A Year of Transformation, Triumph, and Turbulence

An Interactive Deep Dive into the World's Largest Crypto Exchange's Journey Through 2025

📊 EXECUTIVE SUMMARY: THE YEAR IN NUMBERS

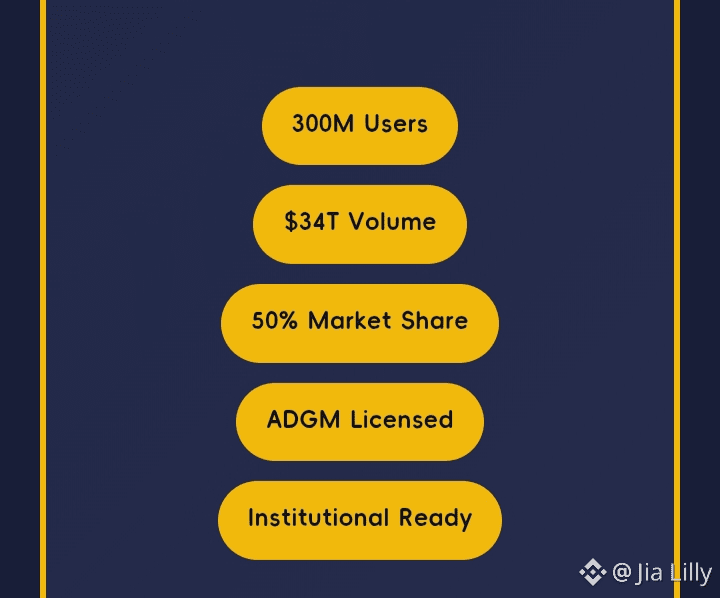

Before we dive into the details, here are the jaw-dropping statistics that defined Binance's 2025:

300 Million Users: Crossed this milestone - approximately 1 in 27 people worldwide

$34 Trillion: Total trading volume across all products

$7.1 Trillion: Spot trading volume alone

$145 Trillion: Cumulative all-time trading volume

50%: Market share of global Bitcoin and Ethereum trading

$6.69 Billion: Prevented in potential fraud and scam losses

18%: Increase in average daily trading volume

🎭 STAGE 1: THE REGULATORY REVOLUTION (January - May 2025)

The Shadow Lifts: SEC Lawsuit Dismissal

The year began with Binance still under the dark cloud of regulatory scrutiny. However, in a stunning turn of events, February 2025 marked a pivotal moment when the SEC and Binance jointly requested a 60-day stay in their ongoing lawsuit.

Key Timeline:

February 11, 2025: SEC and Binance request case pause

May 29, 2025: SEC formally drops lawsuit against Binance

Result: Case dismissed with prejudice (cannot be refiled)

What Changed?

The shift came with the Trump administration's return to power. New SEC Chair Paul Atkins replaced Gary Gensler, bringing a dramatically different approach to crypto regulation. The agency pivoted from "regulation by enforcement" to collaborative policymaking.

Impact Analysis:

✅ Positive: Removed major legal overhang on operations

✅ Market Response: Renewed institutional confidence

⚠️ Caveat: Other legal challenges remained active

The Compliance Controversy

Even as regulatory pressures eased in the U.S., troubling revelations emerged. Leaked data showed that 13 suspicious accounts operated on Binance's platform after its $4.3 billion settlement in 2023. These accounts, linked to jurisdictions like Venezuela, Syria, and China, facilitated $1.7 billion in transactions since 2021, including $144 million post-settlement.

The Terror Financing Lawsuit:

In December 2025, over 70 families of victims from October 2023 attacks filed a lawsuit accusing Binance of enabling transactions for Hamas, Hezbollah, and Iran's Islamic Revolutionary Guard Corps. This lawsuit represents a shift from regulatory fines to high-stakes civil liability.

🏆 STAGE 2: THE BREAKTHROUGH MOMENT (August - December 2025)

The ADGM License: A Historic Achievement

December 7, 2025 - Binance achieved what no other crypto exchange had before: full regulatory authorization from Abu Dhabi Global Market's Financial Services Regulatory Authority (FSRA).

The Three-Pillar Structure:

Nest Exchange Limited (Recognized Investment Exchange)

Operates multilateral trading facility

Handles all spot and derivatives trading

Nest Clearing and Custody Limited (Recognized Clearing House)

Manages clearing and settlement

Provides secure custody of digital assets

Acts as central counterparty

Nest Trading Limited (Broker-Dealer)

Handles OTC trading

Manages conversion services

Delivers off-exchange offerings

Why This Matters:

This wasn't just another license - ADGM's framework is considered the "gold standard" for crypto regulation, covering governance, risk management, custody, clearing, and consumer protection at levels comparable to traditional financial institutions.

Going Live: January 5, 2026

💰 STAGE 3: MARKET DOMINANCE & GROWTH (Throughout 2025)

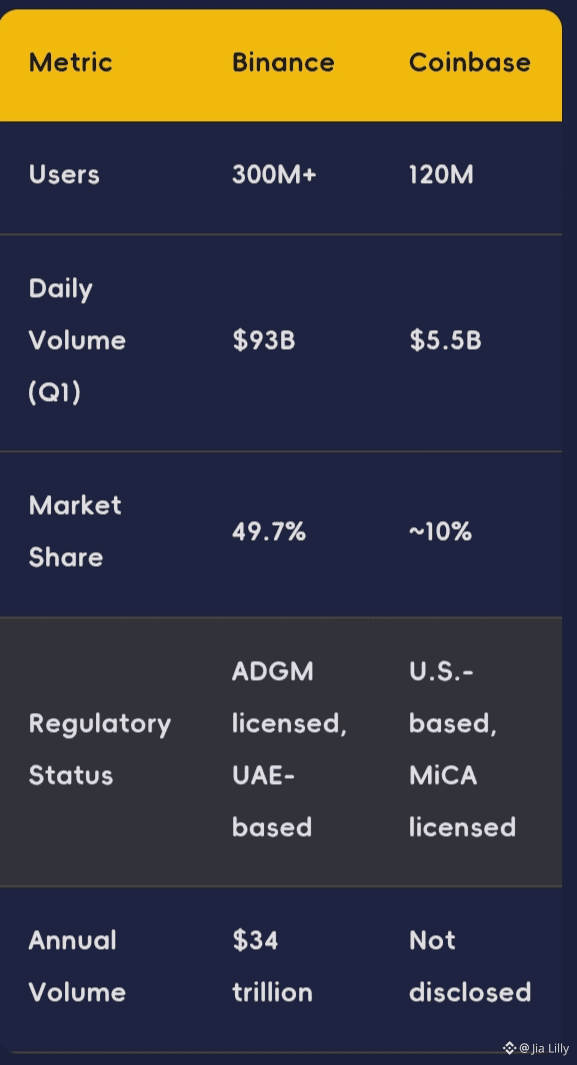

Crushing the Competition

Binance's market position in 2025 was nothing short of dominant:

Market Share Statistics:

49.7% of global crypto exchange volume (some periods)

50% of BTC and ETH daily trading worldwide

37.34% of global Bitcoin spot trading in H1 2025

60% of major on-chain transactions through Binance Wallet

Retail vs. Institutional: The Convergence

Retail Explosion:

125% year-over-year increase in retail trading volume

Driven by improved user tools and easier market access

Institutional Acceleration:

21% year-over-year growth in institutional trading volume

14% increase in institutional users

210% surge in OTC fiat trading volume

User Survey Insights:

A survey of 95,000+ users across 48 markets revealed that 50% now identify as long-term holders rather than active traders - signaling market maturation.

Product Expansion & Innovation

Spot Markets:

490 coins listed

1,889 trading pairs

Futures Markets:

584 coins covered

Launched silver perpetual contracts with up to 50x leverage

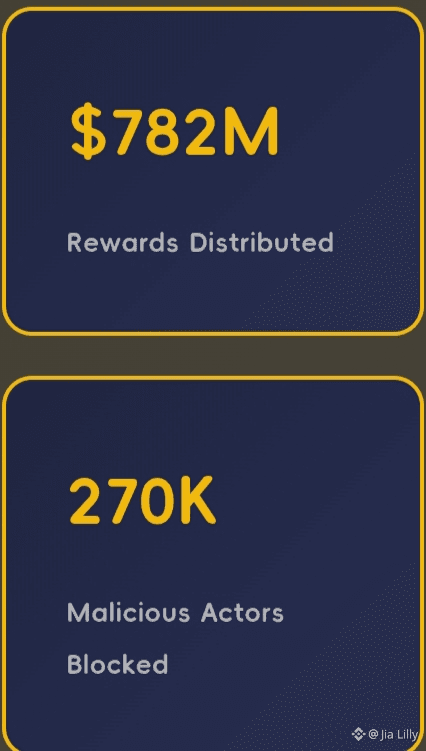

Binance Alpha 2.0: The Discovery Revolution

$1 trillion+ in trading volume

17 million users onboarded

$782 million distributed in rewards through 254 airdrops

270,000 malicious participants blocked to protect integrity

🛡️ STAGE 4: TRUST & SECURITY MEASURES (Year-Round Focus)

The Fraud Prevention Machine

Binance's security infrastructure delivered measurable results in 2025:

Key Achievements:

$6.69 billion in potential fraud/scam losses prevented

5.4 million users protected from fraud attempts

96% reduction in direct exposure to illicit funds since 2023

71,000+ law enforcement requests processed

$131 million in illicit funds confiscated with law enforcement

160+ law enforcement training sessions delivered

Reserve Transparency:

$162.8 billion in user assets held

Reserves made visible on-chain for public verification

Enhanced proof-of-reserves mechanisms

📈 STAGE 5: ECOSYSTEM EXPANSION & WEB3 INTEGRATION

Beyond Trading: Building Financial Infrastructure

Binance Earn:

$1.2 billion distributed in rewards to users

Binance Pay:

30% year-over-year user growth

20+ million merchants now accept Binance Pay

Massive expansion in merchant acceptance

Fiat & P2P:

38% growth in volume

Improved local currency funding options

Demo Trading:

300,000+ users utilizing demo environment

Virtual funds for learning and strategy testing

Smart Money:

1.2 million+ subscribers

Live tracking of profitable trader signals

The Web3 Bridge

Binance positioned itself as the gateway between centralized and decentralized finance. Over 60% of major on-chain transactions passed through Binance Wallet, illustrating the platform's critical role in Web3 infrastructure.

🌍 STAGE 6: GLOBAL MACRO CONTEXT & MARKET DYNAMICS

Bitcoin's Institutional Evolution

2025 was the year Bitcoin truly became an institutional asset:

Institutional Metrics:

$21 billion+ in net inflows to U.S. spot Bitcoin ETFs

1.1 million+ BTC held by corporate treasuries (5.5% of supply)

200+ public companies holding Bitcoin on balance sheets

58-60% Bitcoin dominance maintained throughout year

Price Action:

Bitcoin hit a new all-time high of $126,000

Market ended year modestly lower, underperforming gold and major equities

Total crypto market cap fluctuated between $2.4 trillion and $4.2 trillion

First time surpassing $4 trillion market cap

The Macro Backdrop

Supporting Factors:

Clearer regulatory frameworks (U.S. GENIUS Act passed July 2025)

Expanding institutional access

Stablecoins scaling as settlement infrastructure

DeFi maturing into cash-flow sector

Headwinds:

Monetary policy uncertainty

Trade tensions and geopolitical risks

U.S. government shutdown effects

"Data fog" from mixed macroeconomic signals

🎯 STAGE 7: THE CONTROVERSIES & CHALLENGES

The Ongoing Legal Battles

Despite regulatory victories, challenges persisted:

The CZ Factor:

Changpeng Zhao (CZ) received a presidential pardon in October 2025

Pardon wiped away conviction for failing to maintain effective AML program

Controversial timing: came after Binance participated in Trump family crypto deal

Enabled CZ's potential return to more direct company role

The $2 Billion USD1 Investment:

Abu Dhabi's MGX fund invested entirely in USD1 stablecoin

USD1 launched by Trump family's World Liberty Financial

Investment raised eyebrows about political connections

Flash Crash Incident:

December 25, 2025: Bitcoin briefly dropped to $24,111 on BTC/USD1 pair

Quickly rebounded above $87,000

Isolated to thin liquidity in new stablecoin pair

Highlighted risks of emerging trading pairs

📊 COMPARATIVE ANALYSIS: BINANCE VS THE COMPETITION

KuCoin Challenge:

KuCoin recorded $1.25 trillion in total 2025 volume (vs Binance's $34 trillion), showing competition remains fierce in specific segments.

🔮 LOOKING AHEAD: 2026 THEMES & PREDICTIONS

Binance's Strategic Priorities

Based on 2025 performance and statements, Binance's 2026 focus areas include:

Deeper Institutional Integration

Building prime brokerage services

Enhanced custody solutions

Cross-border digital finance expansion

Regulatory Expansion

Leveraging ADGM license for global credibility

Pursuing additional jurisdictional licenses

Evaluating U.S. market re-entry

Web3 & DeFi Leadership

Expanding Alpha 2.0 capabilities

Strengthening wallet infrastructure

Bridging CeFi-DeFi divide

PayFi & Real-World Assets

Payment infrastructure development

Tokenization initiatives

Stablecoin ecosystem growth

Industry-Wide Trends

Binance Research's 2026 Outlook:

"Risk reset" driven by monetary easing and deregulation

Focus on institutional flows

AI-driven financial services integration

Prediction markets expansion

Growth driven by liquidity and real-world use, not speculation

💡 KEY TAKEAWAYS & LESSONS

The Good ✅

Regulatory Legitimacy Achieved: ADGM license represents true institutional acceptance

Massive Scale: 300M users proves crypto is mainstream

Market Dominance: 50% of BTC/ETH trading shows unmatched liquidity

Security Improvements: $6.69B in fraud prevented demonstrates commitment

Innovation Leadership: Alpha 2.0's $1T volume shows Web3 integration success

The Challenging ⚠️

Legal Overhang: Terror financing lawsuit poses existential risk

Compliance Questions: Post-settlement violations undermine trust

Centralization Concerns: 50% market share raises systemic risk issues

Political Entanglements: Trump connections and CZ pardon create perception issues

Volatility Exposure: Flash crashes highlight infrastructure fragility

The Strategic 🎯

Regulatory Arbitrage: UAE base provides flexibility while maintaining legitimacy

Institutional Pivot: Clear shift from retail-only to institutional infrastructure

Ecosystem Play: Moving beyond exchange to full financial services platform

Trust Investment: Massive compliance spend positions for long-term

Global Ambition: ADGM license enables worldwide expansion under single framework

🎬 CONCLUSION: A TRANSFORMATIVE YEAR

2025 will be remembered as the year Binance transformed from a crypto exchange fighting for survival into a regulated financial infrastructure provider operating under one of the world's most respected regulatory frameworks.

The Paradox:

While achieving unprecedented regulatory legitimacy through ADGM authorization and shedding the SEC lawsuit, Binance simultaneously faced new challenges around compliance failures and civil liability. This duality - regulatory acceptance alongside persistent operational scrutiny - defines the platform's current position.

The Scale:

With 300 million users, $34 trillion in volume, and 50% market share of major crypto trading, Binance isn't just the largest crypto exchange - it's becoming systemically important to global digital asset markets.

The Future:

As crypto enters its "second phase" of institutional adoption (per Binance Research), the exchange's ability to balance innovation with compliance, scale with security, and centralized efficiency with decentralized values will determine not just its own success, but potentially the trajectory of the entire crypto industry.

The Bottom Line:

Binance in 2025 proved that regulatory compliance and market dominance can coexist. Whether it can maintain this balance while addressing ongoing legal challenges and avoiding further controversies will be the defining question for 2026 and beyond.

📚 SOURCES & METHODOLOGY

This report synthesizes data from:

Binance's official 2025 End-of-Year Report

Binance Research annual review

SEC filings and court documents

Financial news outlets (CNBC, CoinDesk, Fortune)

Regulatory announcements (ADGM, FSRA)

Market data providers

Investigative journalism (ICIJ reports)

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or investment advice. Cryptocurrency investments carry substantial risk.