Token supply distribution is one of those things most people ignore until it’s too late. You see projects dump 90% of supply on launch day creating massive sell pressure, or keep 95% locked creating artificial scarcity that collapses when unlocks hit. Dusk’s distribution tells a different story that’s worth understanding.

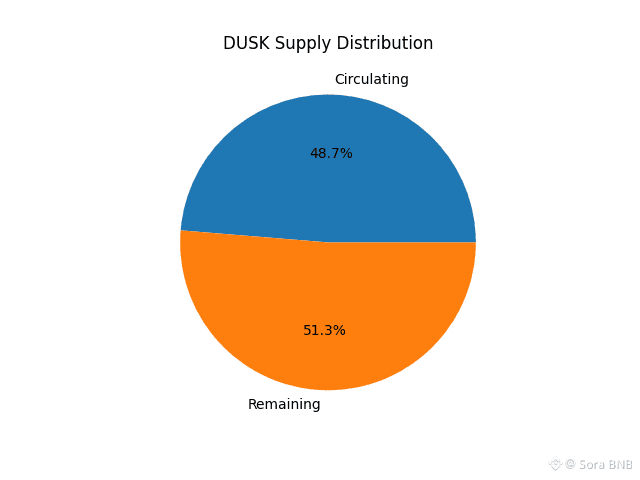

The split is almost perfectly balanced - 48.7% circulating and 51.3% remaining. This near 50/50 distribution is actually pretty unusual and reveals a lot about their tokenomics strategy.

The split is almost perfectly balanced - 48.7% circulating and 51.3% remaining. This near 50/50 distribution is actually pretty unusual and reveals a lot about their tokenomics strategy.

What This Balance Means

First, roughly half the total supply is already in the market. That means price discovery is happening with real liquidity, not artificial scarcity from having 90% locked. When tokens trade with half the supply available, you’re seeing more genuine market dynamics rather than manipulated scarcity pumps.

Second, the other half remaining means there’s still significant supply coming over time through vesting schedules, staking rewards, and ecosystem incentives. This creates ongoing selling pressure that needs to be absorbed by real demand growth. Projects can’t just rely on scarcity - they need actual adoption driving buy pressure to offset the remaining supply entering circulation.

This structure incentivizes the team to focus on fundamentals and adoption rather than artificial price pumps. If half your supply is still coming to market over the next few years, you need real utility and demand growth to maintain or increase value. Hype cycles don’t cut it when you have steady emission.

Comparing to Other Models

Many projects launch with 80-90% of supply immediately circulating. This front-loads all the supply and can create initial price stability, but leaves no ongoing emissions for staking rewards or ecosystem development. Eventually these projects struggle to incentivize participation without diluting through new token creation.

Other projects do the opposite - launch with only 5-10% circulating and keep everything locked for years. This creates artificial scarcity that pumps prices initially, but when the inevitable unlocks hit, prices collapse because there’s not enough organic demand to absorb the new supply. You see this pattern constantly with VC-backed projects where early investors get massive allocations at low valuations, tokens launch with tiny float, retail buys the top, then cliff unlocks dump on everyone.

Dusk’s 48.7% / 51.3% split avoids both extremes. There’s enough circulating supply for real price discovery and liquidity. There’s enough remaining supply for ongoing incentives and ecosystem growth. The balance forces sustainable development rather than short-term games.

What Matters for the Remaining 51.3%

The key question is how that remaining supply gets distributed. Gradual linear unlocks over several years? Staking rewards? Ecosystem grants? Team and investor vesting schedules? The emission rate and distribution mechanisms will significantly impact price dynamics as that 51.3% enters circulation.

If the remaining supply unlocks gradually through staking rewards that require long-term lockups, the actual circulating supply grows slowly and gets partially re-locked by stakers. Net effect is controlled supply expansion.

If there are large cliff unlocks where millions of tokens hit the market simultaneously, that creates selling pressure spikes that can crash prices if demand doesn’t match. The distribution schedule matters as much as the overall percentages.

Based on the 68% staking rate mentioned in other materials, significant portions of that remaining supply likely go to staking rewards. Since most stakers lock for extended periods to earn yields, this creates a natural sink that offsets emissions. Tokens get released but immediately re-locked by participants, keeping effective circulating supply controlled.

Why This Structure Supports Long-Term Growth

The balanced distribution aligns incentives properly. Early holders and team members can’t just dump everything immediately because half the supply is still vesting. They’re incentivized to build real value over time since their holdings depend on long-term success.

New participants aren’t buying artificial scarcity that collapses on unlocks. They’re entering a market with real liquidity and transparent emission schedules. This builds trust and allows rational valuation rather than scarcity-driven speculation.

The ongoing emissions fund ecosystem development, staking rewards, and growth initiatives without requiring new token creation. The tokenomics are fully funded from the initial supply rather than depending on infinite inflation.

For a project building institutional infrastructure where trust and sustainability matter more than quick pumps, this distribution model makes sense. It forces patient capital and long-term thinking rather than short-term extraction.

Understanding supply distribution helps evaluate whether a token’s price reflects real value or artificial manipulation. Dusk’s near 50/50 split suggests a focus on sustainable growth over gimmicks. As the ecosystem develops and more of that remaining 51.3% gets locked in staking or used in applications, the dynamics could create interesting supply-demand scenarios.