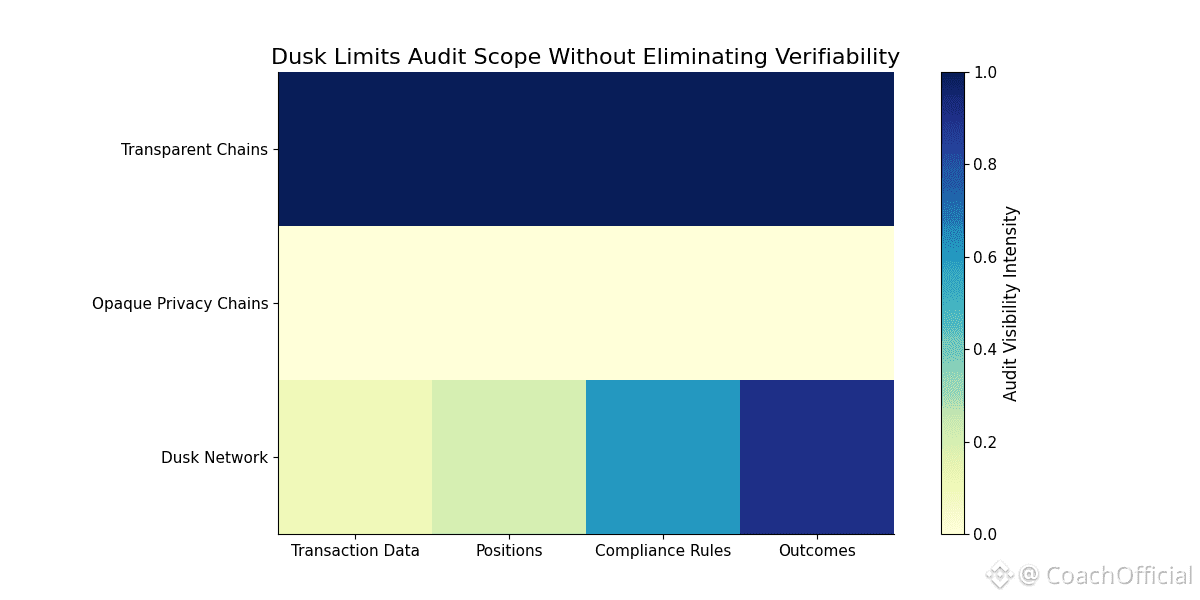

One of the least glamorous problems in onchain finance is also one of the most important: audits. Real financial systems are examined constantly. By regulators. By auditors. By counterparties who need assurance before they commit capital. The challenge is that audits are about verification, not exposure. Most blockchains blur that line. They assume that if something must be auditable, it must also be visible to everyone. Dusk Network is built on the opposite assumption.

In traditional finance, audits are narrow and contextual. Auditors do not publish sensitive transaction data for the world to see. They verify compliance within a defined scope, under defined permissions. Confidentiality is preserved, accountability is maintained, and trust is earned through process rather than exposure. Dusk takes this familiar model and translates it into protocol design. Instead of trusting institutions to behave correctly, it relies on cryptographic proofs to make verification possible without public disclosure.

That distinction matters because exposure is not neutral. Public financial data carries risk. It reveals positions, strategies, relationships, and timing. As onchain systems begin to support real assets and regulated activity, those risks stop being theoretical. They become unacceptable. Dusk treats confidentiality as a prerequisite for participation, not as something that conflicts with oversight.

At the center of this design is selective disclosure. On Dusk, transactions and asset states can remain private by default, while still being verifiable when authorization is required. This is not a feature layered on later. It is a starting point. Verification is separated from visibility. Outcomes can be proven correct without revealing the data that produced them.

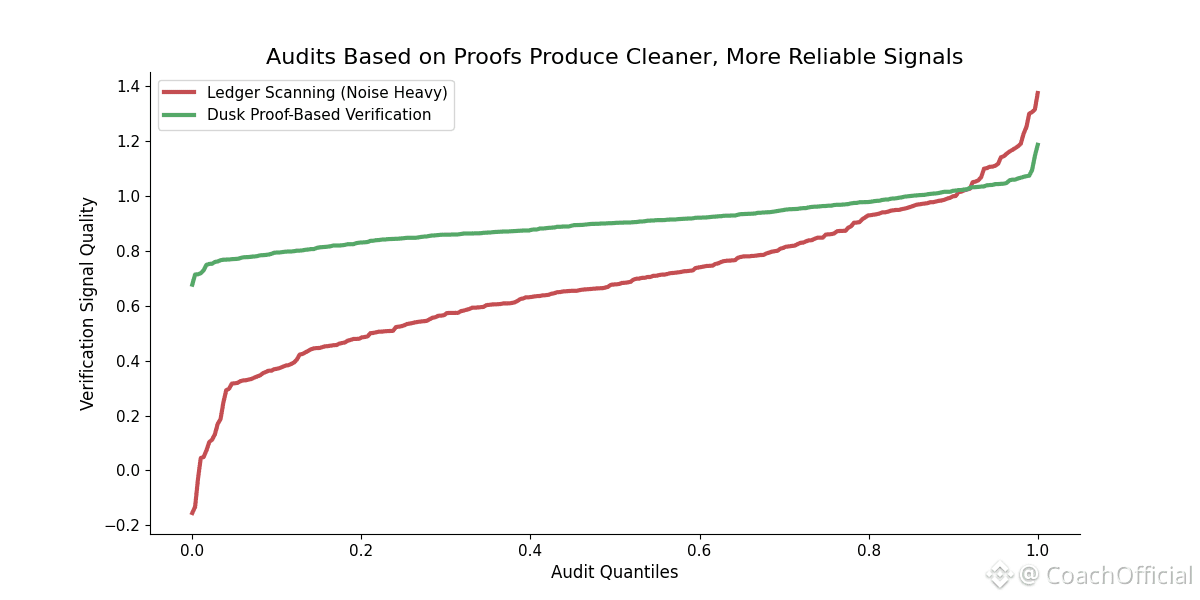

This changes how audits work onchain. Instead of scanning public ledgers in practice, and piecing together activity, auditors verify proofs that attest to rule compliance. The question is no longer “what happened in practice, in detail” but “were the rules followed.” This shift reduces noise and limits unnecessary exposure. Accountability becomes precise rather than broad.

Smart contracts make this practical. Dusk’s execution environment supports confidential state while remaining deterministic. Developers can encode rules in practice, that apply consistently, regardless of who interacts with the system. Eligibility checks, transfer conditions, and compliance logic are enforced automatically. Violations are prevented rather than merely recorded for later review.

This is especially important for financial instruments that carry obligations over time. Tokenized securities, regulated funds, and institutional settlement systems are not static. Rules change. Disclosures evolve. Ownership conditions shift. Dusk’s modular architecture allows these requirements to live inside the asset itself. Governance and compliance are part of the lifecycle, not external processes bolted on after issuance.

The teams building on Dusk reflect this mindset. They are not optimizing for speed of deployment or short-term visibility. They are working on issuance frameworks, settlement layers, and compliance-aware financial primitives that assume examination. Their systems are designed to keep working through audits, regulatory review, and market stress. That focus shows up in both technical decisions and governance choices.

Dusk also reframes how trust is established. In many blockchains, trust is assumed to come from transparency. Everyone sees everything, so misconduct should be obvious. In practice, this creates overload rather than safety. Dusk replaces observational trust with verifiable trust. Participants do not need access to all activity. They need assurance that rules are enforced. Cryptographic proofs provide that assurance more reliably than exposure ever could.

This has implications for decentralization as well. Decentralization is often confused with the absence of structure. Financial systems always have rules. The real question is who enforces them. Dusk removes discretionary enforcement by embedding rules directly into the protocol. Enforcement becomes automatic and impartial. Intermediaries are reduced, but structure remains.

For institutions and enterprises, this architecture lowers the barrier to participation. Many are open to onchain infrastructure, but cannot operate in environments where sensitive activity is public by default. Dusk offers an alternative. Confidentiality is preserved. Audits remain possible. Oversight happens through verification, not surveillance.

As a result, usage and liquidity develop differently. Dusk is not built to attract speculative flows through incentives or hype. It appeals to participants who care about predictability, privacy, and legal clarity. That kind of engagement grows slowly, through integration rather than excitement. Over time, it tends to be more resilient.

Technically, Dusk applies zero-knowledge cryptography with restraint. The goal is not novelty. It is clarity. Proof systems are used where they reduce risk and remove ambiguity. This discipline matters because financial infrastructure punishes mistakes harshly. Correctness has to be repeatable and understandable, not impressive.

As the broader crypto industry matures, the limits of transparency-first design are becoming obvious. Enterprises exploring onchain settlement encounter confidentiality constraints almost immediately. Regulated markets require selective disclosure by design. Dusk does not retrofit around these realities. It starts from them.

What stands out is consistency. Privacy is selective. Compliance is native. Verification replaces exposure. The network does not chase narratives or drift into unrelated problem spaces. That coherence builds credibility slowly, but it compounds.

Dusk is not trying to make onchain finance louder or faster. It is trying to make it auditable without making it fragile. That is a harder path, but it is the one real financial systems require.

In an industry still negotiating the balance between openness and accountability, Dusk is building as if audits are inevitable. Quietly, deliberately, and with the understanding that in finance, being provable matters far more than being visible.

For educational purposes only. Not financial advice. Do your own research.

@Dusk $DUSK #dusk #Dusk