Imagine you’re standing in front of a €50 million luxury apartment complex in Amsterdam. Traditionally, owning a piece of this would require millions in capital, months of legal paperwork, and a mountain of notary fees. But what if you could own a fraction of it—down to the square meter—with the same ease as buying a coffee, all while keeping your financial footprint completely private?

This isn't a futuristic dream. It is the reality being built on Dusk, a Layer-1 blockchain specifically engineered to bring the $300 trillion real estate market into the digital age without breaking the law—or your privacy.

The "Privacy Paradox" in Real Estate

Most people think blockchain transparency is a feature. For institutional real estate, it’s actually a bug. Large investors and developers cannot afford to have their entire balance sheet, transaction history, and contract terms visible on a public ledger like Ethereum.

This is where Dusk changes the game. It solves the Privacy Paradox by using "Confidential Smart Contracts."

How it works: The Life of a Tokenized Asset

1. The Shielded Issuance: A developer tokenizes a commercial building. On Dusk, the total value is verified, but the specific identities of the buyers remain private.

2. Compliant Freedom: Through the Citadel protocol, users undergo a one-time KYC (Know Your Customer) process. They receive a "proof of eligibility" that lets them trade real estate tokens globally without re-sharing their passport with every new platform.

3. Instant Settlement: Unlike the 30-day "headache" of traditional property transfers, Dusk’s Piecrust virtual machine processes transactions with near-instant finality.

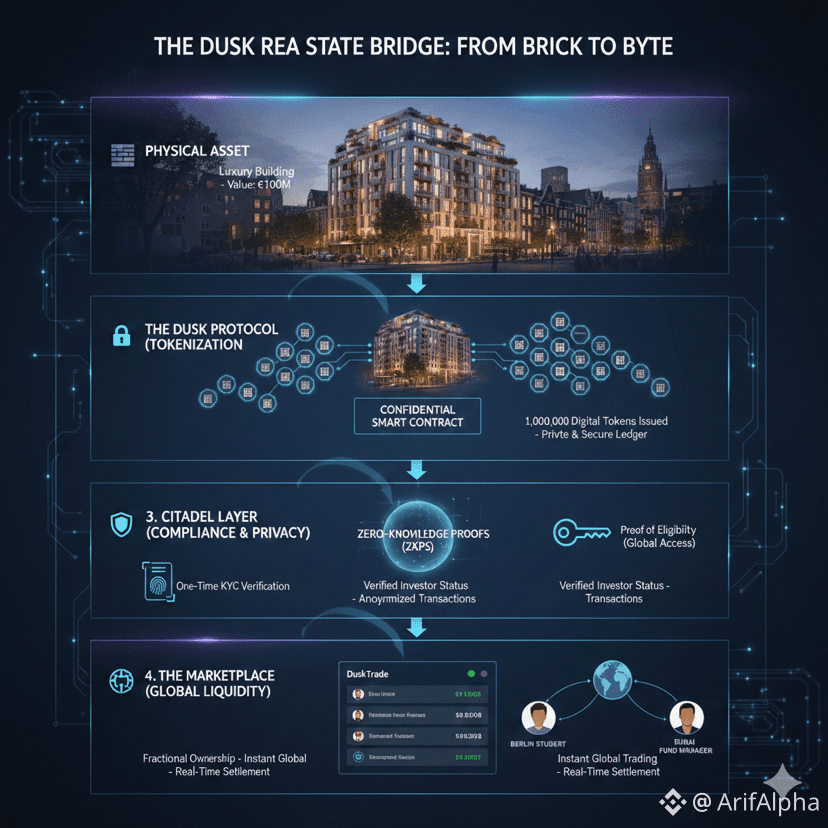

Visualizing the Flow: From Brick to Byte

Layer 1 (Physical): A luxury building with a value of €100M.

Layer 1 (Physical): A luxury building with a value of €100M.Layer 2 (The Dusk Protocol): The building is "mapped" into 1,000,000 digital tokens via a Private Smart Contract.

Layer 3 (The Citadel Layer): Zero-Knowledge Proofs (ZKPs) verify that "User A" is a verified investor without revealing their name or bank balance.

Layer 4 (The Market): Tokens trade on DuskTrade, allowing a student in Berlin and a fund manager in Dubai to share ownership of the same asset.

Why 2026 is the "Dusk Era" for RWAs

While other chains talk about Real-World Assets (RWAs), Dusk is executing. Through its partnership with the NPEX stock exchange, over €300 million in regulated securities are being funneled into the ecosystem. This isn't just "testnet money"—it's real equity, real bonds, and real property.

The Product Features That Matter:

• Confidential Ownership: You own the asset, but the world doesn't need to see your wallet.

• Selective Disclosure: If a regulator asks for an audit, you can grant them "view keys" to your specific transactions without exposing them to the public.

• MiCA Ready: Built from the ground up to satisfy European financial regulations, making it a "safe harbor" for institutional capital.

A Real-Life Scenario: The "Bored Capital" Solution

Meet Sarah, a professional who has €5,000 sitting in a savings account earning 1%. She wants to invest in real estate but can’t afford a down payment. On the other side is Marcus, a developer who needs €5 million to finish a sustainable housing project.

In the old world, they would never meet. The fees to bridge their gap would eat all the profit.

On Dusk, Marcus issues "Green Housing Tokens." Sarah buys €5,000 worth. Her investment is secured by a legal claim on the building, her dividends are paid automatically via smart contracts, and she can sell her "fraction" of the building on a secondary market whenever she needs the cash. Liquidity has finally met the least liquid asset on earth.

The Mindshare Shift

We are moving away from the era of "speculative JPEGs" and into the era of Digital Utility. Dusk isn't just another blockchain; it is the plumbing for a new global economy. By combining the compliance of a bank with the privacy of cash and the efficiency of code, it is quietly becoming the standard for how the world will own... well, everything.

If you could own a fraction of any iconic landmark in your city today, which one would it be, and do you think fractional ownership will eventually replace traditional mortgages?