At its core, @Plasma is trying to fix a problem that almost everyone in DeFi quietly agrees on: a lot of capital is being wasted. Billions of dollars move around on-chain chasing yields that look good for a week or two, then disappear. Capital moves fast, but it doesn’t always do useful work. Plasma’s bet is that this doesn’t have to be the norm. Capital can be both active and efficient.

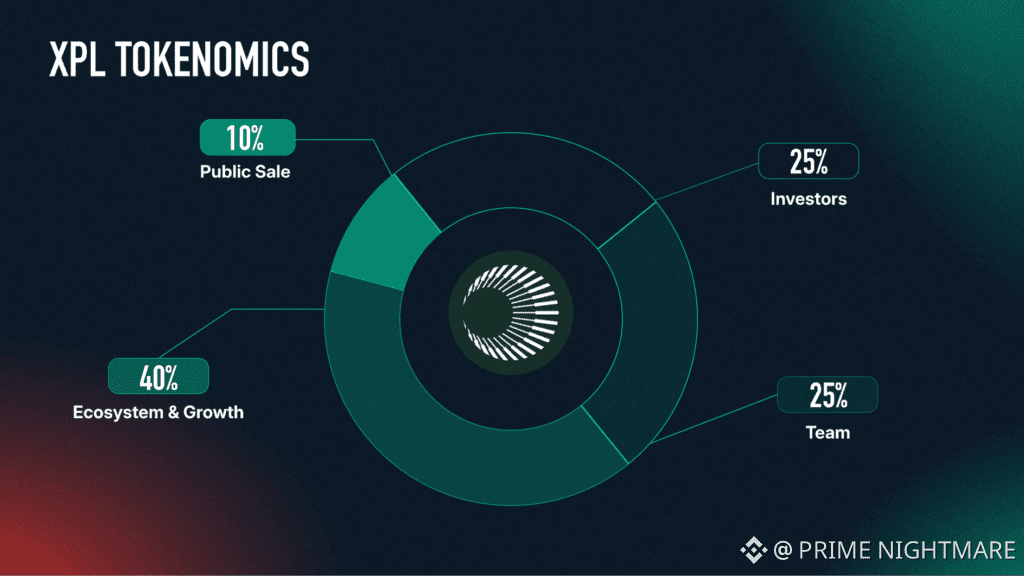

$XPL Instead of designing systems that reward whoever jumps in earliest or fastest, Plasma takes a more long-term view. The idea is that financial infrastructure should still make sense months or years down the line, not just during a launch phase. That means thinking carefully about motive, risk, and behavior before scaling things up. It’s less about hype cycles and more about building something that doesn’t fall apart when conditions change.

A big part of this is alignment. Plasma is designed so that users, liquidity providers, and the protocol itself all benefit from the same outcomes. When incentives are aligned, people are more likely to act in ways that strengthen the system rather than drain it. This helps reduce the “mercenary capital” problem, where liquidity shows up only for rewards and leaves the moment they drop. Over time, aligned systems tend to be more resilient.

You can see this mindset in Plasma’s product design too. On the surface, things are kept relatively simple and natural. Underneath, though, the mechanics are carefully thought out. This makes Plasma approachable #Plasma