A financial system is usually doing its job best when it does not draw attention to itself. Payments are not meant to feel clever or exciting. They are meant to be fast, predictable, and uneventful. Many blockchains struggle with this because they were designed as markets first and infrastructure second. Plasma starts from the opposite place. Settlement is treated as the core function, and everything else is built around that.

The reason for this focus is practical, not abstract. Stablecoins are already the most widely used form of crypto in real economic activity. They are used for day-to-day payments, cross-border transfers, payroll, and business settlement, especially in regions where traditional banking is limited or unreliable. Yet most blockchains still run stablecoins on infrastructure optimized for speculation. That mismatch creates friction where there should be none.

Plasma treats stablecoins as the center of the system rather than as applications sitting on top of it. This choice changes how the network behaves. Finality matters more than optionality. Fees are designed to stay consistent instead of reacting to congestion. The network is shaped to behave like settlement infrastructure, not a trading venue. That difference becomes important when users rely on it to move value, not to express strategy.

At the same time, Plasma stays compatible with existing Ethereum tooling through Reth. This is not about expansion or attracting developers with novelty. It is about continuity. Developers can deploy familiar applications, but they run in an environment designed for payments instead of yield extraction. The execution layer feels familiar, while the economic assumptions underneath it are different.

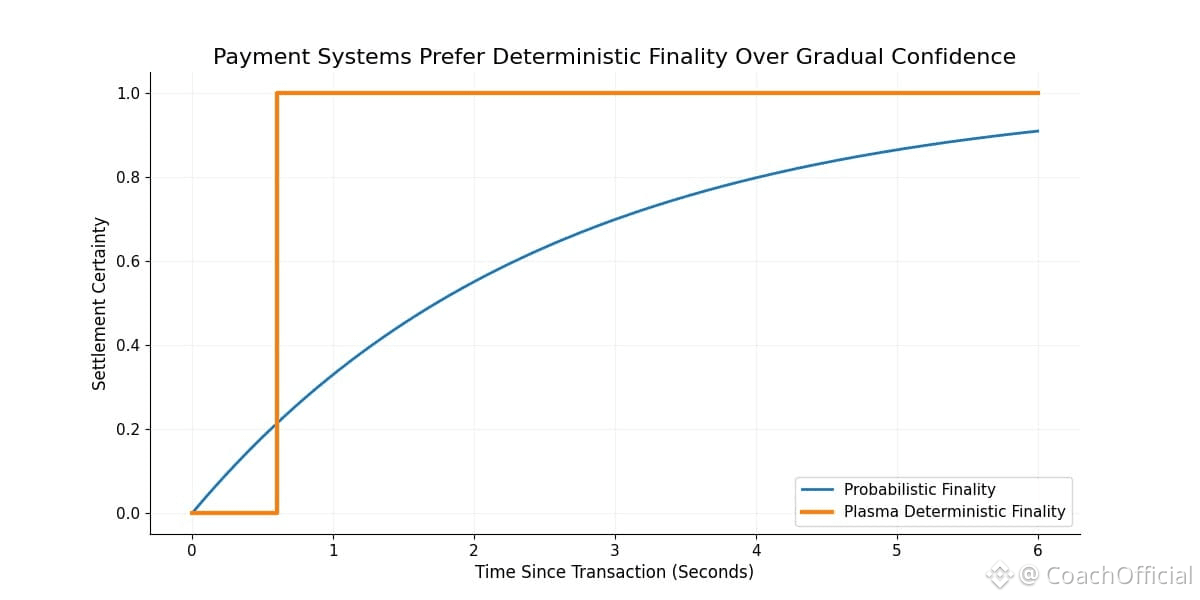

Finality is where this design shows most clearly. Plasma is built for sub-second confirmation. In speculative settings, delayed or probabilistic finality is often accepted. In payment systems, it is not. Merchants, users, and institutions need certainty. A transaction is either done or it is not. Plasma reduces ambiguity by shrinking the gap between intent and settlement. In real payment contexts, that clarity matters more than peak throughput.

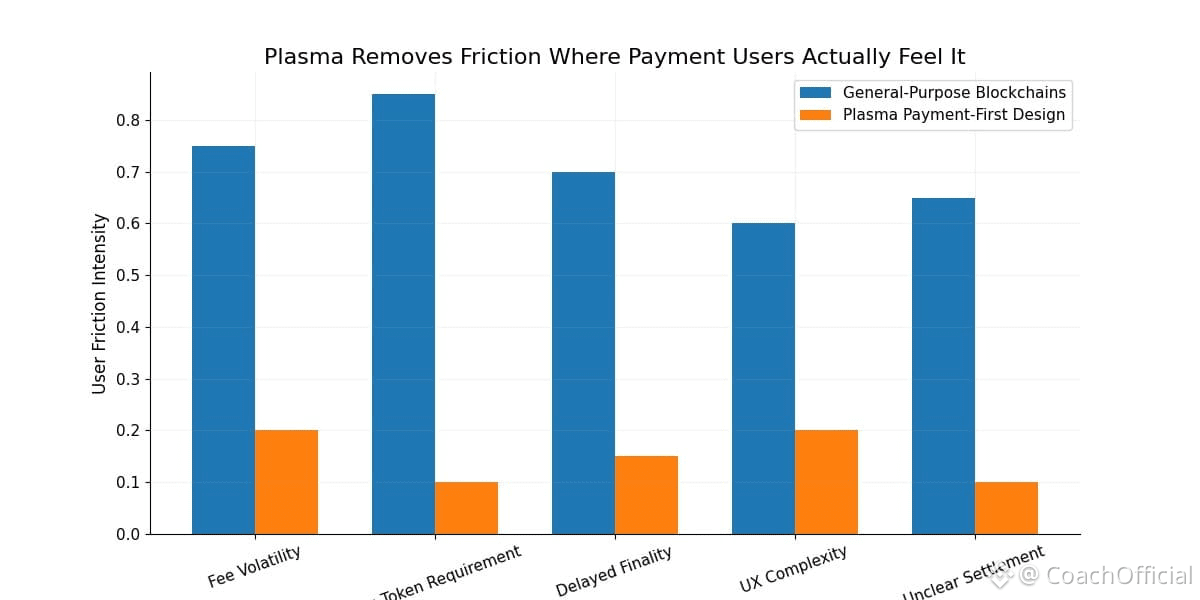

User experience follows the same logic. Gasless USDT transfers and stablecoin-based gas are not cosmetic features. They remove friction that everyday users notice immediately. Requiring a volatile native token just in practice, to move a stable asset adds complexity that most users do not want. Plasma aligns mechanics with intent by letting stablecoins behave like first-class instruments, with costs denominated in units people already understand.

This approach also fits institutional needs. Payment processors and financial institutions care less about composability narratives and more about operational certainty. Volatile fee markets make accounting and risk management harder. Plasma’s stablecoin-centric fee model simplifies those concerns. Settlement behavior is consistent, execution guarantees are clear, and the system behaves in ways institutions can reason about.

Security choices reflect the same mindset. Plasma anchors its security in practice, to Bitcoin, prioritizing neutrality and durability over rapid experimentation. Bitcoin’s role here is not transactional. It serves as a conservative reference point. Payments infrastructure benefits from slow, deliberate change, and Plasma is built with that in mind.

The users Plasma is designed for are defined by necessity, not curiosity. Retail users in high-adoption regions depend on stablecoins as everyday money. Institutions need fast settlement with predictable outcomes. Businesses need systems that behave the same way every day, regardless of market conditions. Plasma is built for environments in practice, where failure is costly and trust is earned through repetition.

This focus also shapes how the network grows. Payment systems are not adopted through hype or incentives. They are adopted when they prove reliable under real conditions. Integration happens gradually. Plasma prioritizes correctness and consistency before scale. That may look slow, but it reduces the risk of deeper problems later.

In the broader crypto landscape, Plasma represents a narrowing of ambition. It does not try to be everything. It commits to doing one thing well: stablecoin settlement. As the industry matures, this kind of specialization becomes more valuable. General-purpose chains are good at experimentation. Real economic activity often demands narrower guarantees.

Stablecoins have already moved from experiment to infrastructure. The systems supporting them are still catching up. Plasma is an attempt to close that gap by building a network that behaves like the asset it supports. Stable, predictable, and focused on execution rather than speculation.

As crypto becomes part of everyday economic life, the networks that matter most will be the ones people stop thinking about. Plasma is built for that outcome. Not to attract attention, but to fade into reliability.

For educational purposes only. Not financial advice. Do your own research.

@Plasma $XPL #plasma #Plasma