So, What Exactly Is Plasma?

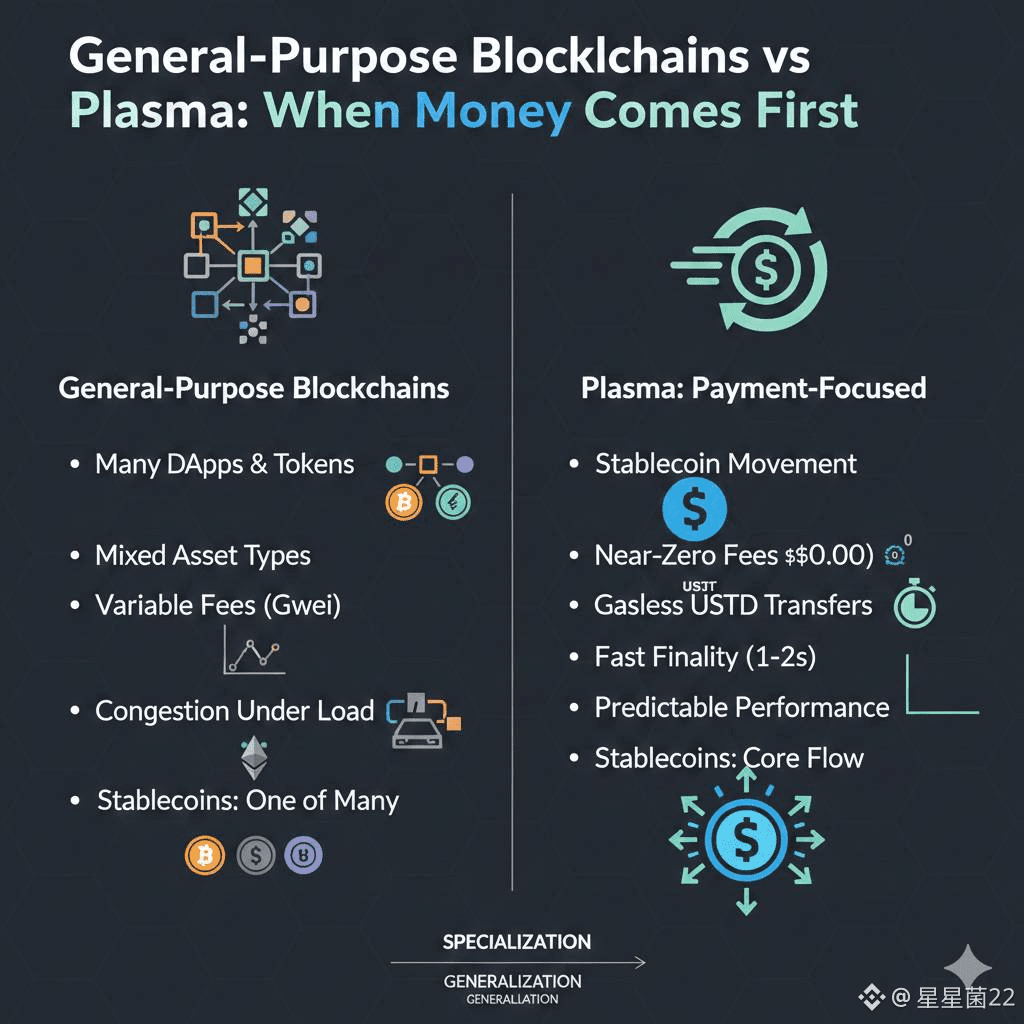

Plasma is a Layer-1 blockchain, but not the kind that tries to do everything at once. It was built with a single, very practical question in mind: why is it still hard to move stablecoins smoothly on-chain?

Instead of competing to host every possible app or experiment, Plasma narrows its focus to one job—moving digital dollars efficiently. Stablecoins like USDT are at the center of the design, not an afterthought. Transactions settle quickly, costs stay minimal, and users aren’t forced to think about gas tokens every time they send money.

At the same time, Plasma doesn’t abandon developers. It stays EVM-compatible, which means Ethereum-style smart contracts work without needing rewrites or new tooling. The difference is that the surrounding environment is optimized for payments, not congestion.

That focus is what separates Plasma from most general-purpose blockchains.

Designed Around Stablecoins, Not Built On Top of Them

On many networks, stablecoins are treated like just another asset sitting on a busy chain. Plasma flips that logic. The chain itself is built around stablecoins.

One of the most noticeable results is gasless stablecoin transfers. For basic USDT payments, users don’t even need to hold XPL. The protocol handles fees in the background, which sounds simple but changes the entire user experience. Sending money feels closer to using a payment app than interacting with a blockchain.

Under the hood, the network is tuned for speed and consistency. Finality is fast, throughput is high, and the system doesn’t slow down just because transaction volume increases. Developers still get the flexibility of Solidity and familiar tools, while users get something rare in crypto—predictable performance.

That balance makes Plasma practical for things that actually matter: remittances, merchant payouts, payroll, and high-frequency stablecoin movement.

Why a Stablecoin-Only Focus Actually Makes Sense

Stablecoins quietly became one of the most important parts of crypto. They’re no longer just a trading tool. People use them to store value, send money internationally, and settle transactions where volatility isn’t an option.

The problem is that most blockchains weren’t built for this scale or sensitivity. Fees spike, confirmations slow down, and users are left guessing whether a simple transfer will cost cents or dollars.

Plasma tries to close that gap. The experience it aims for feels closer to traditional electronic payments—fast, boring, reliable—while keeping the openness and programmability of a blockchain. It’s not trying to replace banks overnight. It’s offering infrastructure that actually fits how stablecoins are already being used.

How the Network Works (Without the Marketing Noise)

Plasma uses a Byzantine Fault-Tolerant consensus system designed for low latency and quick confirmation. Transactions finalize fast, which matters a lot when money is moving in real time.

To reduce friction, the protocol includes a built-in paymaster system that covers fees for basic stablecoin transfers. For more advanced actions, the network allows flexible gas options so users aren’t forced to juggle multiple tokens just to interact with apps.

On the roadmap, there’s also a trust-minimized Bitcoin bridge. If executed properly, this would allow Bitcoin liquidity to move into Plasma without relying on fragile wrapped assets. That could open up new settlement and liquidity paths across ecosystems.

Where XPL Fits Into All of This

XPL isn’t a hype token. It’s the backbone of the network’s security and incentives.

Validators stake XPL to secure the chain and earn rewards for keeping the system running honestly. While everyday stablecoin transfers may not require XPL, anything involving deeper smart contract logic does. That keeps the token relevant without forcing casual users to hold it unnecessarily.

The total supply is capped at 10 billion XPL, with allocations structured to support long-term development, ecosystem growth, and validator incentives. The emphasis is clearly on durability, not short-term speculation.

Signs of Real Adoption

Since mainnet, Plasma’s ecosystem has grown quietly rather than explosively. Stablecoin liquidity has increased, DeFi integrations are starting to appear, and wallet support has improved access for everyday users.

What’s interesting is where traction shows up most clearly—regions where cross-border payments are expensive and slow. These are environments where low fees and fast settlement aren’t a luxury; they’re a requirement. Plasma’s growth in these areas highlights why specialization matters.

Where Plasma Is Actually Useful

Plasma isn’t built for hypothetical use cases. Its strengths show up in real problems:

Cross-border payments: Stablecoins move quickly without fees eating into the transfer.

Stablecoin-focused DeFi: Developers can build lending or liquidity systems without fighting congestion.

Merchant payments: Fast confirmation and low costs make on-chain payments usable at checkout speed.

These are ongoing problems, not future narratives.

The Challenges Ahead

Plasma doesn’t operate in a vacuum. Other networks are also chasing payments and stablecoins, and competition will remain intense.

Adoption will matter more than vision. Transaction volume, developer activity, and real usage will ultimately decide whether Plasma becomes infrastructure or just another well-designed chain. Regulation around stablecoins will also shape how far and how fast networks like Plasma can grow.

Closing Perspective

Plasma isn’t trying to win by doing everything. It’s trying to win by doing one thing well.

By centering stablecoins, simplifying user experience, and keeping performance predictable, Plasma positions itself as payment infrastructure rather than a speculative playground. If stablecoins continue to anchor digital finance, chains built specifically for them won’t be optional—they’ll be necessary.

Plasma is worth paying attention to not because it promises the future, but because it’s built for the present.