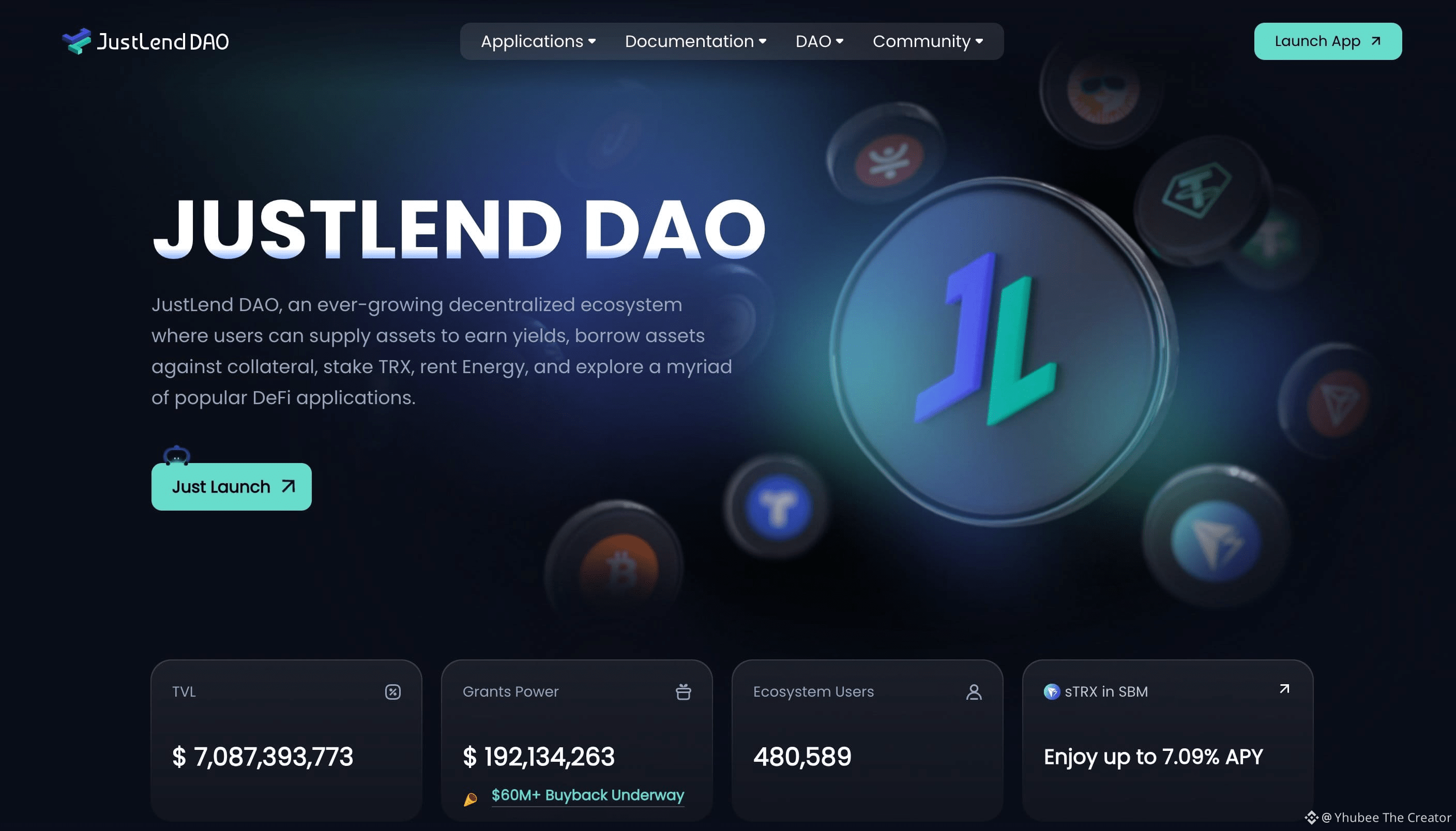

Steady growth in DeFi rarely comes from hype. It comes from real usage, liquidity that stays put, and a community that keeps interacting on chain and this week’s data from JustLend DAO reflects exactly that.

As one of TRON’s foundational DeFi protocols, @JUST DAO functions as a complete decentralized money market. Within a single ecosystem, users can supply assets to earn yield, borrow against collateral, stake TRX, rent Energy, and take part in governance all transparently on chain.

Recent protocol metrics highlight how consistently the platform is being used:

▫️ $7.08B TVL, representing capital actively deployed across lending, staking, and other DeFi functions

▫️ $192M+ in Grants Power, reinforcing long term sustainability and ecosystem development

▫️ 480,000+ users, showing broad and distributed participation rather than short lived inflows

Beyond scale, yield efficiency continues to be a major draw. Assets like USDD are currently offering up to 7.09% APY, appealing to users seeking reliable on chain returns without relying on excessive volatility or speculative strategies.

What stands out is the structure behind the numbers.

High TVL paired with a large user base suggests that capital isn’t just passing through it’s actively working within the protocol. Meanwhile, the growing grants pool signals ongoing reinvestment into infrastructure, tooling, and community driven expansion.

Altogether, this paints a clear picture of a DeFi platform operating as intended:

▫️ Assets supplied to generate yield

▫️ Liquidity borrowed for real on chain activity

▫️ Participation happening at scale

▫️ Protocol resources reinvested for long term growth

For anyone navigating DeFi on TRON, JustLend DAO continues to stand out as a core hub where lending, borrowing, and sustainable yield intersect all backed by transparent on chain metrics.

Explore the protocol and engage directly:

👉 justlend.org

@justinsuntron @DeFi_JUST

#JustLendDAO #TRON #DeFi #TRONEcoStar