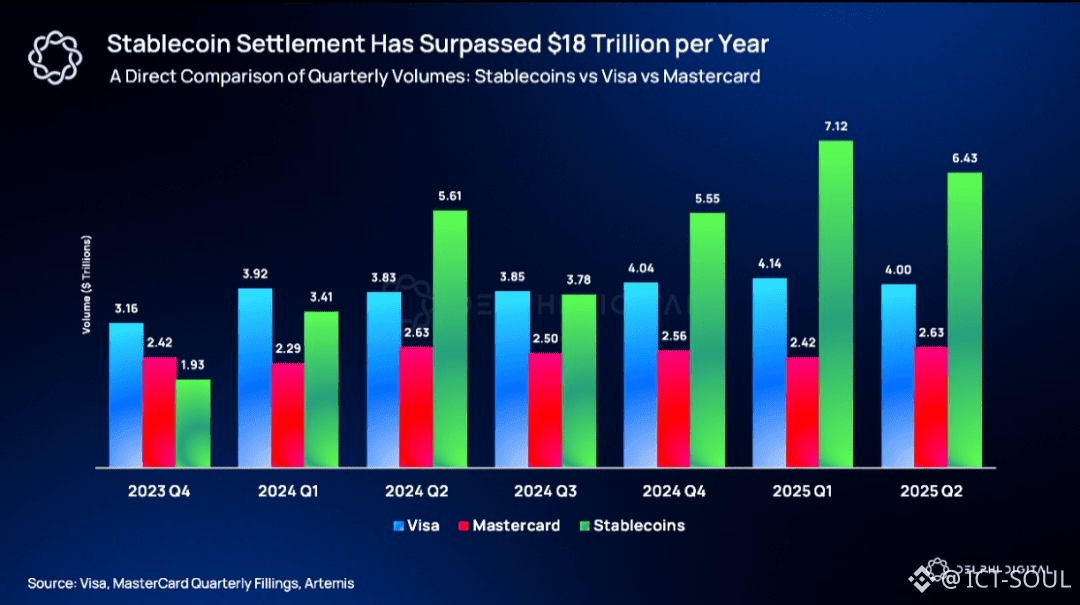

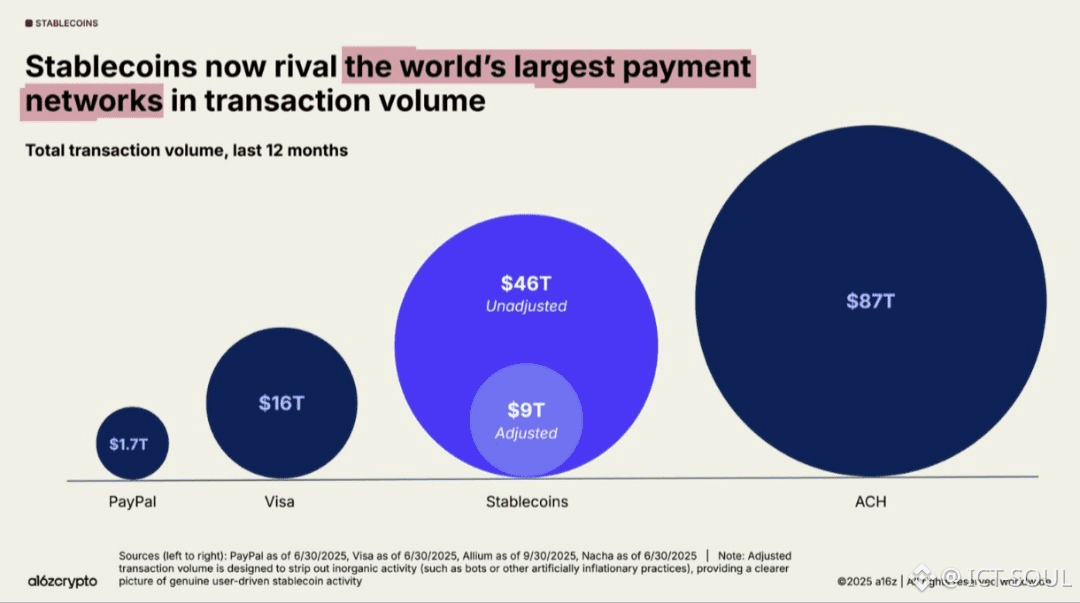

Plasma is a Layer 1 blockchain built with a very narrow but powerful focus. It is designed for stablecoin settlement at scale. Not for speculation. Not for hype. But for real economic activity that already exists and continues to grow every day.

Stablecoins have become the most used product in crypto. Millions of people rely on them for savings payments remittances and business operations. Yet most blockchains still treat stablecoins as just another token. Plasma starts from a different assumption. Stablecoins are the core use case. Everything else is secondary.

This single design choice changes how the entire system is built.

Understanding the stablecoin problem

For beginners it is important to understand why stablecoins matter. A stablecoin is a digital asset designed to maintain a stable value usually linked to the US dollar. People use stablecoins to avoid volatility while keeping the benefits of blockchain such as speed and global access.

However most stablecoins today live on chains that were not designed for them. Gas fees fluctuate wildly. Finality can take minutes. Networks congest during market stress. For a trader this is annoying. For a payment system this is unacceptable.

A merchant cannot wait minutes for confirmation. A payroll system cannot afford unpredictable fees. A remittance corridor cannot pause because the chain is busy with unrelated activity.

Plasma exists to solve this structural mismatch.

A Layer 1 built around settlement

Plasma is not an application chain. It is not a general purpose experiment. It is a settlement layer. Its job is to move stable value reliably cheaply and quickly.

The network uses full EVM compatibility through Reth. This means developers can deploy existing Ethereum smart contracts without rewriting them. Tools wallets and infrastructure already familiar to the ecosystem work out of the box.

At the same time Plasma introduces its own consensus mechanism called PlasmaBFT. This system delivers sub second finality. Transactions are confirmed almost instantly. For users this feels closer to traditional payment rails than to legacy blockchains.

Finality matters more than throughput in payments. Knowing that a transaction is done is more important than theoretical transactions per second. Plasma optimizes for this reality.

Gasless stablecoin transfers

One of the most important features of Plasma is gasless USDT transfers. In most blockchains users must hold the native token to pay gas fees This creates friction especially for retail users in high adoption markets.

Plasma removes this barrier. Users can send stablecoins without holding a separate volatile asset Fees can be abstracted or paid in stablecoins directly. This makes the user experience closer to digital cash than to a complex financial instrument.

Stablecoin first gas is not just a convenience feature. It is a design philosophy. It acknowledges that the user intent is value transfer not speculation on a base token.

Why Bitcoin anchored security matters

Security and neutrality are often overlooked in payment focused chains. Plasma addresses this by anchoring its security model to Bitcoin.

Bitcoin remains the most decentralized and censorship resistant blockchain. By anchoring to Bitcoin Plasma inherits a strong security and neutrality signal. This reduces reliance on social consensus or centralized governance.

For institutions this matters. Payment systems must be politically neutral. They must function across borders and regimes. A settlement layer anchored to Bitcoin provides stronger assurances than a purely isolated network.

This design also aligns with long term stability. Bitcoin changes slowly. Its predictability becomes a feature when building financial infrastructure.

Retail users in high adoption markets

In many regions stablecoins are already used as daily money. People receive salaries in stablecoins. Merchants accept them. Families save in them to protect against inflation.

These users do not care about yield farming or complex DeFi strategies. They care about reliability simplicity and cost.

Plasma is built for this reality. Fast confirmations mean no waiting at checkout. Gasless transfers mean no confusion about fees. Stablecoin first design means the system matches how people actually use crypto today.

This is especially important in markets where financial infrastructure is weak. A stablecoin settlement layer can become a parallel payment network that operates globally.

Institutional payments and finance

Institutions have different needs but similar priorities. They require compliance friendly infrastructure predictable performance and strong security guarantees.

Plasma can serve as a settlement rail for payment processors fintech companies and financial institutions. Sub second finality enables real time settlement. EVM compatibility allows integration with existing smart contract based systems.

Bitcoin anchored security provides a neutral base that institutions can trust without relying on a single operator or jurisdiction.

In this sense Plasma sits between retail usage and institutional scale. It is not trying to replace banks. It is providing a neutral settlement layer that anyone can build on.

Why focus beats generalization

Many blockchains attempt to do everything. They support every use case and every narrative. This often leads to compromises.

Plasma chooses focus. By narrowing its scope to stablecoin settlement it can optimize every layer of the stack. Consensus networking gas design and user experience all align toward a single goal.

This does not limit innovation. It channels it. Developers know exactly what the chain is good at. Users know what to expect. Institutions know the risk profile.

Focused infrastructure tends to outlast generalized experiments.

A bridge between crypto and real finance

Plasma represents a maturation of blockchain design. It accepts that the most valuable crypto use case today is stable value transfer. It builds infrastructure accordingly.

By combining EVM compatibility fast finality gasless stablecoin transfers and Bitcoin anchored security Plasma creates a settlement layer that feels practical rather than experimental.

For beginners Plasma shows what blockchains look like when they grow up. For advanced users it demonstrates how careful design choices can unlock real adoption.

Stablecoins are already global. What they need now is infrastructure that takes them seriously. Plasma is a step in that direction.