Most blockchains are built like digital cities. They try to host everything: DeFi, NFTs, gaming, social apps, and payments. Plasma made a very different choice. It stripped everything down and asked one hard question: what if a blockchain was designed only to move stablecoins at global scale?

That design decision changes everything.

Instead of optimizing for flexibility, Plasma optimizes for predictability. In payments, speed and cost matter more than composability. A USDT transfer should feel like sending a message, not like interacting with a smart contract.

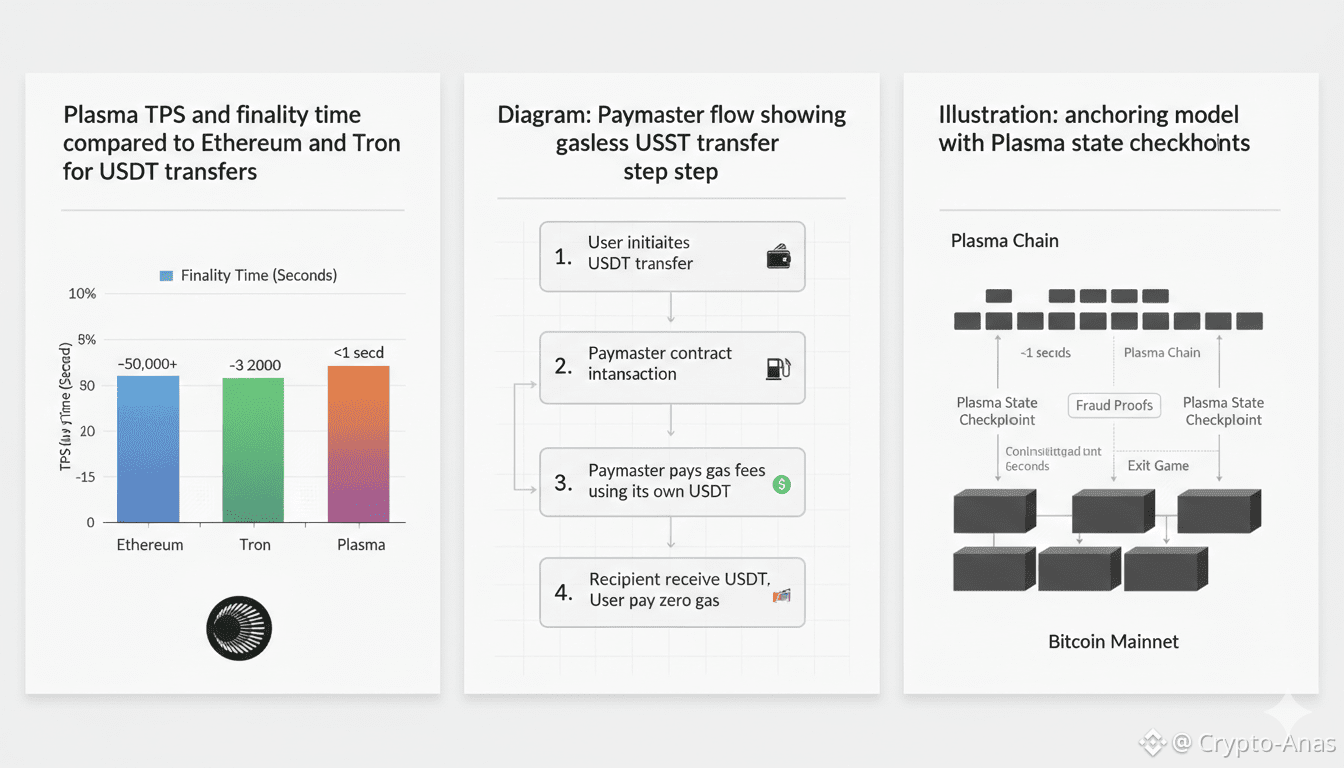

The most underrated innovation on Plasma is not speed. It is who pays the fee. Gasless USDT transfers through a paymaster model quietly remove the biggest friction in crypto onboarding. Users do not need XPL. They do not need ETH. They only need dollars on-chain. This mirrors real-world payment apps where infrastructure costs are invisible to the user.

From a systems perspective, PlasmaBFT is equally important. Fast HotStuff-style consensus allows deterministic finality in seconds. This matters because stablecoins are used for settlement, not speculation. Merchants, desks, and payment processors care about finality certainty, not block times.

EVM compatibility is not about developers. It is about liquidity gravity. Plasma can absorb existing tooling and contracts without rebuilding an ecosystem from zero. That shortens the path from launch to real usage.

Security is where Plasma takes a long-term view. By anchoring state to Bitcoin, Plasma borrows credibility from the most battle-tested ledger in crypto. This is not about marketing. It is about signaling to institutions that the system is designed for decades, not cycles.

Now the critical part: XPL.

XPL is not a fee token chasing volume. Its value is structural. Validators stake XPL to protect a chain that moves billions in dollar-denominated value. Governance with XPL is not cosmetic either. Payment networks live or die by fee policy, compliance alignment, and infrastructure upgrades. Those decisions need a token with real weight.

The 40 percent ecosystem allocation tells another story. Plasma is not betting on hype-driven adoption. It is funding integrations, liquidity routes, and real payment corridors. That is how financial infrastructure grows.

Plasma does not need users to speculate on XPL. It needs users to trust the rails. If stablecoins become the default digital dollar, Plasma is positioning itself as the settlement layer beneath the surface.

This is not a general blockchain thesis. It is an infrastructure thesis.

Plasma is not trying to win narratives. It is trying to disappear into everyday payments. That is exactly why it matters.