There is a point where flexibility stops being helpful. In payments, that point arrives very quickly. People moving money do not want options. They want the same result every time. Clear fees. Clear settlement. No guessing. That is the assumption Plasma starts from.

Stablecoins are already doing real work. They are used to pay salaries, send remittances, settle invoices, and move value across borders where banks are slow or unreliable. Yet the infrastructure underneath them is usually borrowed from chains designed for trading and speculation. Plasma flips that relationship. It treats stablecoins as the reason the system exists, not as passengers on a general-purpose network.

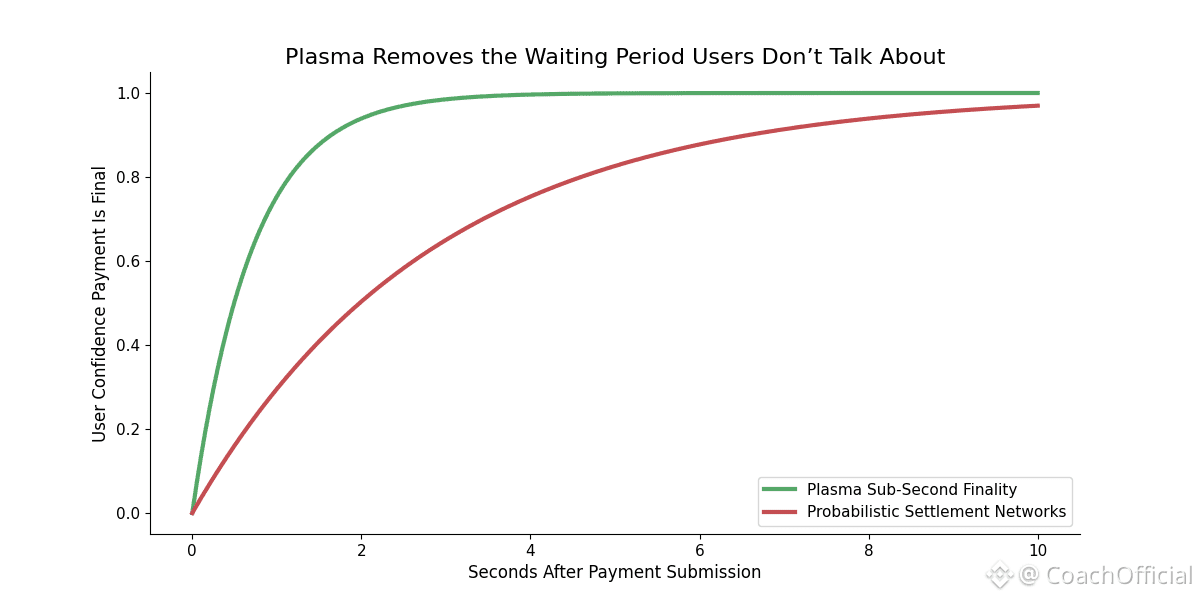

That focus shows up first in settlement. In trading-heavy environments, delayed or probabilistic finality is tolerated. In payments, it creates stress. Users need to know when money is actually there. Plasma is designed to make that moment clear and fast, using sub-second finality to reduce the gap between sending and settling. The goal is not to feel fast. It is to feel certain.

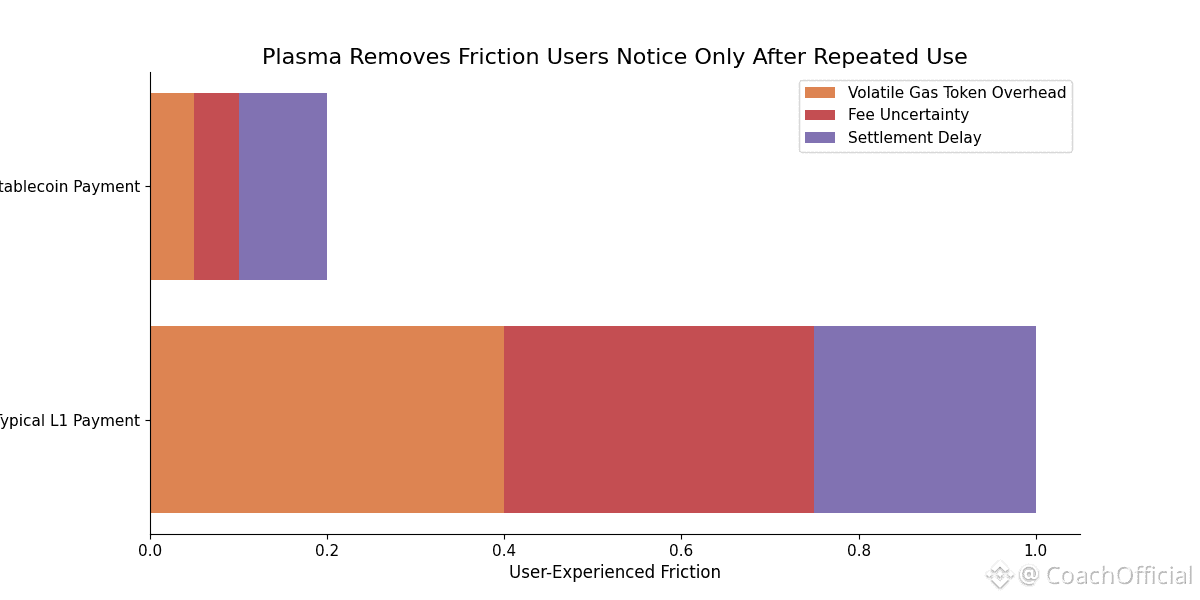

Fees follow the same logic. Paying for a dollar-denominated transfer with a volatile token adds friction that real users do not ask for. Plasma removes that by supporting stablecoin-based gas and gasless stablecoin transfers. Costs stay in the same unit people already understand. That sounds simple, but simplicity is exactly what payment systems need.

Plasma still supports a full EVM environment through Reth, so developers are not forced into new tooling or rewrites. Existing applications can move over easily. What changes is not the code, but the environment. Applications run in a system tuned for settlement reliability rather than for market-driven fee dynamics. Over time, that difference matters.

The network behaves more like infrastructure than a marketplace. Fees stay predictable. Transactions settle the same way during calm periods and busy ones. Users do not have to think about timing or congestion. That consistency is what builds trust in payment rails, not feature breadth.

Security choices reflect the same mindset. Plasma anchors its security to Bitcoin to emphasize neutrality and durability. This is not about innovation speed. It is about minimizing surprises. Payment infrastructure benefits from conservative assumptions and slow, deliberate change.

The people Plasma is built for are defined by usage, not curiosity. Retail users who rely on stablecoins daily. Businesses that need settlement to behave the same way every morning. Institutions that care about execution guarantees more than composability narratives. These users value repetition over optionality.

Growth, in this context, is expected to be gradual. Payment systems are not adopted because they are exciting. They are adopted because they keep working. Plasma prioritizes getting the basics right before chasing scale. That patience reduces the risk of failures that only show up once systems are under real load.

In a broader sense, Plasma represents a narrowing of ambition. It does not try to serve every use case. It commits to one. Stablecoin settlement. As crypto matures, that kind of focus becomes more valuable than generality.

Stablecoins are already infrastructure. Plasma is an attempt to give them infrastructure that behaves the same way. Predictable. Neutral. Easy to reason about.

When payments work well, users stop noticing them. That is the standard Plasma is aiming for. Quiet reliability instead of endless choice.

For educational purposes only. Not financial advice. Do your own research.

@Plasma #plasma #Plasma $XPL