One way to understand Dusk is to look at the environments it is preparing for. Not open sandboxes where failure is part of the learning curve, but financial settings where errors carry legal, economic, and reputational consequences. In those contexts, experimentation has limits. Systems have to work correctly from the start and keep working over time. Dusk is built with that expectation in mind.

Most blockchains emerged in a period where reversibility was assumed. Losses were framed as lessons. Transparency was often treated as a substitute for accountability. That model starts to fall apart once onchain systems intersect with regulated finance, real-world assets, and institutional participation. In those environments, visibility alone does not prevent failure. Structure does. Dusk’s architecture reflects this shift by favoring enforceable guarantees over the open-ended flexibility.

A central part of this design is how Dusk approaches privacy. Privacy is not treated as a way to avoid responsibility. It is treated as a condition for participation. Financial actors cannot operate when positions, counterparties, or strategies are permanently exposed. At the same time, systems must remain auditable. Dusk addresses this through selective disclosure. Transactions and asset states stay confidential by default, while correctness can still be proven when verification is required. Trust is replaced with cryptographic assurance.

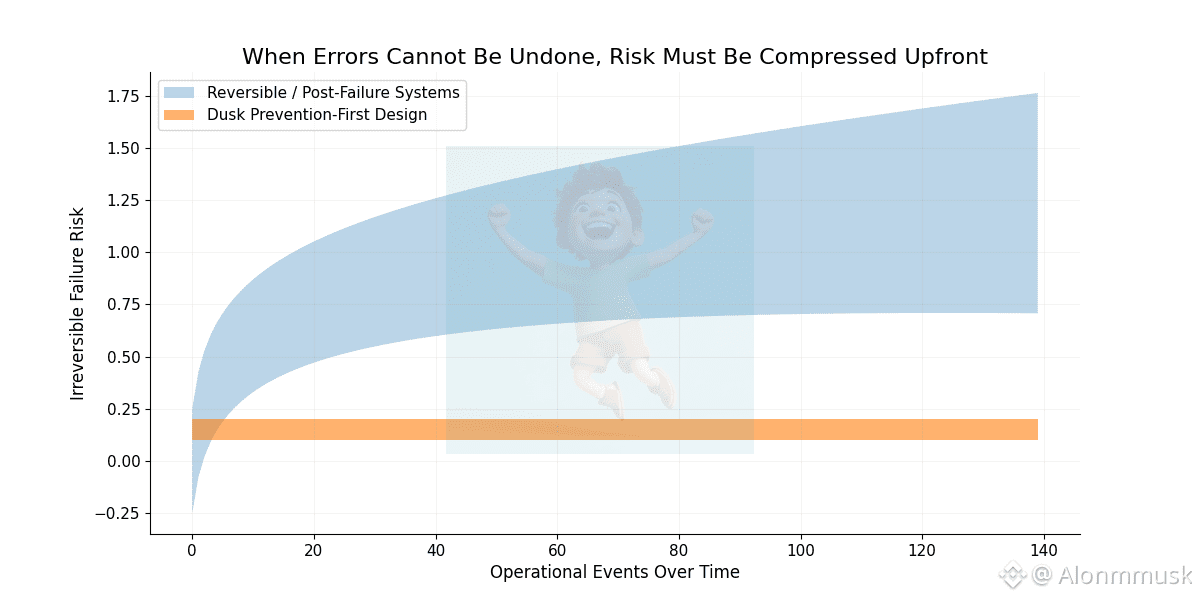

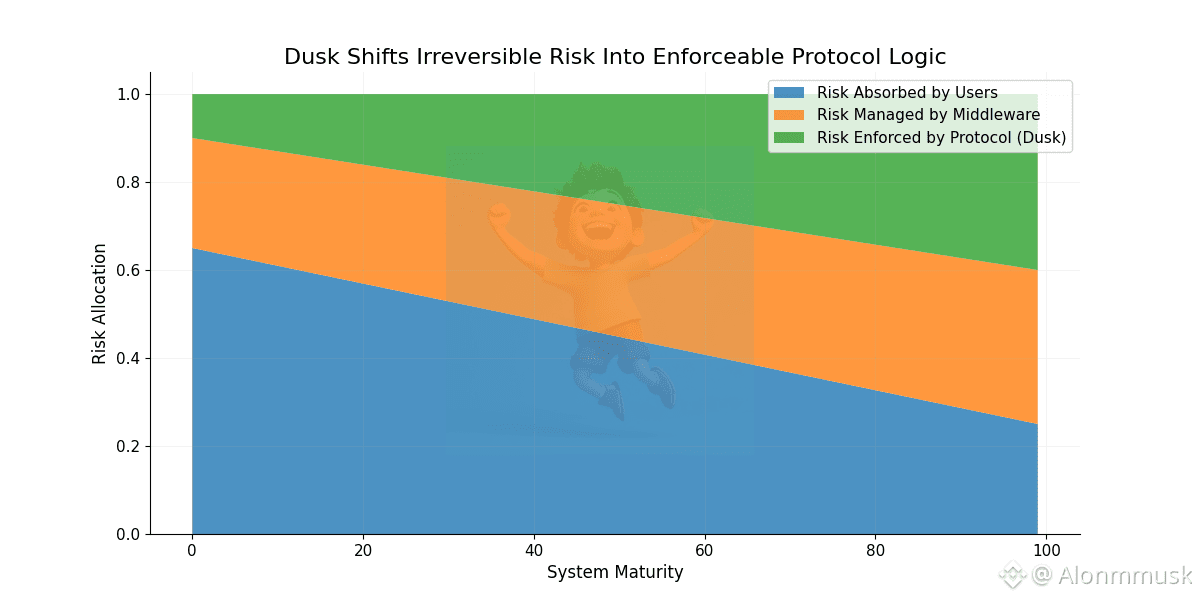

This choice changes how risk is handled onchain. In fully transparent systems, risk is often pushed outward. Participants are expected to watch everything all the time. In practice, that leads to information overload rather than safety. Dusk pulls risk management into the protocol itself. Rules are enforced automatically. Violations are prevented instead of merely observed. This mirrors how real financial infrastructure is designed, where prevention matters more than detection.

Smart contracts on Dusk are built to support this approach. They operate on confidential state while remaining deterministic. Developers can encode financial logic that stays private without becoming ambiguous. Transfer conditions, eligibility rules, and compliance checks can all be enforced consistently without exposing underlying data. Correctness depends on execution, not observation.

Tokenized assets make this especially clear. Real-world assets brought onchain are not static representations. They come with obligations that persist over time. Ownership may need to be restricted. Transfers may need conditions. Disclosures may need to be selective. Dusk’s modular design allows these constraints to be expressed directly as part of the asset lifecycle. Instead of forcing assets into rigid abstractions, the protocol adapts to their requirements.

The builders drawn to Dusk tend to reflect this seriousness. They are not focused on rapid iteration or short-term metrics. They are working on issuance frameworks, settlement layers, and regulated financial primitives that assume scrutiny. These teams think in terms of durability. Their systems are expected to operate through audits, regulatory review, and market stress without breaking core assumptions.

Dusk also takes a grounded view of decentralization. Decentralization is often described as the absence of control. In practice, financial systems require rules. The real question is who enforces them. Dusk replaces discretionary enforcement with protocol-level enforcement. Rules are encoded in smart contracts apply consistently, regardless of who is participating. This reduces reliance on intermediaries while preserving necessary structure. Decentralization becomes a property of enforcement, not exposure.

This perspective shapes how adoption is likely to be happen. Dusk is not optimized for the rapid growth driven by incentives or trends. Its design appeals more to participants who value predictability, privacy, and legal alignment. That kind of adoption usually moves slowly, but it tends to last because systems continue to behave as expected over time.

From a technical standpoint, Dusk applies zero-knowledge cryptography with restraint. The goal is not to impress with complexity, but to solve specific problems around verification and confidentiality. Proof systems are used where they reduce ambiguity and risk. This discipline matters because financial infrastructure punishes overengineering just as much as underengineering. Correctness has to be repeatable.

As the industry matures, the cost of failure rises. Systems handling real value cannot rely on social consensus to unwind mistakes. They have to be designed to prevent them. Fully transparent chains struggle here because they assume visibility is enough. Dusk assumes the opposite. That prevention and enforcement have to be built into the system itself.

What stands out is the consistency of Dusk’s choices. Privacy is selective. Compliance is native. Enforcement is automatic. The network does not drift between narratives or chase adjacent use cases. That coherence is often what separates infrastructure that lasts from infrastructure that fades when conditions change.

Dusk is not trying to make onchain finance louder or faster. It is trying to make it safer to operate at scale. That requires patience and discipline, and an acceptance that some problems cannot be solved with shortcuts. As onchain systems move closer to real financial responsibility, those qualities become decisive.

In an industry still learning how to deal with permanence, Dusk Network is building as if permanence is unavoidable. That mindset may not generate immediate attention, but it is often what underpins systems that remain relevant long after the noise fades.

For educational purposes only. Not financial advice. Do your own research.

@Dusk $DUSK #Dusk #dusk