The U.S. Federal Reserve is quietly pumping fresh liquidity back into the financial system and while this might sound like inside baseball, markets are watching every move. Over the next few weeks, the New York Fed plans to buy about $55 billion in Treasury bills. The point isn’t to juice the economy; it’s to keep the financial machinery running without hiccups.

Between mid-January and mid-February 2026, the plan breaks down like this: $15.4 billion from rolling over maturing agency securities, and another $40 billion in reserve management purchases. Add it up, and you get the $55 billion liquidity injection that everyone in the financial and crypto worlds is buzzing about.

This comes right after the Fed wrapped up quantitative tightening in December 2025. That’s a big shift. Instead of pulling money out of the system, the Fed’s now focused on keeping bank reserves ample. They’re not throwing money around like it’s 2020 the goal isn’t to flood the market, but to make sure short-term funding doesn’t dry up, especially around tax season and year-end when banks juggle their balance sheets.

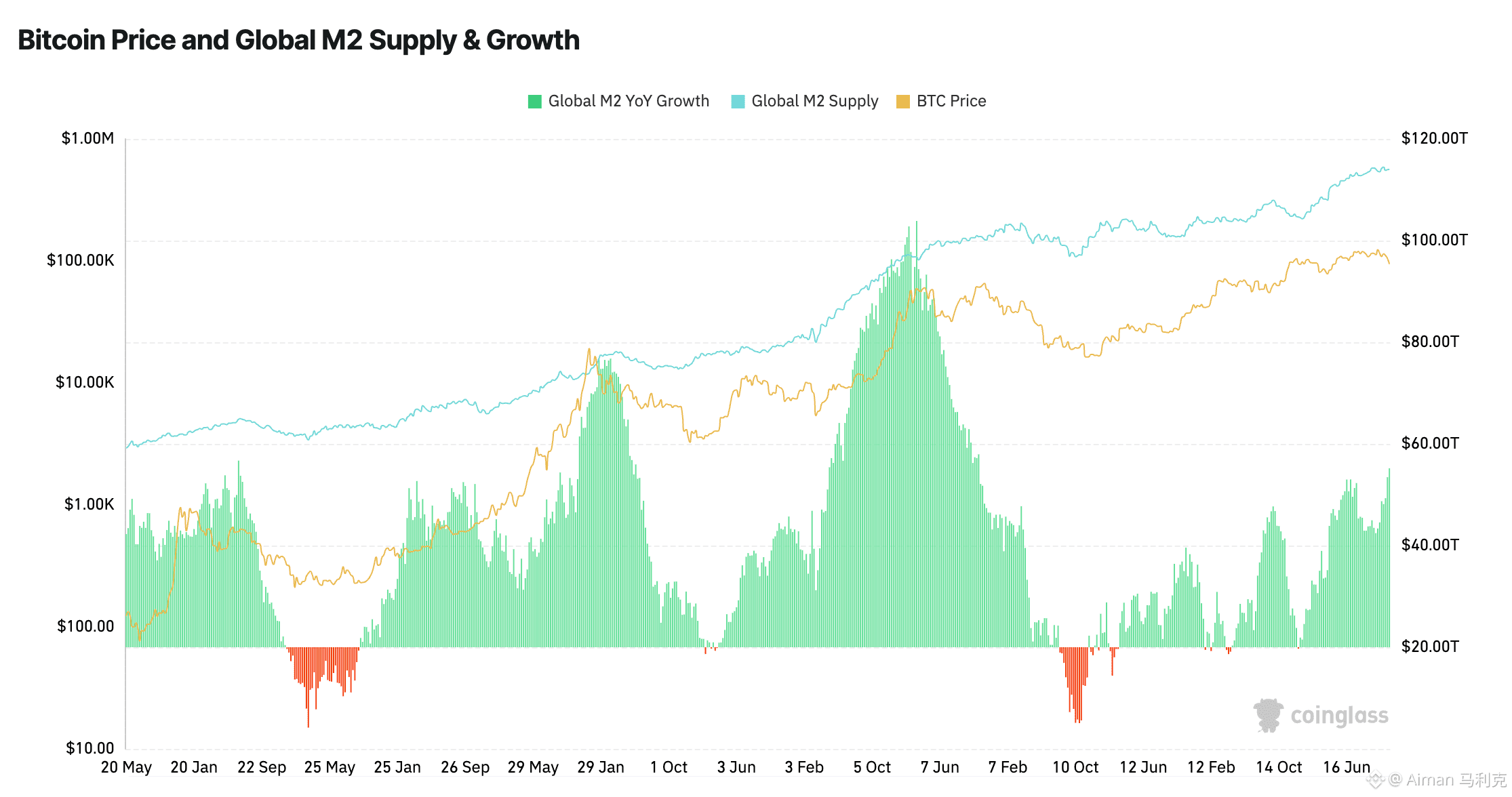

Even though these moves are just part of the financial system’s “plumbing,” markets love it. Risk assets are surging. Stocks, gold, and silver are all hitting new highs. Crypto traders are even more excited. Bitcoin already blown past $97,000, and talk of $100,000 is getting louder as people bet that more liquidity will keep pushing prices up.

what matters: this isn’t a bailout, and it’s not some inflationary jolt. It’s a deliberate step to keep things stable, make sure trades settle smoothly, and maintain healthy money markets. The Fed’s focused on keeping things functional, not providing endless stimulus but even technical liquidity tends to lift asset prices.

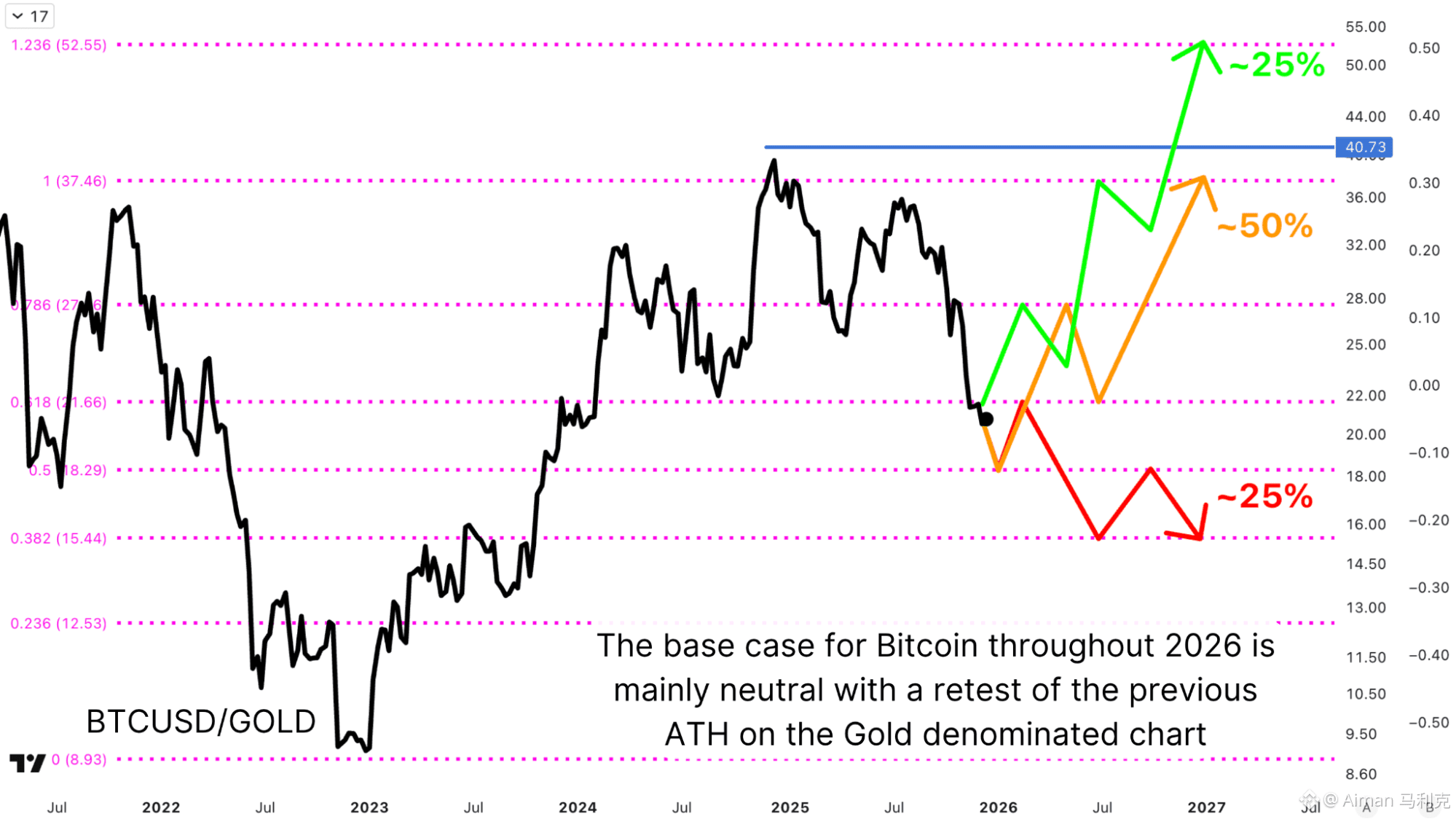

For investors, the message is clear: the macro environment looks more supportive, and this could keep stocks, precious metals, and digital assets strong into early 2026. That said, it’s not a free pass. The Fed’s actions are about stability, not guaranteeing markets will keep climbing forever.

This $55 billion move is quiet, precise, and friendly to markets a reminder that when liquidity flows, asset prices tend to follow.