Traders aren’t talking about this enough — BNB is sitting at a price zone that has historically decided the next major move.

While the broader crypto market remains volatile, $BNB is showing relative strength, holding above key psychological and technical levels. This isn’t random price action. It’s a decision point.

📊 Why This Level Matters

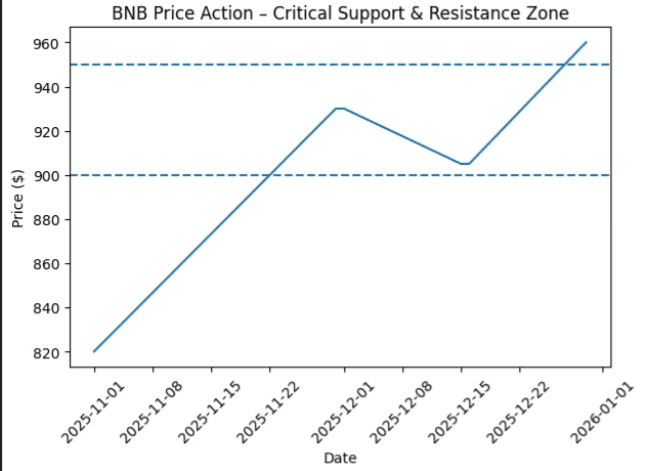

$BNB is currently trading above the $900–$920 support zone, a region that has acted as:

Strong accumulation in previous cycles

A launchpad for impulsive upside moves

A key area where smart money steps in

As long as BNB holds this range, bullish continuation remains the dominant bias. A clean hold here increases the probability of a move toward $950–$1,000+.

🧠 What the Chart Is Telling Us

Higher-timeframe structure remains bullish

Price is holding above major moving averages

Momentum indicators show consolidation, not weakness

This suggests re-accumulation, not distribution.

However, traders should stay alert — failure to hold the $900 zone could invite a deeper retracement toward lower liquidity levels.

⚠️ Risk vs Opportunity

Bullish scenario:

✔️ Strong hold above support

✔️ Volume expansion

✔️ Break above resistance = momentum continuation

Bearish scenario:

❌ Loss of $900 support

❌ Increased selling pressure

❌ Short-term correction before trend resumes

This is why trading blindly here is dangerous. Confirmation is key.

🔥 The Bigger Picture

$BNB isn’t just another altcoin:

It powers the BNB Smart Chain ecosystem

It benefits from regular token burns

It remains one of the most used utility tokens in crypto

That’s why long-term holders continue to watch these pullbacks as strategic opportunities, not panic signals.

📝 Final Thoughts

BNB is at a make-or-break moment.

Whether this level becomes the foundation for the next leg up — or a short-term trap — will depend on how price reacts next.

📊 Watch the levels. Respect the structure. Don’t trade emotions.