One of the biggest differences between speculative blockchains and real payment infrastructure is how much failure they can tolerate. In trading environments, delays, rollbacks, and complexity are often accepted. Users are chasing opportunity, not certainty. In payment systems, that tolerance disappears. Either a transaction settles quickly and predictably, or trust breaks down. Plasma is designed with that reality in mind.

Most blockchains evolved around flexibility. They prioritize composability, experimentation, and optionality, even if that comes at the cost of determinism. That works well for innovation, but it becomes fragile when the main job of the network is moving value. Plasma takes the opposite approach. Settlement comes first. Flexibility exists, but it is secondary, not the organizing principle.

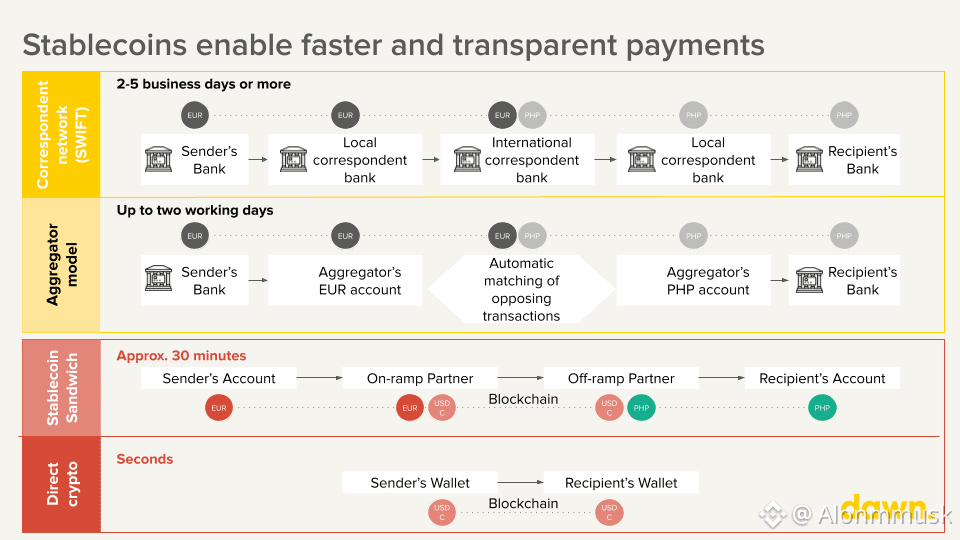

This starts with how Plasma treats stablecoins. On most networks, stablecoins sit on top of infrastructure that was never built for payments. Fees move unpredictably. Finality is probabilistic. Users end up exposed to volatility even when they are transacting in assets meant to be stable. Plasma removes that mismatch by treating stablecoins as the core purpose of the network. Everything else is shaped around that assumption.

Finality is the clearest example. Plasma is designed to deliver sub-second, deterministic confirmation through its consensus. This is not about chasing performance metrics. It is about removing uncertainty. In payments, knowing exactly when a transaction is finished matters far more than theoretical throughput. Plasma prioritizes clarity because ambiguity is expensive in real economic activity.

That same thinking carries into fees and user experience. Stablecoin-based gas and gasless stablecoin transfers remove friction that disproportionately hurts real users. In many regions where stablecoins are heavily used, people rely on them specifically to avoid volatility. Forcing users to manage a volatile native token just to send a stable asset works against that goal. Plasma aligns incentives by letting stablecoins behave like native instruments, not add-ons.

The result feels less like a marketplace and more like a settlement rail. Fees are understandable. Execution is consistent. Transactions behave the same way regardless of market conditions. That consistency matters for individuals and institutions alike. Good payment infrastructure fades into the background. Plasma is designed to work quietly, without demanding constant attention.

For developers, Plasma maintains full EVM compatibility through an execution environment powered by Reth. This keeps deployment familiar without changing the network’s priorities. Applications can be reused, but they run in an environment optimized for settlement rather than speculation. The tools stay recognizable, but the assumptions underneath them change.

That difference matters for payment systems, remittance flows, and onchain settlement applications. These systems are less concerned with complex composability and more focused on execution guarantees. Plasma gives developers an environment where fast finality and predictable costs can be assumed, rather than worked around.

That same mindset shows up in how Plasma approaches security. It anchors itself to Bitcoin not to chase a narrative, but because Bitcoin offers neutrality and long-term reliability that are already proven. The decision is practical rather than symbolic. Instead of experimenting for the sake of novelty, Plasma leans toward durability and predictability. For payment infrastructure, that matters. Systems people rely on to settle value benefit from foundations that are familiar, conservative, and trusted. Confidence in settlement is earned slowly, through consistency, not constant change.

The users Plasma is built for are defined by necessity, not curiosity. Retail users in high-adoption regions depend on stablecoins for everyday value transfer. Institutions explore stablecoin settlement because they need predictability and clear guarantees. These users are not looking for novelty. They are looking for systems that behave correctly under pressure.

That focus also shapes how Plasma thinks about growth. It is not optimized for incentives or sudden bursts of activity. Payment infrastructure grows through integration and repetition. Trust is earned by working the same way every time. Plasma prioritizes correctness before scale, reliability before reach.

As the space grows up, this kind of focus starts to matter more. General-purpose chains are great places to experiment, but real economic activity usually needs clearer, tighter guarantees. By centering itself on stablecoin settlement, Plasma sidesteps the friction that shows up when a network tries to do too many different things at once. That narrow focus helps keep priorities aligned and behavior predictable, which is exactly what settlement infrastructure is supposed to deliver.

Stablecoins have already proven their role in global finance. What remains underdeveloped is infrastructure designed specifically around their needs. Plasma is an attempt to close that gap by treating settlement as the primary problem, not a side effect.

What ultimately defines Plasma is restraint. It is not trying to reinvent crypto. It is focused on supporting how crypto is already used. That restraint allows the system’s architecture, incentives, and user experience to stay aligned around a single, proven demand.

As onchain finance moves closer to everyday economic life, the systems that last will be the ones that behave predictably when it matters most. Plasma is built for that environment. Not as an experiment, but as infrastructure.

For educational purposes only. Not financial advice. Do your own research.

@Plasma $XPL #plasma