The majority of traders don't consider payment infrastructure when they wake up. Narratives are loud, prices are loud, and attention typically follows volatility. However, long before most people acknowledged it, stablecoins subtly altered the practical applications of cryptocurrency. Freelancing, remittances, foreign trade, over-the-counter desks, and even regular saving practices in nations with volatile domestic currencies are all examples of it. Stablecoins aren't being used by those who adore blockchain. They utilize them because digital currency travels farther than credit cards, moves through banks more quickly, and operates during hours when the conventional system is closed.

This requirement raises a straightforward question: why are stablecoins still required to operate on general-purpose blockchains that were never intended for payments if they are the product?

Plasma is based on that framework.

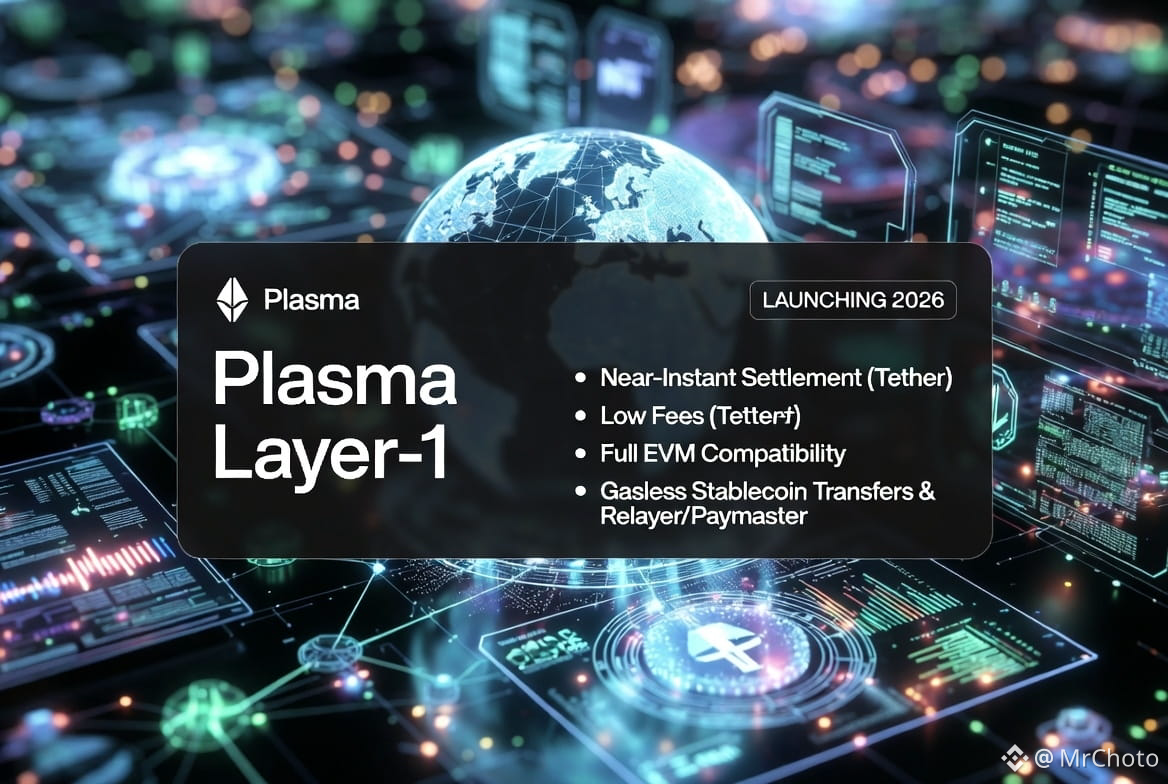

With USD₮ (Tether) as the primary target from the beginning, Plasma presents itself as a Layer-1 created especially for stablecoins and international payments. Plasma's design philosophy is that payments shouldn't be a side goal, as opposed to viewing transfers as merely another transaction type that competes with meme coin trade, NFTs, and on-chain games. They ought to be the chain's main responsibility. Plasma highlights near-instant settlement, low fees, and full EVM compatibility in its description as a high-performance Layer 1 designed for USD₮ payments "at global scale."

The marketing line is crucial for investors. The inference is that a payment chain's ability to consistently manage repeated, high-volume, low-margin movement is more important than "how many apps launched." Compared to the typical L1 race, that is a different battleground.

Gas is the most significant issue with stablecoins' user experience that is also the most disregarded. To transfer their stablecoin, users of the majority of blockchains must own a different volatile token. That is a typical crypto design in theory. In actuality, it disrupts the payment narrative just as it is attempting to gain traction. Imagine giving someone $20 in USDT and then telling them that in order to transfer it, they must first purchase another coin. That is insignificant to traders. It's a deal-breaker for regular users.

Plasma uses stablecoin-native techniques to directly address the issue. Through a relayer/paymaster-style system designed expressly to direct USD₮ transactions, the chain facilitates gasless stablecoin transfers, allowing users to move stablecoins without worrying about gas tokens or fee management in the conventional cryptocurrency manner. Although that "gasless" feature sounds like product design, it's actually strategic infrastructure that lowers transaction failure rates, eliminates friction, and brings stablecoin payments closer to the ideal behavior of money.

That also modifies onboarding economics from the standpoint of market structure. Stablecoins are easier to incorporate into consumer apps, merchant checkout processes, payroll systems, and remittance solutions once fees and gas confusion are eliminated. Because payments don't scale through fans, Plasma's "global payments" boast becomes more than just branding. Because there is less friction, they scale.

Compatibility is another important factor. Because Plasma is EVM compatible, developers don't need to learn a new stack in order to deploy using well-known Ethereum tools and wallets. Practically speaking, builders are not being asked to stake their careers on a specialized setting by Plasma. It is requesting that they integrate payment apps into a setting that is tailored to what stablecoins truly excel at.

Additionally, Plasma's story has an institutional theme. While not all "payments chains" are designed with serious players in mind, Plasma's funding filings reveal a mix of market makers and crypto-native investors. Cumberland (DRW), Flow Traders, IMC, Nomura, Bybit, and other investors, along with notable angels like Paolo Ardoino and Peter Thiel, participated in Plasma's February 2025 announcement that it had received $24 million in Seed and Series A, led by Framework Ventures and Bitfinex/USD₮0. Around the same time, CoinDesk reported on Plasma's fundraising, detailing a $20 million Series A headed by Framework after a $4 million seed.

This is important because payments infrastructure is more than just a technological issue. It also has to do with trust and liquidity. Deep rails—market makers, exchange connectors, custody support, and reliable partners who prioritize uptime above hype—are necessary for stablecoin movement at scale.

The idea that "stablecoins as payments" are no longer a niche is supported by what is going on in the larger market. For the purpose of cross-border efficiency, major fintechs have been deliberately pushing toward stablecoin tests. For instance, the Financial Times revealed that Klarna launched a payment stablecoin (KlarnaUSD) to lower cross-border expenses, highlighting the fact that even big consumer fintechs increasingly view stablecoins as a tool for cost reduction rather than a speculative toy. When fintechs begin replicating crypto rails, it typically indicates that the previous rails are too costly and

Personally, I believe that the easiest approach to comprehend Plasma is to picture a fairly typical scenario: you're sending money to family overseas, getting paid by a foreign client, or paying a supplier in another nation. The least priced choice is still frequently a painful compromise today because local remittance firms charge hidden spreads, bank wires are costly and slow, and card networks are inoperable for direct transfers. The "digital dollar teleportation" issue has already been resolved by stablecoins. Making that encounter feel comfortable and natural for everyone, every time, is still a challenge.

The next hot DeFi ecosystem won't be the reason Plasma is successful. The reason for this is that it subtly causes stablecoins to exhibit characteristics of real money rails, such as quick settlement, predictable costs, little friction, simple integration, and dependability under load.

For traders and investors, Plasma represents a wager on a certain vision of the future of cryptocurrency: money flow on-chain at scale rather than "everything on-chain." The benefit is simple: the chains built around that flow may become essential infrastructure if stablecoins continue to be the go-to method for making payments. The risk is also simple: payments is a harsh environment where gaining users is costly, compliance is inevitable, and trust is developed gradually.

But despite those dangers, Plasma is a sophisticated development in the field of cryptocurrency. "What can we tokenize next?" is not the question. It poses a more serious question: what should the foundation layer look like when everyone begins to treat stablecoins as global digital currencies? $XPL @Plasma #Plasma $XPL