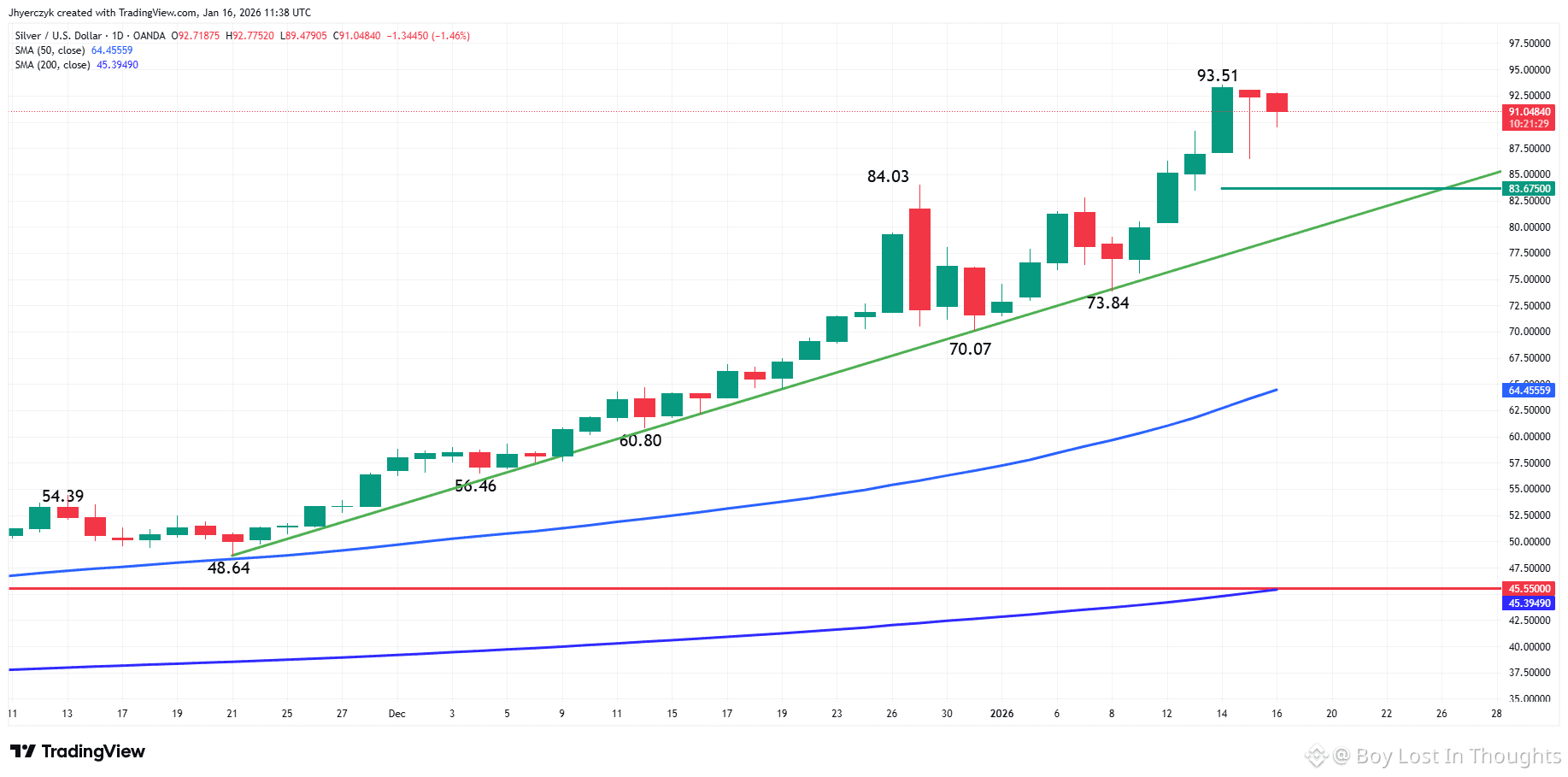

Silver (XAG/USD) maintains a solid bullish trend, backed by strong technical indicators and supportive fundamentals—including anticipated Fed rate cuts and robust industrial demand. While short-term factors like easing Iran concerns have triggered profit-taking, the larger uptrend remains unbroken. Traders now face a tactical decision: either pursue a breakout above $93.51 or wait for a dip toward the value area around $83.67. Key support levels lie at $83.67 and $78.88, with long-term moving averages providing a safety net. Regardless of short-term fluctuations, silver's structural outlook remains positive.

Major Points Highlighted:

Uptrend Firmly Intact

Silver’s bullish trend is confirmed by swing charts, trendlines, and moving averages (50-day and 200-day).

Critical resistance level is $93.51; a break above signals further upward momentum.

Traders Face a Strategic Choice

Option A: Chase the breakout above $93.51 for momentum plays.

Option B: Wait for a pullback to the value zone near $83.67 for a more favorable entry.

Strong Fundamental Backing

Expectations of Fed rate cuts in 2026 continue to support the bullish outlook.

Surging industrial demand from AI, electric vehicles, and solar energy sustains long-term optimism.

Persistent supply constraints add further upward pressure on prices.

Short-Term Volatility from Geopolitics & Policy

Recent price dips are attributed to profit-taking as Iran tensions ease.

Trump’s shifting stance on Iran and delayed tariffs have injected near-term volatility.

Core fundamentals remain unchanged, with dips viewed as potential buying opportunities.

Key Technical Levels to Watch

Support: $83.67 (50% retracement level), followed by $78.88 (trendline support).

Long-term support: 50-DMA at $64.45 and 200-DMA at $45.39.

A fall below $73.84 would signal a trend reversal.