As onchain finance edges closer to real markets, one assumption keeps breaking down. That systems can remain credible without planning for scrutiny. In practice, oversight is not an edge case. Audits happen. Rules change. Accountability is required. Dusk is designed with that baseline in mind, treating scrutiny as the normal operating environment rather than an interruption.

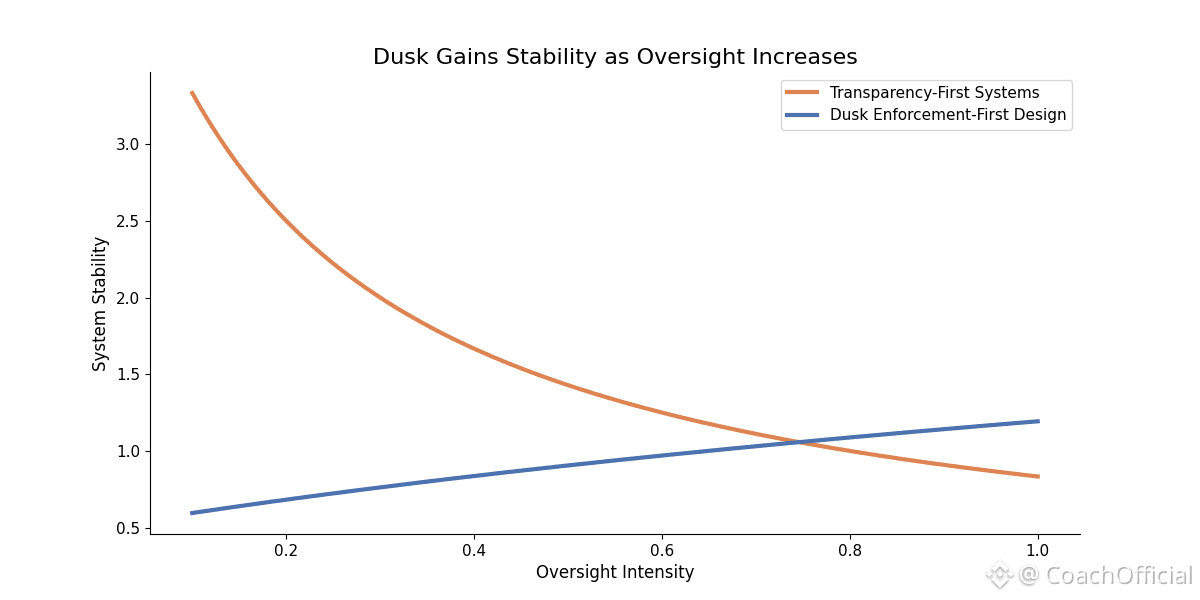

Many blockchains were created in settings where responsibility was diffuse and consequences were limited. Transparency was often used as a substitute for structure. If everything was visible, the system was assumed to be safe. That logic weakens once real assets, institutions, and regulated participants are involved. Visibility does not prevent errors. It only reveals them after damage is done. Dusk approaches this differently by focusing on prevention instead of exposure.

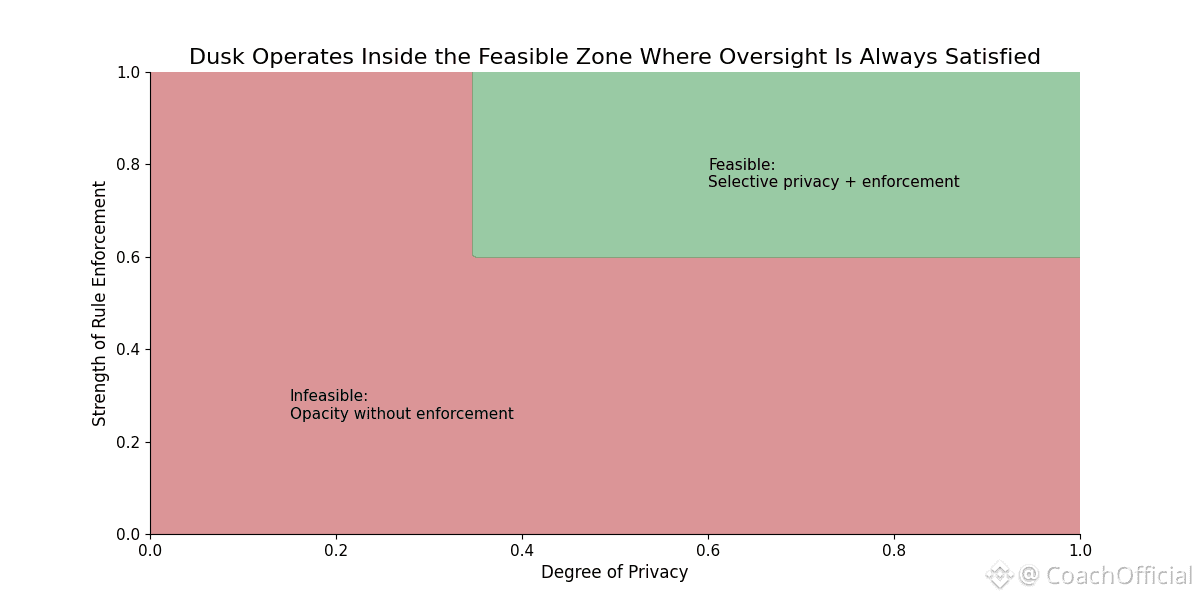

At the core of in practice, this design is selective confidentiality combined with verifiable correctness. Activity on Dusk can remain private by default, while still being provable under defined conditions. This is not about hiding behavior. It is about controlling access. Real financial systems do not operate with universal visibility. They operate with layered access. Dusk mirrors that reality at the protocol level, using cryptography instead of discretionary trust.

This changes how accountability works onchain. Rather than relying on public observation to discourage misuse, Dusk relies on rules that are enforced directly through execution. Smart contracts can operate on confidential state while producing deterministic outcomes. Compliance logic can be in practice, embedded so violations are blocked rather than merely visible. Accountability often becomes part in practice, of how the system runs, not something added on top.

For developers, this opens a different design space. Applications on Dusk are not built for maximum exposure or frictionless composability at any cost. They are built to behave correctly under constraint. Roles, permissions, and conditions can be enforced automatically by the protocol itself. This makes it possible to design systems that assume audits and regulatory interaction without leaning on offchain enforcement.

Tokenized assets make this especially clear. Real world assets brought onchain come with ongoing obligations. Ownership may need to stay private. Transfers may need restrictions. Disclosures may need to happen selectively. Dusk’s modular architecture allows these requirements to live inside the asset lifecycle from the start. Rules are not patched in later. They are part of the asset’s behavior.

The ecosystem around Dusk reflects this seriousness. Teams are not optimizing for rapid experimentation or short-term metrics. They are working on issuance frameworks, regulated DeFi primitives, and settlement layers that assume scrutiny from day one. These builders think in long time horizons. Their systems need to hold up through audits, regulatory review, and changing conditions.

Dusk also takes a grounded view of decentralization. Decentralization is often framed as the removal of constraints. Dusk challenges that idea. The real issue is not whether rules exist, but who enforces them. Rules enforced by code are more decentralized than rules enforced by intermediaries, even if those rules limit visibility or participation.

This perspective matters for adoption. Institutions and enterprises are often open to onchain systems, but they cannot operate in environments where every action is public. Dusk lowers that barrier by making oversight part of execution rather than an external process. Participation does not require giving up confidentiality.

Usage on such a network grows differently. Dusk is not built to attract speculative activity through incentives or narratives. It appeals to participants who value predictability, privacy, and legal clarity. That kind of engagement grows slowly through integration, but it tends to be more resilient over time.

Technically, Dusk applies zero-knowledge cryptography with discipline. The goal is not novelty. It is to reduce risk where it matters. Proof systems are used where they add clarity and enforceability. Financial infrastructure punishes both shortcuts and unnecessary complexity, and Dusk’s design reflects that balance.

As the industry matures, the limits of transparency-first systems become harder to ignore. Enterprises and regulated markets encounter confidentiality requirements almost immediately. Dusk Network is built around those realities rather than trying to retrofit them later.

What stands out is consistency. Privacy is selective. Compliance is native. Enforcement is automatic. The network does not drift between narratives or chase unrelated use cases. That coherence builds credibility slowly, but it compounds.

Dusk is not trying to make onchain finance louder or faster. It is trying to make it dependable when oversight is unavoidable. That path is quieter and slower, but it is the one required for systems that are meant to last.

For educational purposes only. Not financial advice. Do your own research.

@Dusk $DUSK #Dusk #dusk