Many networks treat tokens as incentives first and infrastructure second. Dusk reverses this order. The DUSK token is tightly linked to how the network operates rather than how it markets itself.

Many networks treat tokens as incentives first and infrastructure second. Dusk reverses this order. The DUSK token is tightly linked to how the network operates rather than how it markets itself.

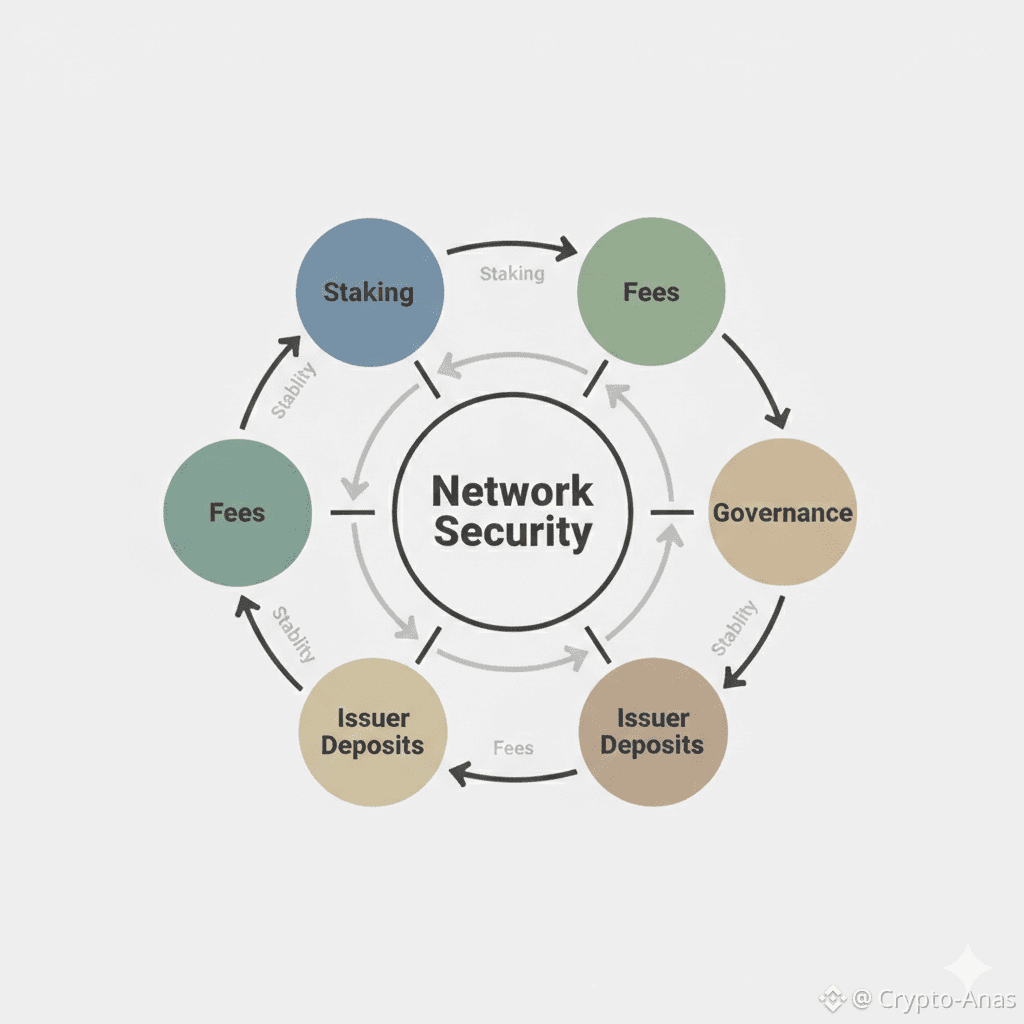

Staking DUSK secures the Segregated Byzantine Agreement consensus, which delivers deterministic finality in seconds. Fees are priced around confidential computation, not cheap spam transactions. Security deposits align asset issuers with regulatory responsibility.

Governance on Dusk is slow by design. That may feel boring, but financial systems require stability, not emotional voting. My perspective is simple. If regulated assets move on-chain at scale, tokens with real structural roles will matter more than tokens built for hype cycles.

DUSK

0.2146

+1.08%