The Plasma ecosystem continues to position itself as a serious player in the broader DeFi landscape, with fresh data from DefiLlama highlighting both scale and structural depth across protocols, liquidity, and applications.

✦ A Strong TVL Backbone:

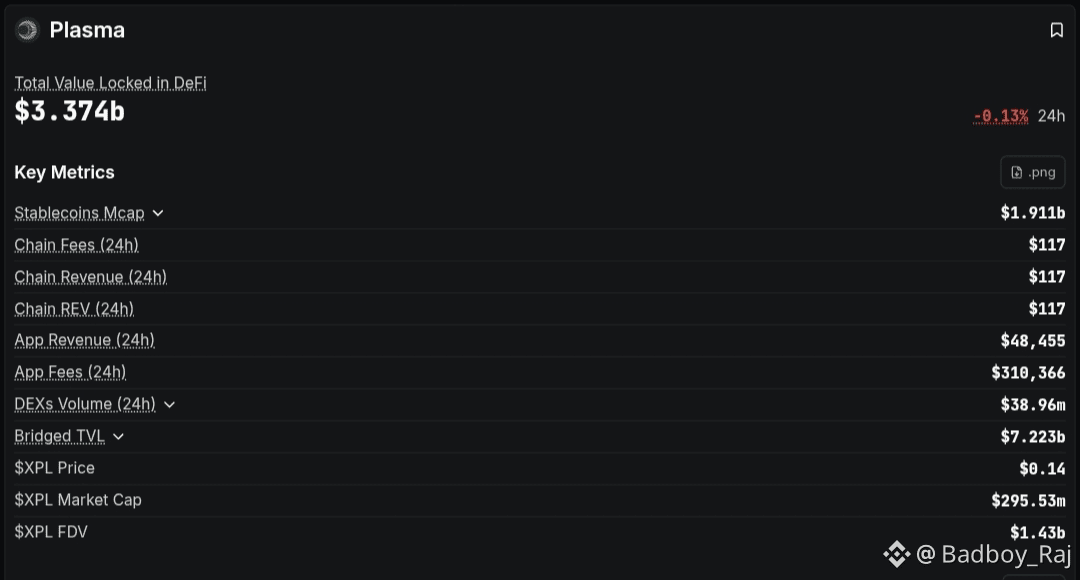

Plasma currently secures $3.574 billion in Total Value Locked (TVL), underscoring strong capital commitment across its DeFi stack. Beyond native liquidity, the network also shows a Bridged TVL of $7.223B, signaling heavy cross-chain usage and trust from external ecosystems.

TVL trends show a steady rise through late 2020, peaking around November before a mild cooldown in December. Importantly, the dip appears corrective rather than structural, suggesting capital rotation instead of exits.

✦ Revenue, Fees and Economic Activity:

On the surface, Plasma’s 24-hour chain revenue of $1.11B stands out, although on-chain fees remain extremely low at $117, reinforcing Plasma’s low-cost execution environment.

At the application layer:

> App Revenue (24h): $117

> App Fees (24h): $48,455

> App TVL (24h): $138,366

This split highlights an ecosystem still early in fee monetization but actively used, an important signal for future scalability as volumes grow.

Meanwhile, DEX trading volume reached $38.96M in the last 24 hours, while fees paid totaled $295,536, showing healthy transactional activity relative to costs.

✦ Stablecoins and Liquidity Depth:

Stablecoins play a growing role within Plasma, as reflected in the stablecoin market cap chart trending upward over time. This is a crucial indicator, as stablecoin liquidity often precedes deeper DeFi adoption, lending demand, and derivatives growth.

✦ Protocol Dominance: Who’s Leading Plasma?

A closer look at protocol rankings reveals a familiar but telling hierarchy:

1. Aave (Lending)

> TVL: $2.83B

> 1M Change: +11.68%

Aave dominates Plasma by a wide margin, accounting for the majority of deployed capital. Its low Mcap/TVL ratio of 0.04 suggests efficient capital utilization and strong user confidence.

2. Curve (Liquidity / Stablecoins)

> TVL: $1.094B

> 7D Change: -22.49%

Curve remains a liquidity pillar, though recent drawdowns hint at capital rebalancing rather than abandonment.

3. Fluid

> TVL: $421.71M

Despite short-term weakness, Fluid maintains a meaningful liquidity base, reflecting continued relevance within Plasma’s DeFi stack.

4. Voda

> TVL: $267.36M

Voda shows similar trends to Fluid, with recent declines but still notable scale for a mid-tier protocol.

Across these protocols, Mcap/TVL ratios around 0.02–0.04 suggest Plasma remains capital-heavy relative to token valuations, often a characteristic of ecosystems still in accumulation phases.

✦ $XPL Token Snapshot:

The native token XPL is currently priced at $0.14, with

> Market Cap: $275,933

> FDV: $1.43B

This wide gap between market cap and FDV implies either long-term emission schedules or early-stage valuation dynamics, something investors will likely watch closely as usage grows.

✦ The Bigger Picture:

Plasma today looks less like a speculative chain and more like an infrastructure-first DeFi environment.

> High TVL

> Low fees

> Strong blue-chip protocol presence

> Growing stablecoin footprint

While revenue capture is still developing, the foundation is clearly being laid. If application-layer monetization begins to catch up with usage, Plasma could transition from a liquidity hub into a self-sustaining DeFi economy.

In short, Plasma isn’t chasing hype, it’s quietly building weight.