As onchain finance grows up, the privacy conversation is changing. Privacy is no longer about avoiding oversight. It is about making participation possible in the first place. Financial systems do not work when positions, counterparties, or strategies are permanently exposed. At the same time, they do not work without accountability. Dusk is built around that tension, treating it as a fact of financial life rather than a problem to escape.

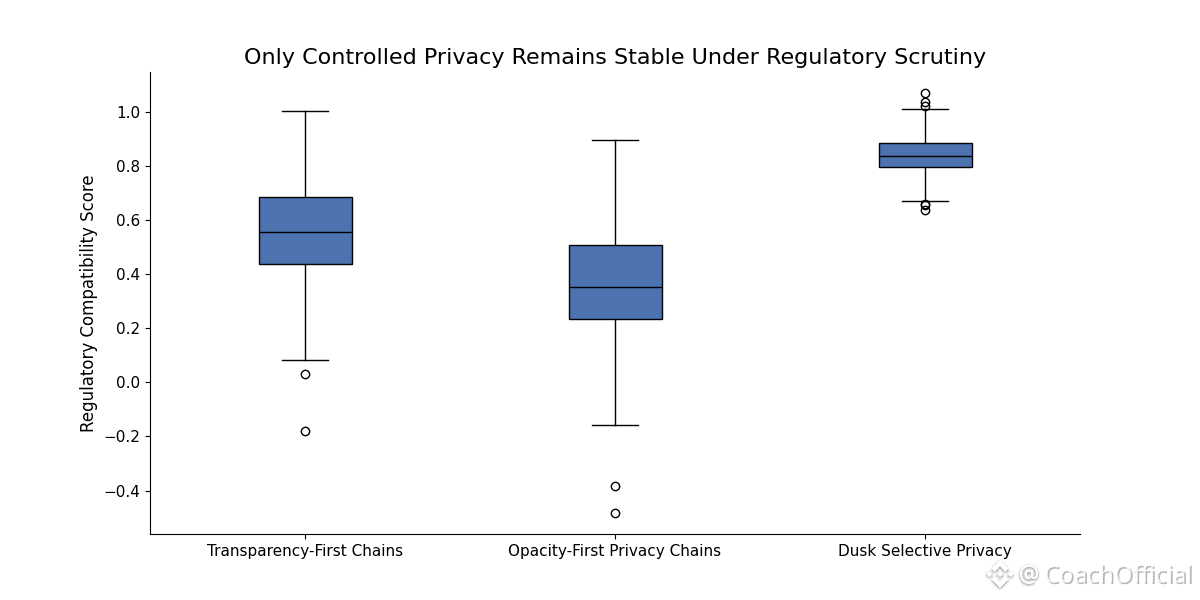

Early blockchains often assumed that transparency alone would create trust. If everything was visible, bad behavior could be spotted and punished socially. That idea worked when systems were small and experimental. It starts to fail once real value is involved. Visibility does not prevent mistakes. In many cases, it increases risk by exposing information that should never be public. Dusk takes a different view. It prioritizes verifiability over exposure.

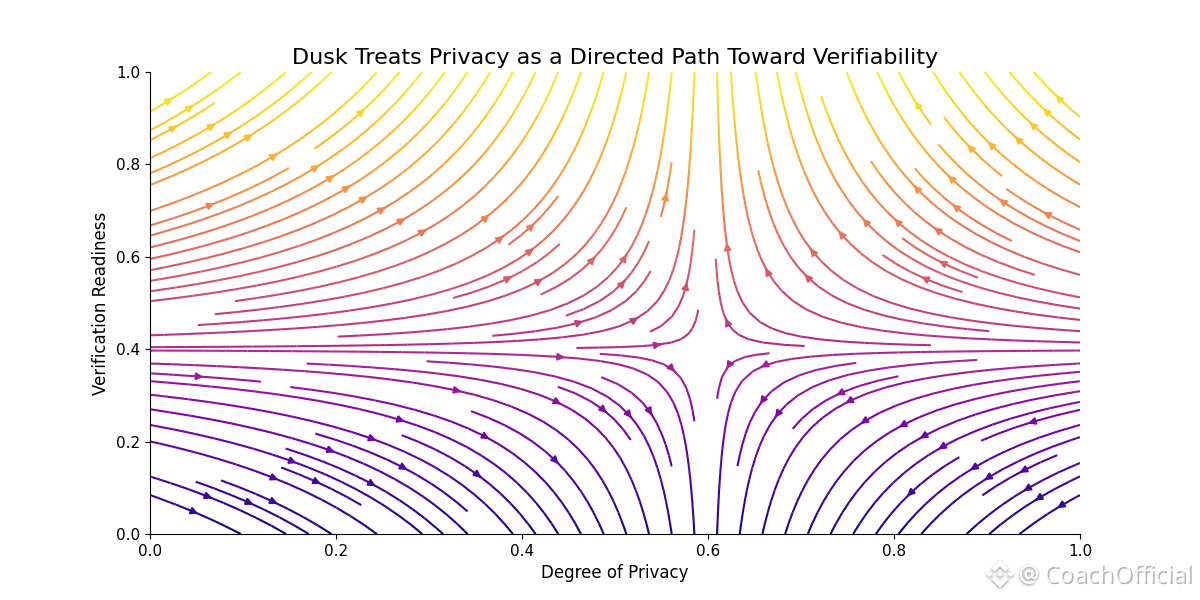

At the protocol level, this shows up as selective disclosure. Transactions and asset states can in practice, remain private by default, while still being provable when verification is required. This mirrors how finance actually operates. Regulators, auditors, and counterparties do not need constant access to everything. They need the ability to check correctness at specific moments. Dusk encodes this directly into the system using cryptography instead of relying on trust in intermediaries.

That choice changes how accountability works onchain. Rather than assuming public in practice, visibility will discourage misuse, Dusk embeds enforcement into execution itself. Smart contracts operate on confidential state while remaining deterministic. Rules are applied automatically and consistently. Violations are blocked instead of merely revealed after the fact. Accountability becomes a property of how the system runs, not how closely it is watched.

For developers, this creates a different design environment. Applications on Dusk are not built for maximum openness or viral composability. They are built to behave correctly under constraint. Permissions, eligibility rules, and compliance conditions can be enforced directly by code. This makes it possible to design systems that assume regulatory interaction without leaning on offchain agreements or discretionary enforcement.

Tokenized assets make this especially clear. Real-world assets brought onchain are not static tokens. They carry obligations over time. Ownership may need to stay private. Transfers may need limits. Disclosures may need to happen selectively. Dusk’s modular design allows these requirements to live inside the asset lifecycle itself. Rules are not added later. They are part of how the asset behaves from the start.

The ecosystem forming around Dusk reflects this seriousness. Teams are not optimizing for short-term attention. They are building issuance frameworks, settlement layers, and regulated financial primitives that assume scrutiny from day one. These builders think in long timelines. Their systems have to survive audits, regulatory review, and changing market conditions without breaking core assumptions.

Dusk also takes a more grounded view of decentralization. Decentralization is often described as the absence of constraints. Dusk challenges that idea. The real issue is not whether rules exist, but who enforces them. Rules enforced by code are more decentralized than rules enforced by intermediaries, even if those rules limit visibility or participation.

This perspective lowers the barrier for institutional use. Many organizations are open to onchain systems, but they cannot operate where every action is public. Dusk offers infrastructure where confidentiality is preserved and oversight happens through verifiable execution rather than constant observation.

Growth on a network like this looks different. Dusk Network is not designed to attract speculative activity through hype or incentives. It appeals to participants who value predictability, privacy, and legal clarity. That kind of adoption grows more slowly, but it tends to last because it is tied to real usage.

Technically, Dusk applies zero-knowledge cryptography with restraint. The goal is not complexity for its own sake. It is to reduce ambiguity and risk where it matters. Financial infrastructure punishes both shortcuts and overengineering. Correctness has to be repeatable and understandable.

As the industry matures, the limits of transparency-first systems are becoming obvious. Enterprises and regulated markets run into confidentiality requirements almost immediately. Dusk is built around those realities instead of patching them later.

Dusk is not trying to make onchain finance louder or faster. It is trying to make it workable under real conditions. That path is quieter and slower, but it is the one required if decentralized systems are going to support serious financial activity.

In a space still learning how to balance openness with responsibility, Dusk is building as if that balance is unavoidable. Privacy is not a loophole. It is a prerequisite.

@Dusk $DUSK #dusk #Dusk