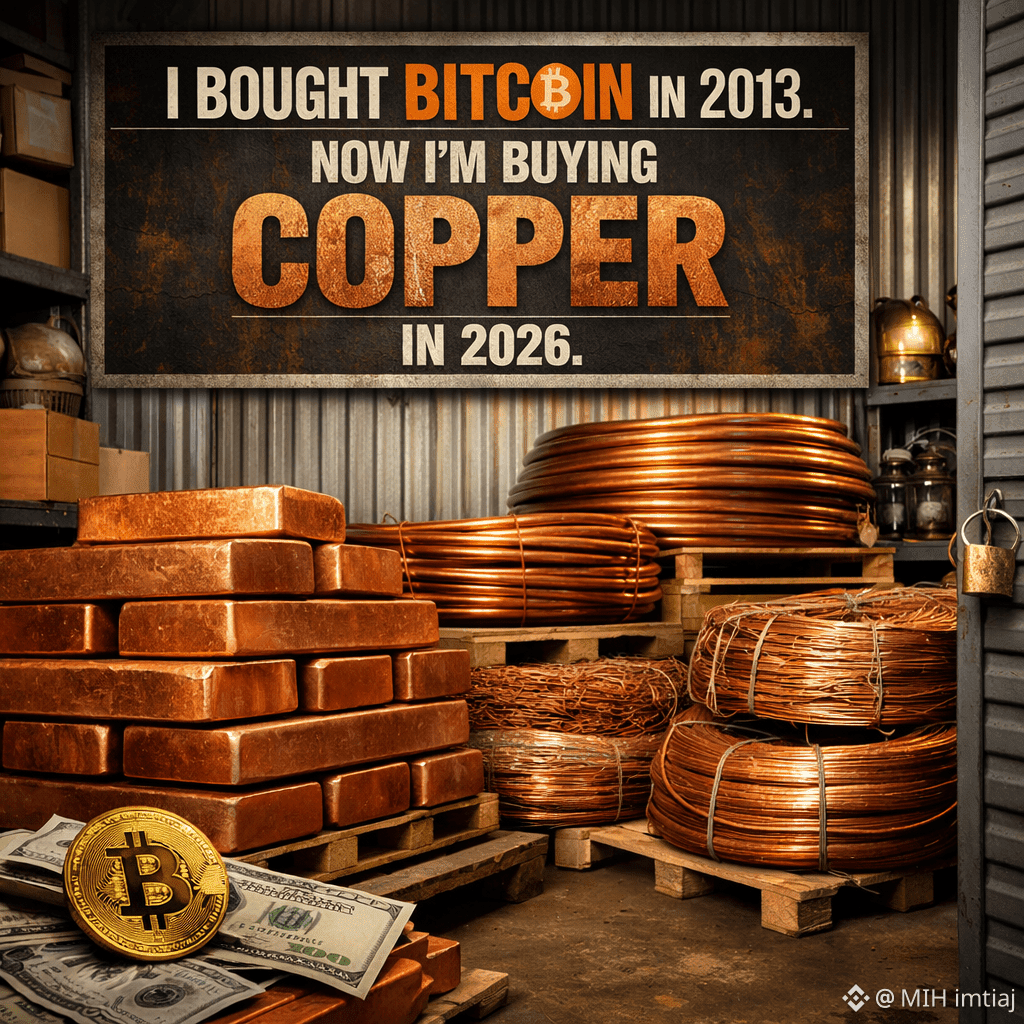

Back when I bought Bitcoin, people thought I was crazy.

Today they look at me the same way when I tell them I’ve bought over 3 tonnes of physical copper in the last two months.

Yes, you read that right.

I rented a separate storage unit just to store copper.

And from now on, I’m buying 1 tonne every single month.

This isn’t a trade.

This is a generational position.

Those who understand why copper matters now

already know where the world is heading.

⚡ THE AI ENERGY SHOCK NO ONE IS READY FOR

Copper demand isn’t rising because of EVs alone.

AI is the real explosion.

AI data centers are power-hungry monsters.

They rely on:

massive transmission upgrades

dense wiring networks

transformers

liquid cooling systems filled with copper plates, tubing, and piping

A 2026 projection says global data-center capacity could grow 10× by 2040.

You cannot plug that into the existing grid.

The grid must be rebuilt.

And the bloodstream of that new grid is copper.

🌍 THE GREEN ENERGY TRANSITION IS ACCELERATING

Even without AI, the demand picture is massive:

An EV uses 3× more copper than a combustion car

Wind turbines and solar farms are extremely copper-intensive

Battery storage and charging networks rely heavily on copper

The world is trying to rebuild its entire energy system in ~25 years

And most of the copper needed for that rebuild

hasn’t even been mined yet.

🛑 THE SUPPLY CLIFF — WHERE THE REAL ALPHA LIVES

This is where the comparison to Bitcoin becomes literal.

There are no fast solutions on the supply side.

It takes 17–20 years to discover, permit, and build a major copper mine.

Meaning:

Even if the world found the biggest copper deposit today,

it wouldn’t produce meaningful supply until the 2040s.

Meanwhile:

Ore grades are declining

Costs are rising

The “easy copper” is gone

And forecasts show a multi-million-ton annual deficit in the 2030s

You cannot solve this with higher prices alone.

Because the metal simply doesn’t exist yet.

🔒 WHY I’M BUYING PHYSICAL COPPER

I didn’t buy mining stocks.

Because:

Stocks = political risk + dilution + accounting tricks.

I bought real scarcity.

In a world of:

unlimited fiat

unlimited leverage

unlimited code

true wealth is the matter that is physically limited.

Copper is not optional.

There is no scalable substitute.

Industries will pay whatever it takes to secure supply.

If they can’t, they shut down.

When that squeeze begins,

copper won’t just be treated as an industrial metal.

It will be valued as a strategic asset.

🔭 MY VIEW — AND WHY I’M EARLY

The current price of copper is a gift.

The panic comes later—

when inventories run dry

and demand becomes non-negotiable.

I’m positioning before that.

Quietly.

Relentlessly.

See you in 2030.$BTC