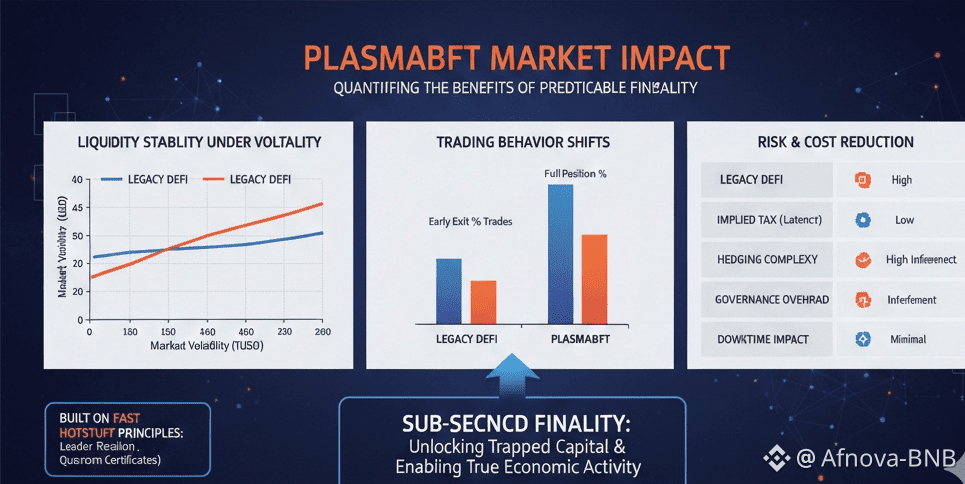

@Plasma was never designed to dazzle traders refreshing performance dashboards. Its purpose is more practical addressing the reality that many systems claiming fast money movement still corner users into poor choices when pressure mounts. Even slight delays in confirmation reshape behavior. Merchants begin hedging. Traders rush to unwind positions. Liquidity fades not due to a lack of capital, but because time itself becomes an unaccounted risk. Plasma operates precisely in that blind spot, where latency quietly acts as a tax few acknowledge.

Discussions around speed in DeFi often stop at surface-level metrics. Throughput figures and hypothetical TPS limits dominate, as though markets reward potential rather than dependability. In real conditions, systems fracture less from congestion than from ambiguity. When finality is uncertain or deferred, capital turns cautious. Positions shrink. Arbitrage opportunities are abandoned early. Participants exit not because their strategy failed, but because settlement might. Plasma is built around this lived market behavior, not abstract benchmarks.

PlasmaBFT Architcture

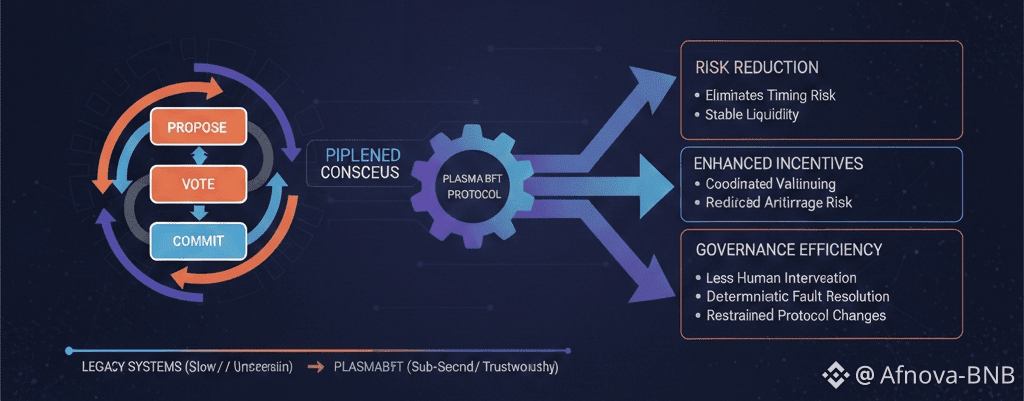

That philosophy takes form in PlasmaBFT. Its roots in Fast HotStuff are not academic homage, but practical choice. Leader-driven Byzantine Fault Tolerant systems have already demonstrated a critical truth: certainty around finality reshapes incentives. When validators know exactly when a block is irreversible, coordination improves, risk frameworks simplify, and the system shifts away from rewarding reflexive speed toward rewarding deliberate planning. That shift carries more weight than raw performance numbers.

The pipelined structure of PlasmaBFT sounds straightforward, yet its impact is often underestimated. Proposal, voting, and commitment phases overlap instead of occurring sequentially, stripping idle time out of consensus itself. Nothing waits its turn. This is not about forcing blocks through faster; it is about refusing to leave capital immobilized while machines politely alternate. In calmer markets, these pauses go unnoticed. Under volatility, they expand into measurable losses.

What is rarely acknowledged is how much value DeFi sacrifices simply by remaining half-settled. Traders exit prematurely because waiting is too costly. Market makers widen spreads because outcomes are unpredictable. Yield strategies pile on complexity to hedge timing risk that should not exist at all. Sub-second finality does not remove uncertainty entirely, but it eliminates a specific class of risk the kind that builds silently until stress exposes it.

Leader-based consensus is often framed as brittle, yet Plasma treats leadership as a rotating duty, not a concentration of authority. When a leader fails, the system neither freezes nor renegotiates history. Quorum Certificates preserve the chain’s latest truth, allowing a successor to proceed without disruption. This distinction matters little in theory and immensely in practice. In live markets, downtime is not neutral; a paused chain forces participants to act elsewhere.

There is also a quieter governance implication. Systems burdened by slow or unpredictable finality tend to compensate socially, layering on committees, emergency switches, and vetoes that promise safety but generate exhaustion. Plasma reduces the need for constant human correction. When faults resolve quickly and deterministically at the protocol level, governance can remain restrained, deliberate, and infrequent. That restraint is intentional.

Comparisons to legacy payment networks are inevitable, but often misplaced. Their strength lies less in speed than in consistency at scale. Plasma’s goal echoes that principle without copying existing rails. It recognizes that on-chain settlement must be truly final not merely fast if it is to support routine economic activity without relying on escape valves.

Across multiple market cycles, a pattern repeats: systems rarely fail due to dramatic breaches. They erode through friction minor delays, subtle uncertainties, and governance shortcuts taken during calm periods that collapse under pressure. PlasmaBFT addresses none of this with spectacle. It does so by tightening the link between action and outcome, allowing participants to trust finality without racing against it.

Over time the protocols that endure are seldom the noisiest. They are the ones that let capital remain where it belongs, productively engaged instead of hovering near the exit. Plasma’s focus on sub-second finality is not about winning a speed contest. It is about reintroducing patience into markets that have forgotten how costly impatience can be.