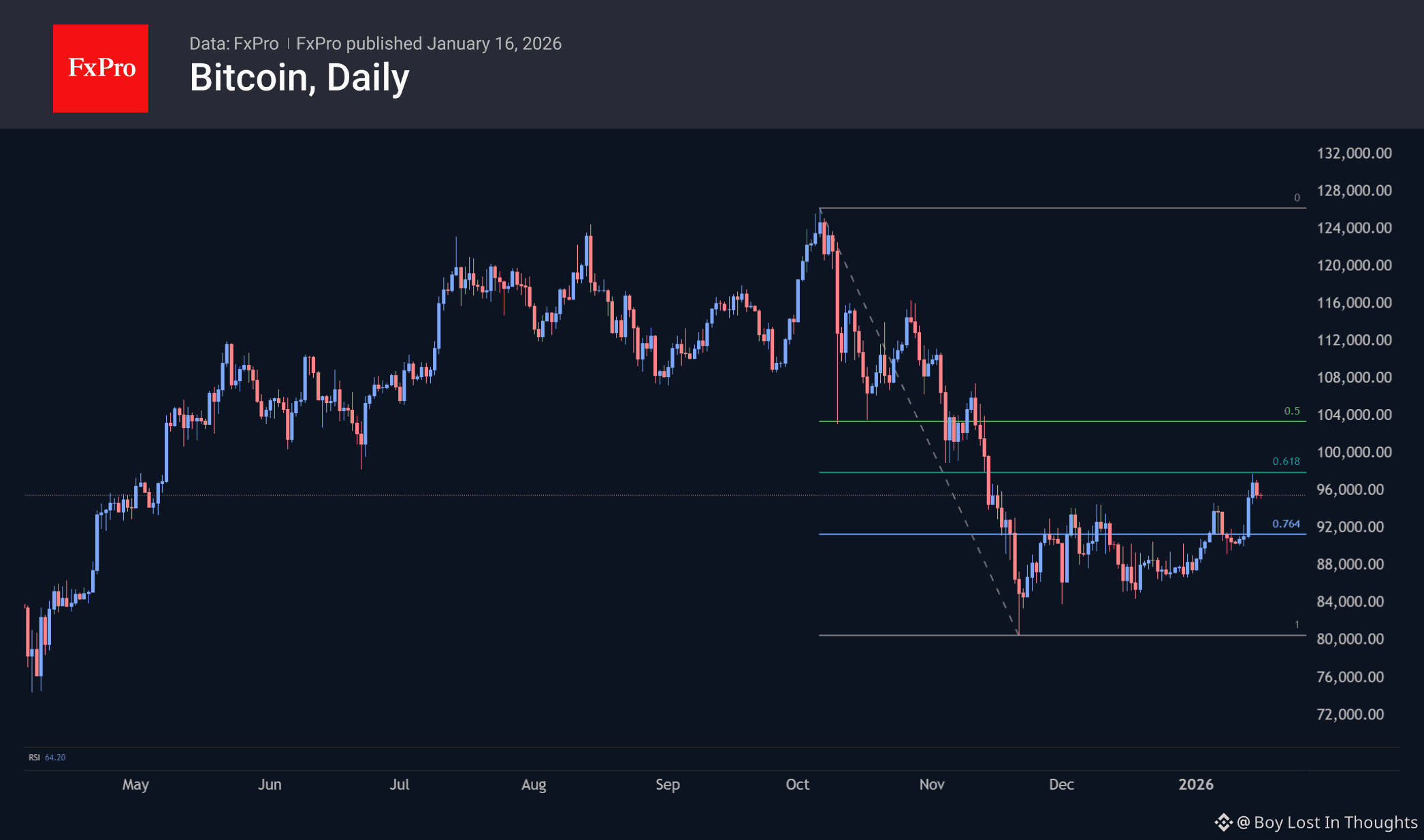

Bitcoin is currently hovering around $95.5K after pulling back from the $98K mark—a level that aligns with the significant 61.8% Fibonacci retracement line. The cryptocurrency is now at a critical technical juncture, with its next directional move largely dependent on external catalysts, as major economic data is sparse in the near term.

Key Points:

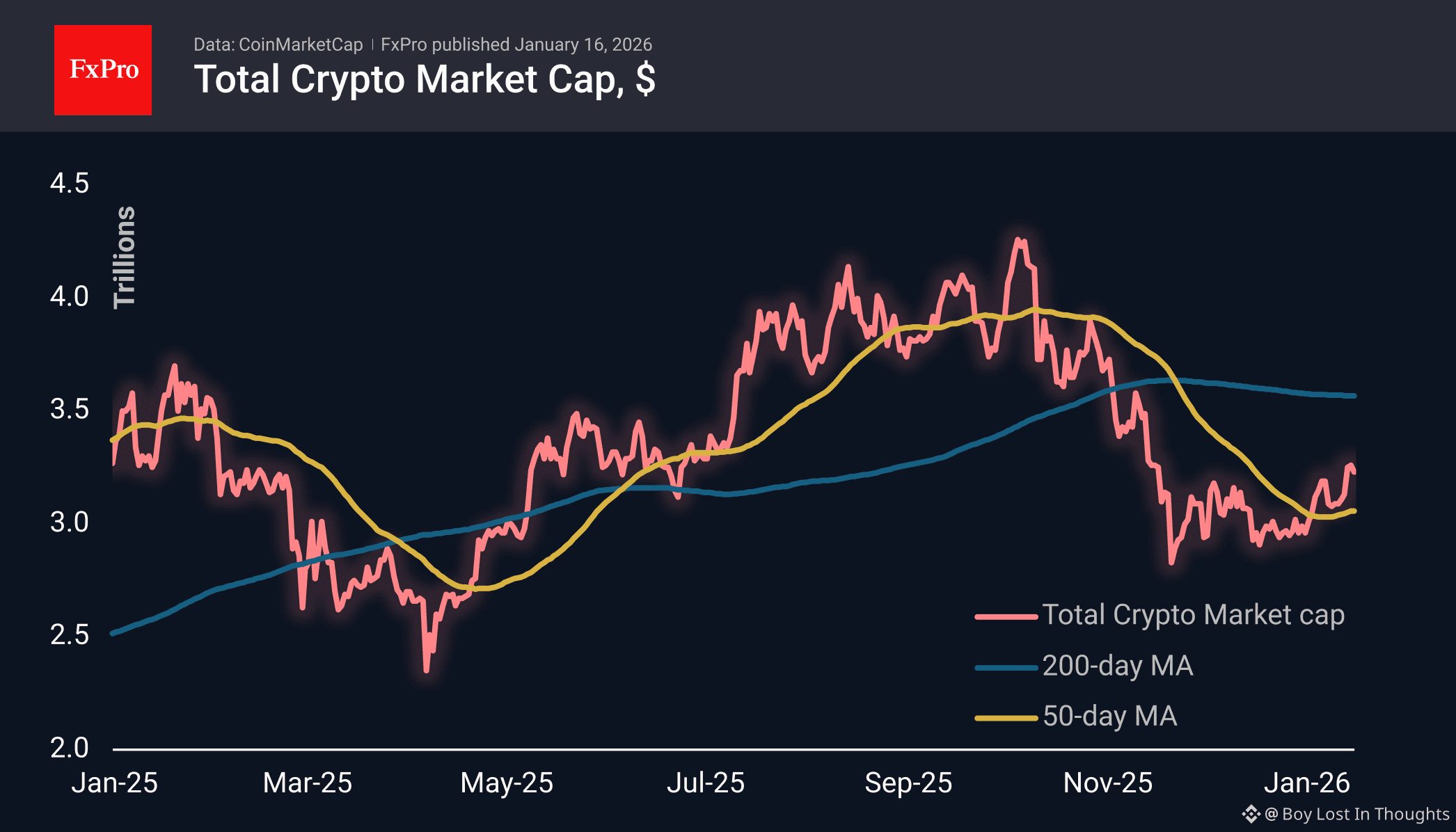

Market Pullback: The crypto market dipped 1.5% in 24 hours, settling at a $3.23 trillion capitalization. Large-cap assets saw minor declines, while smaller altcoins fell more sharply—except Tron, which continued its steady rise.

Critical Technical Level: Bitcoin is testing the 61.8% Fibonacci retracement near $98K. A clear breakout or rejection here could determine the near-term trend.

Low Exchange Supply: Bitcoin holdings on exchanges have hit a seven-month low, suggesting reduced selling pressure.

Holder Behavior: Long-term Bitcoin holders are not taking profits despite recent price increases, indicating underlying strength rather than speculative frenzy.

Reduced Leverage: Open interest in Bitcoin derivatives is down 28% from its October peak, signaling a healthier, less overheated market.

Sentiment & Risk: Over 47,000 retail investors exited recently amid fear and uncertainty. While some metrics appear optimistic, the options market still reflects caution, and recent price movements may be driven more by short squeezes than new capital inflows.

Regulatory Note: The SEC has closed its case against the Zcash Foundation, removing a minor regulatory overhang for the privacy-focused coin.

In short: Bitcoin is consolidating at a pivotal technical level amid mixed signals—strongholder conviction and lower exchange supply provide support, but low liquidity and retail caution suggest volatility ahead. All eyes are on whether BTC can break above the $98K Fibonacci barrier.