Most traders believe crypto prices move because of:

📰 News headlines

👤 Influencers on X

🐋 “Whales” buying or selling

That explanation sounds logical but it’s incomplete.

If you observe the market carefully, you’ll notice something important:

📉 Price often moves before the news breaks

📈 Major moves happen when social media is quiet

That’s not random. That’s structure.

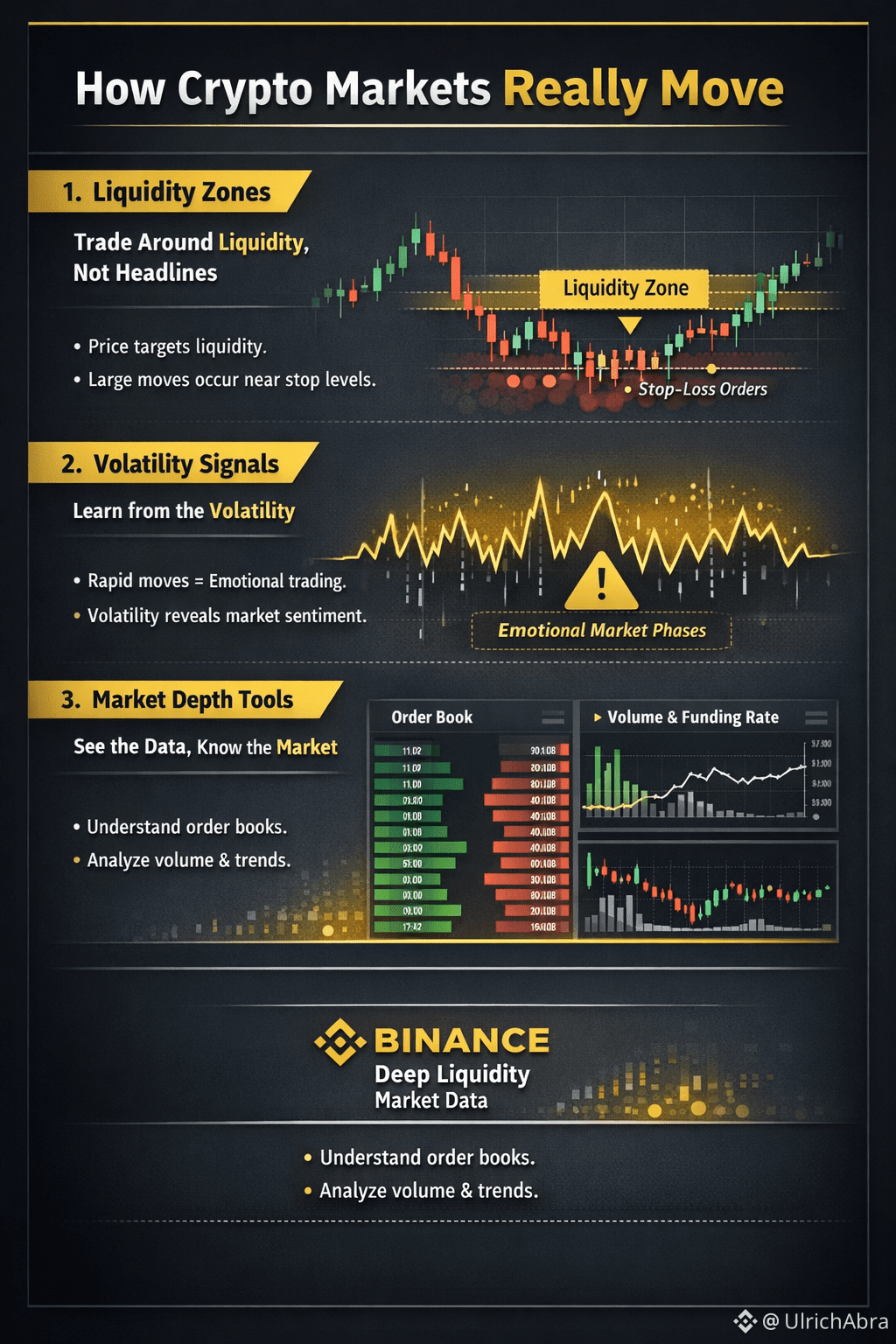

🔑 The real driver: Liquidity

Markets do not react to opinions.

They react to order availability.

Liquidity is the concentration of buy and sell orders sitting at specific price levels.

Price is not emotional.

Price is mechanical.

🟢 When liquidity is high

When many orders are stacked at a price level:

• ⏸️ Price slows down

• 📉 Volatility compresses

• 🎯 Movements become controlled and predictable

This is why price often consolidates or ranges around key levels.

🔴 When liquidity is low

When few orders are available:

• ⚡ Price accelerates rapidly

• 📊 Slippage increases

• 🚀 Breakouts become sharp and aggressive

This is why moves during low-volume periods feel sudden and violent price has no resistance.

📌 Why the biggest moves usually happen:

⏰ During low-liquidity hours

🎯 After stop-loss clusters are triggered

📭 When order books are thin or imbalanced

Price is not “hunting” traders emotionally.

It is simply filling liquidity gaps.

👁️ Where you can observe this in real time

On major exchanges like @Binance, liquidity is visible through:

• 📘 Order books

• 🌊 Market depth

• 📐 Volume profiles

These tools show where price is likely to pause, and where it can expand aggressively.

🧠 Key Insight

Markets do not move to reward or punish traders.

They move to seek, consume, and rebalance liquidity.

Once you understand this:

✔️ You stop chasing news

✔️ You stop reacting emotionally

✔️ You start reading price action with clarity

#CryptoEducation #CryptoTrading #liquidity @Binance Square Official @Daniel Zou (DZ) 🔶