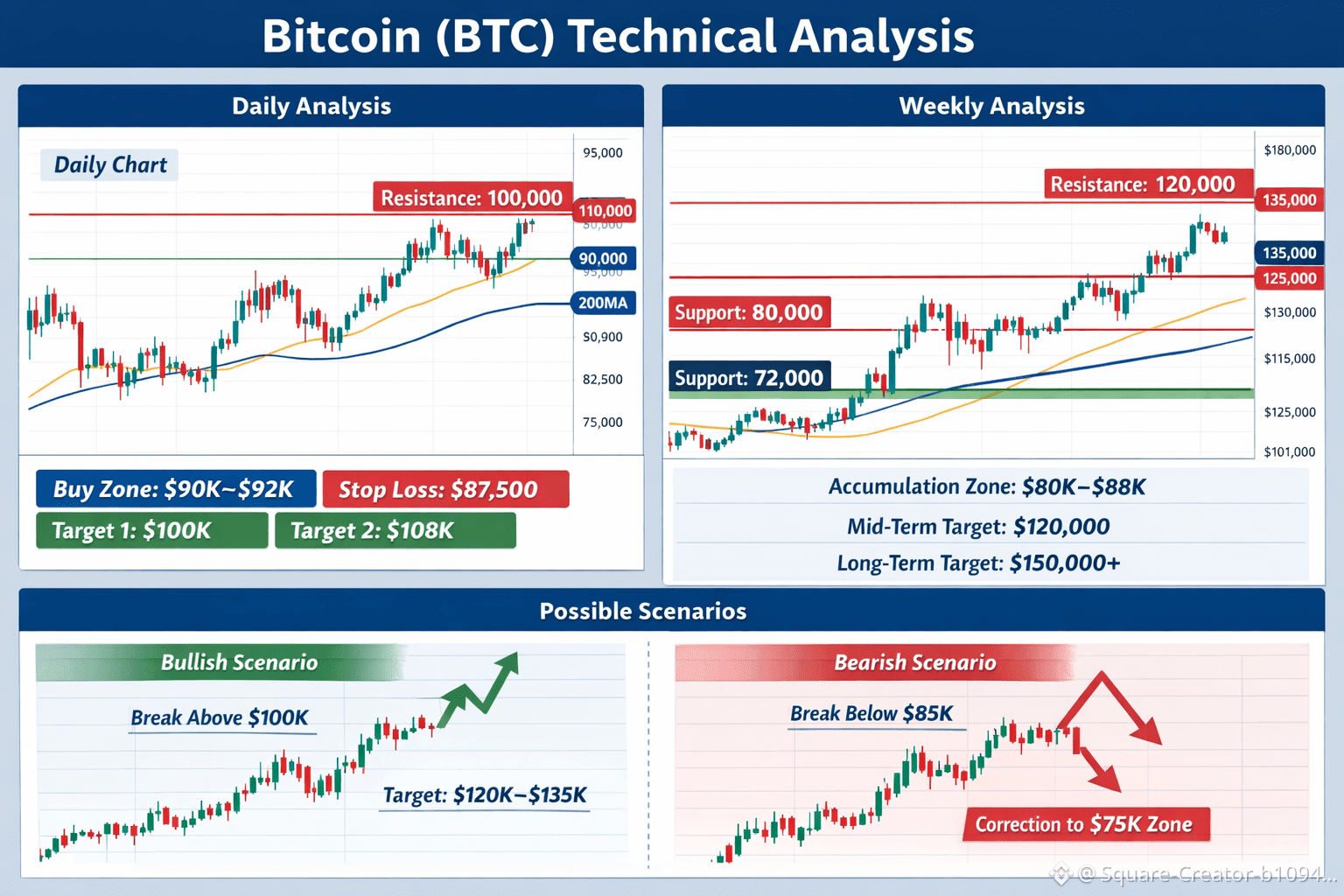

Here is a clear Bitcoin ($BTC ) technical analysis in English, including trend, entry/exit zones, and scenarios:

🔹 Bitcoin (BTC) Technical Analysis

📊 Daily Timeframe

Trend: Medium-term bullish with normal pullbacks

Price is trading above the 50-day and 200-day moving averages → bullish strength

RSI is elevated but not showing strong bearish divergence

Key Support Levels:

90,000

85,000

Key Resistance Levels:

100,000 (major psychological resistance)

108,000

Daily Trade Setup:

Buy Zone: 90,000 – 92,000

Stop Loss: 87,500

Targets:

TP1: 100,000

TP2: 108,000

🔹 Weekly Timeframe

Trend: Strong long-term uptrend (Bull Market)

No confirmed reversal signals

Market structure remains higher highs and higher lows

Weekly Support:

80,000

72,000

Weekly Resistance:

120,000

135,000

Investment Strategy:

Accumulate between 80,000 – 88,000

Mid-term Target: 120,000

Long-term Target: 150,000+

🔹 Possible Scenarios

✅ Bullish Scenario

Strong breakout and daily close above 100,000

Momentum continuation toward 120K → 135K

⚠️ Bearish / Correction Scenario

Breakdown below 85,000

Deeper correction toward 75,000, considered a strong long-term buy zone

🔹 Summary

Scalping & Swing: Buy at support, sell near resistance

Investment: Overall trend remains bullish

Risk Management is critical due to high volatility