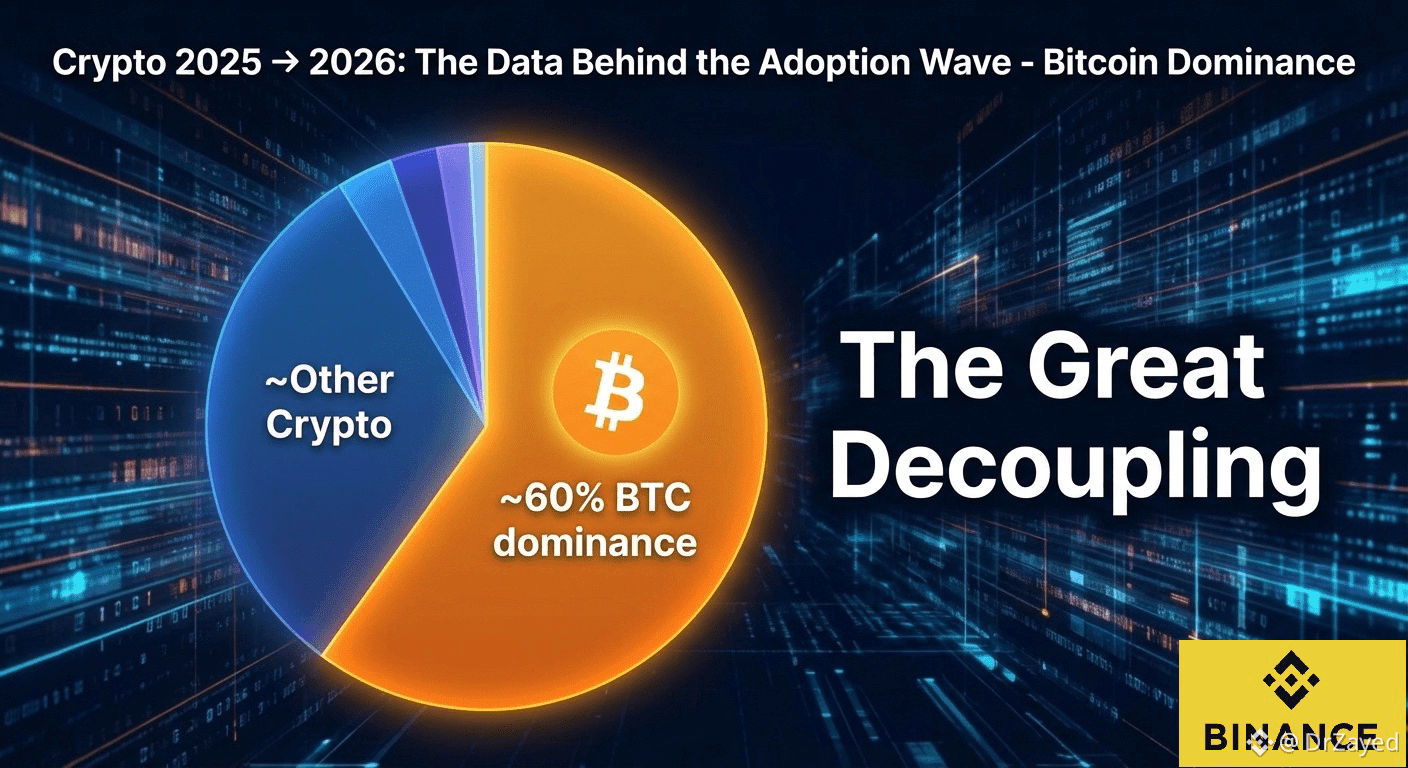

DeFi protocols generated $16.2 billion in revenue, exceeding the combined earnings of Nasdaq and CME Group, marking a historic milestone for decentralized financial infrastructure. Bitcoin ended the year with ~60% dominance, reflecting investor consolidation into BTC amid global uncertainty — a trend Binance Research identifies as The Great Decoupling.

BNB Chain processed 15–18 million daily transactions, demonstrating large-scale real-world usage, while BNB Greenfield saw a 565% increase in decentralized data network activity.

Together, these metrics point to a clear conclusion: 2026 will be an adoption-led year, defined by institutional integration, stablecoin expansion, DeFi’s continued revenue growth, and the rise of high-throughput blockchain ecosystems.