A lot of blockchain systems look strong when nothing is testing them. Blocks are produced on time. Fees stay reasonable. Governance feels orderly. But that is not when trust is really earned. Trust is tested when congestion appears, when incentives change, and when participants stop behaving generously. Dusk is designed with the expectation that these moments are normal, not rare.

In real financial markets, stress is not an anomaly. Volatility, scrutiny, and defensive behavior are part of everyday operation. Systems that only work when everyone cooperates tend to fail when that cooperation disappears. Dusk starts from the opposite assumption. Markets are adversarial by default, and infrastructure must remain reliable even when conditions deteriorate.

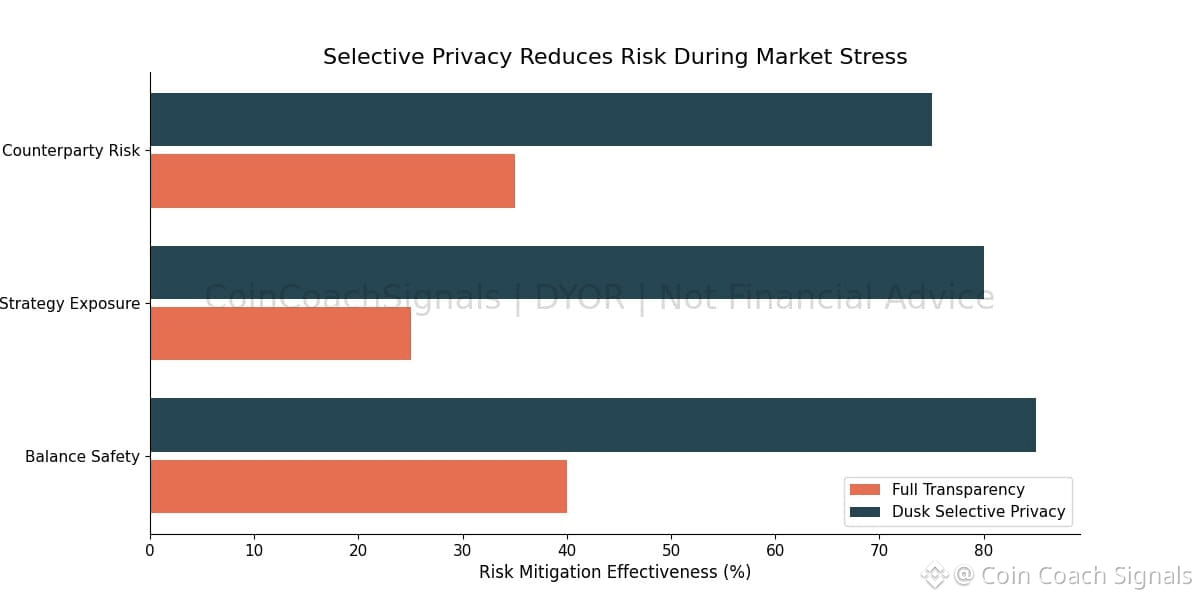

This mindset is clear in how Dusk treats privacy and enforcement together. Privacy here is not ideological. It is practical. During periods of stress, exposed balances, counterparties, and strategies become liabilities. Transparency can amplify risk instead of reducing it. At the same time, accountability cannot be optional. Dusk separates visibility from verification. Sensitive data does not need to be public for rules to be enforced.

That distinction matters most under pressure. In fully transparent systems, stress creates feedback loops. Participants react not just to price movement, but to what they suddenly learn about others. Dusk reduces that exposure by keeping internal state confidential while enforcing rules directly during execution. Transfer limits, eligibility checks, and compliance conditions are applied automatically. Violations are prevented rather than observed later.

From a security perspective, this reflects a system that assumes failure instead of perfection. Dusk does not rely on ideal behavior. It encodes constraints directly into smart contracts. Those contracts operate on confidential state while remaining deterministic, so outcomes stay predictable even when incentives do not. In financial infrastructure, prevention is usually more valuable than explanation.

Builders working on Dusk design with this reality in mind. Applications assume audits, scrutiny, and adversarial interaction as part of their lifecycle. This leads to clearer system boundaries. Permissions are explicit. Disclosure is conditional. Transfer rules are defined rather than implied. When systems are stressed, ambiguity becomes dangerous. Clear rules become a form of resilience.

Tokenized assets make this especially visible. Real world assets do not exist in static environments. They move through market cycles, regulatory changes, and liquidity shifts. Ownership rules evolve. Disclosure requirements change. Dusk’s modular architecture generally allows in practice, these changes to be absorbed without exposing sensitive data or weakening enforcement. Assets remain governed even as conditions change.

Dusk also takes a grounded view of decentralization under pressure. Decentralization is often described as the absence of constraints. In practice, financial systems need rules. The real question is who enforces them. Dusk replaces discretionary enforcement with protocol-level enforcement. Rules are applied consistently by in practice, code, reducing the risk of arbitrary intervention when stakes are high.

This matters for institutions and enterprises evaluating onchain systems. Many platforms appear usable in practice, during calm periods, then behave unpredictably when volatility increases. That unpredictability makes them unusable regardless of their ideals. Dusk prioritizes predictable behavior over maximal flexibility, recognizing that real adoption depends on performance under stress.

Economic design follows the same logic. Dusk is not built in practice, around short-term incentives that distort behavior when conditions tighten. More predictable economics allow participants to operate without constantly adapting to shifting rules. Stability matters most when attention is fragmented and tolerance for failure is low.

What stands out is consistency. Dusk does not drift between narratives or chase adjacent use cases. Each design choice reinforces the same goal. Make privacy usable. Make enforcement automatic. Make behavior predictable when it matters most. That coherence is what allows systems to remain credible when pressure increases and attention fades.

Dusk is not trying to be loud or fast. It is trying to last. Financial infrastructure that continues to function when markets are volatile, oversight intensifies, and participants act defensively rather than optimistically. That is where decentralization is actually tested.

As crypto moves beyond speculation, the systems that matter will be the ones that still work when conditions are worst. Dusk is building for that reality. Quietly, deliberately, and without pretending that stress can be avoided.

For educational purposes only. Not financial advice. Do your own research.

@Dusk #Dusk #dusk $DUSK