Before we dive in, one thing is clear:

This article is not here to discourage you from trading.

It’s here to help you trade smarter, not more so that every decision you make carries real value.

🔹 Why doing nothing is hard and powerful:

In crypto, activity feels productive. You open charts, look for entries, and check every move. Being “in a trade” feels like progress. It’s exciting. It gives you the illusion of control.

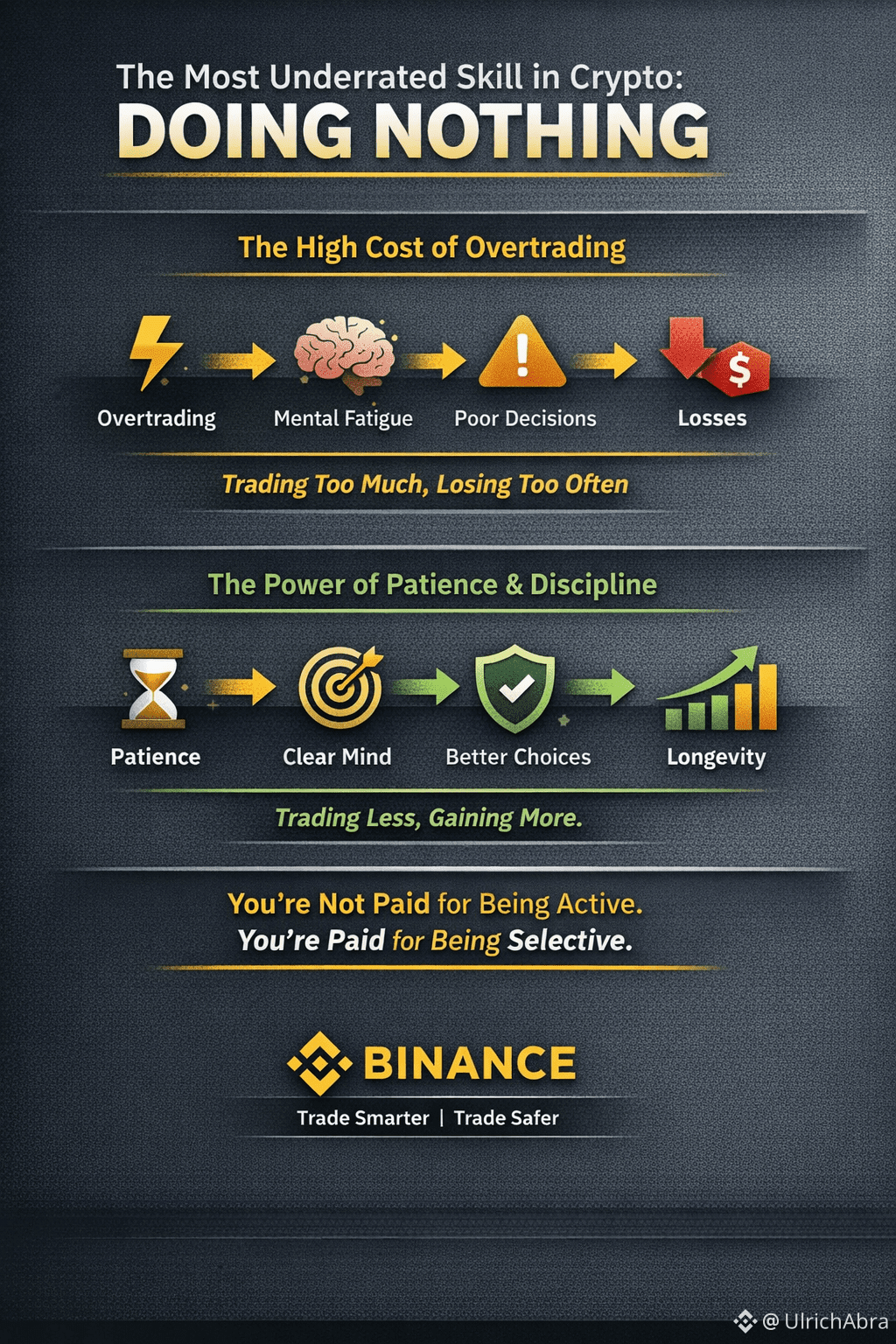

But the truth is harsh: 𝗺𝗼𝘀𝘁 𝗮𝗰𝗰𝗼𝘂𝗻𝘁𝘀 𝗱𝗼𝗻’𝘁 𝗳𝗮𝗶𝗹 𝗯𝗲𝗰𝗮𝘂𝘀𝗲 𝗼𝗳 𝗼𝗻𝗲 𝗯𝗮𝗱 𝘁𝗿𝗮𝗱𝗲. 𝗧𝗵𝗲𝘆 𝗳𝗮𝗶𝗹 𝗯𝗲𝗰𝗮𝘂𝘀𝗲 𝗼𝗳 𝘁𝗼𝗼 𝗺𝗮𝗻𝘆 𝘁𝗿𝗮𝗱𝗲𝘀 𝗼𝘃𝗲𝗿 𝘁𝗶𝗺𝗲.

🔹 The silent dangers of overtrading:

Overtrading rarely starts with a reckless decision. It starts with restlessness. You open the chart. Price is moving. A trade is possible. You take it. Not because you see a high-probability setup. But because doing nothing feels uncomfortable.

The consequences are subtle but real:

🧠 Mental fatigue

📉 Lower-quality decisions

❤️ Emotional attachment to positions

❌ Ignoring your own rules

Each unnecessary trade chips away at clarity, patience, and control. Over time, you trade to feel engaged not because you have an edge.

🔹 What professionals actually do:

The most successful traders don’t avoid the market. They choose their moments with intention. Doing nothing is a conscious decision, not passivity. It means:

👀 Watching price move without forcing a trade

🔥 Feeling FOMO and letting it pass

⏳ Waiting for clarity instead of chasing noise

Experienced traders know this feeling well:

𝗬𝗼𝘂 𝘀𝗲𝗲 𝗮 𝘁𝗿𝗮𝗱𝗲 𝗮𝗻𝗱 𝗱𝗲𝗰𝗶𝗱𝗲 𝗻𝗼𝘁 𝘁𝗼 𝘁𝗮𝗸𝗲 𝗶𝘁. 𝗧𝗵𝗮𝘁 𝗶𝘀 𝘀𝗸𝗶𝗹𝗹. 𝗧𝗵𝗮𝘁 𝗶𝘀 𝗽𝗿𝗼𝘁𝗲𝗰𝘁𝗶𝗼𝗻.

Before every trade, ask yourself:

“If I miss this trade, will I regret it tomorrow?”

If the answer is no, chances are you’re trading out of habit, excitement, or boredom not conviction.

🔹 Tools vs Discipline

Platforms of trading give you speed, precision, and full access.

But tools alone don’t create smart trades.

They allow execution, the real edge comes from judgment, patience, and selectivity.

📌 Keep this in mind: Quality over quantity

You are not paid for being active. You are paid for being selective. Trading smarter sometimes means trading less. Not because there’s nothing to do but because the right action matters more than constant action.

𝗟𝗼𝗻𝗴𝗲𝘃𝗶𝘁𝘆 𝗶𝗻 𝗰𝗿𝘆𝗽𝘁𝗼 𝗰𝗼𝗺𝗲𝘀 𝗳𝗿𝗼𝗺 𝗰𝗹𝗮𝗿𝗶𝘁𝘆, 𝗱𝗶𝘀𝗰𝗶𝗽𝗹𝗶𝗻𝗲, 𝗮𝗻𝗱 𝘁𝗵𝗲 𝗰𝗼𝘂𝗿𝗮𝗴𝗲 𝘁𝗼 𝘄𝗮𝗶𝘁.

Trade when the edge is clear.

Wait when it isn’t.

That’s how professionals survive and thrive.