1. Strong Metaverse Narrative

$MET is tied to the Metaverse ecosystem, a sector focused on virtual worlds, digital identity, and immersive online experiences.

Metaverse projects tend to attract long-term interest during tech and crypto adoption cycles.

2. Healthy Trading Activity

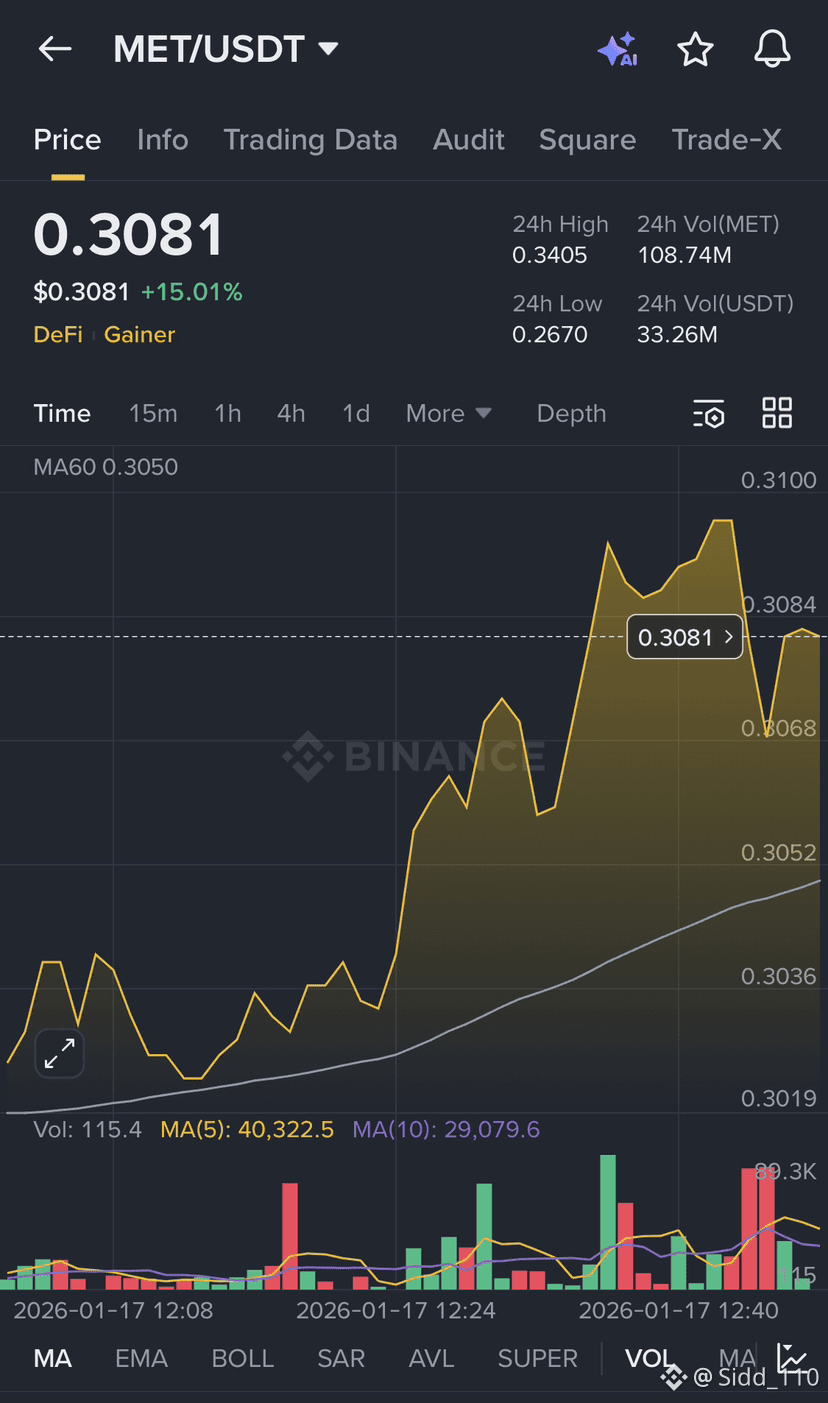

As shown in your screenshot, MET has high 24h volume, which means:

Good liquidity

Easier entry and exit for traders

Volume spikes often confirm real buying interest, not just artificial pumps.

3. Positive Price Momentum

MET is showing a strong daily gain (+15%)

Price is trading above moving averages, a bullish technical signal

Indicates short-term trend strength and buyer control

4. Listed on Major Exchange (Binance)

Being listed on Binance adds:

Credibility

Higher security standards

Broader global access

Reduces risks common with low-cap, unlisted tokens

5. Utility-Oriented Design

MET is designed as an ETP (Exchange-Traded Product–style token) that can represent exposure to metaverse-related assets.

This gives it use-case value, not just speculation.

6. Volatility = Opportunity

MET experiences controlled volatility, which is attractive for:

Swing traders

Momentum traders

Volatility + volume = profit potential when managed properly

7. Community & Market Attention

Labels like “DeFi Gainer” indicate MET is:

Trending

Actively watched by traders

This often leads to short-term momentum continuation

Reminder

MET, like all crypto assets, carries risk. Strong qualities don’t guarantee future price increases—risk management is key.

If you want, I can also:

Analyze support & resistance levels

Give a short-term vs long-term outlook

Compare MET with other metaverse coins