The first time I attempted to explain tokenized bonds to a friend who trades conventional fixed income is still fresh in my mind. He didn't dispute the technology. "So who makes sure the buyer is allowed to hold it, the issuer follows the rules, and regulators can audit it when needed?" he posed a more pragmatic query. That's precisely the reason why DeFi has advanced more quickly than controlled tokenization. "On-chain" is meaningless in actual markets if the asset cannot be transported lawfully.

Since 2018, Dusk Network has been designed to fill this gap: tokenization that maintains the privacy of financial data without violating regulations. The basic concept is straightforward but challenging to implement: enable the issuance and trading of regulated instruments (such as tokenized bonds, stocks, funds, and stablecoin-like cash instruments) in a way that protects market participants' privacy while still providing institutions and regulators with the necessary controls. "Privacy at all costs" is not Dusk's stance. Designed for actual financial workflows, it offers selectable privacy with auditability.

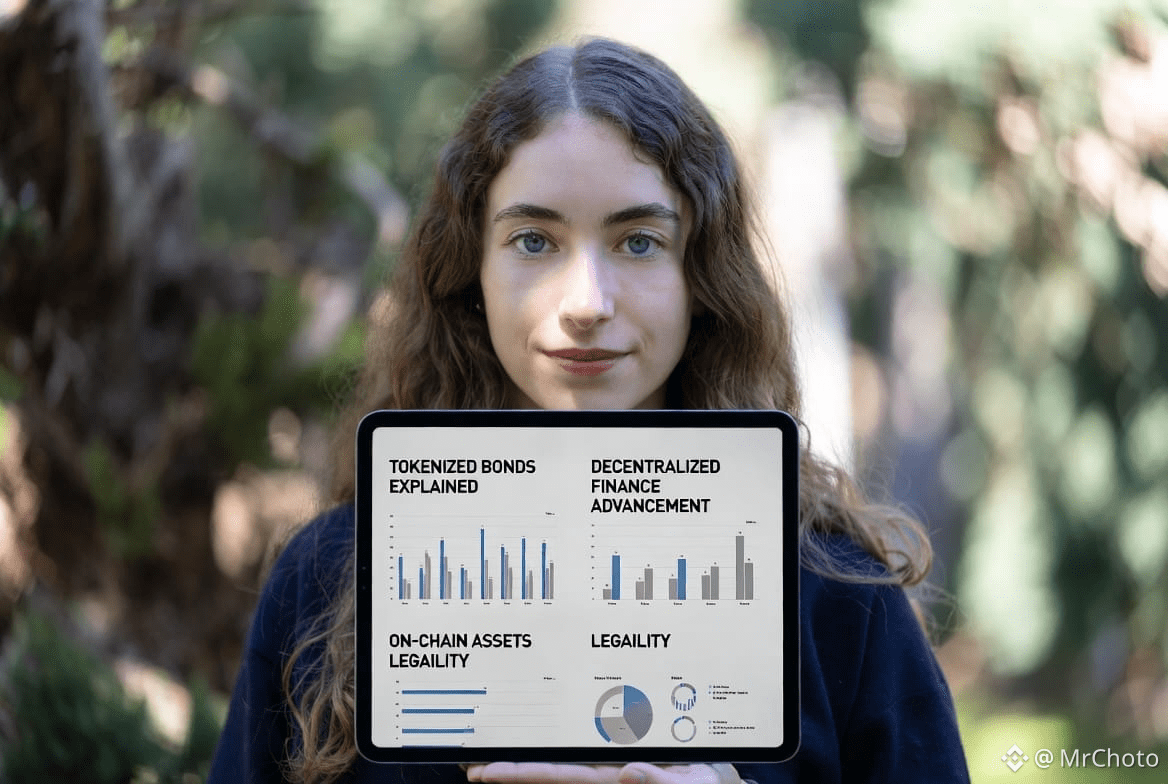

Consider how bonds actually trade to see why this is important. Identity verification (KYC), eligibility restrictions (who may purchase), transfer limitations, business activities (coupon payments), and reporting are all included. These are the product; they are not optional extras. The asset may move more quickly if tokenization disregards these limitations, but it becomes noncompliant and unsuitable for serious issuers. For this reason, in a regulated setting, tokenized bonds require more than just a smart contract. A compatible lifecycle is required.

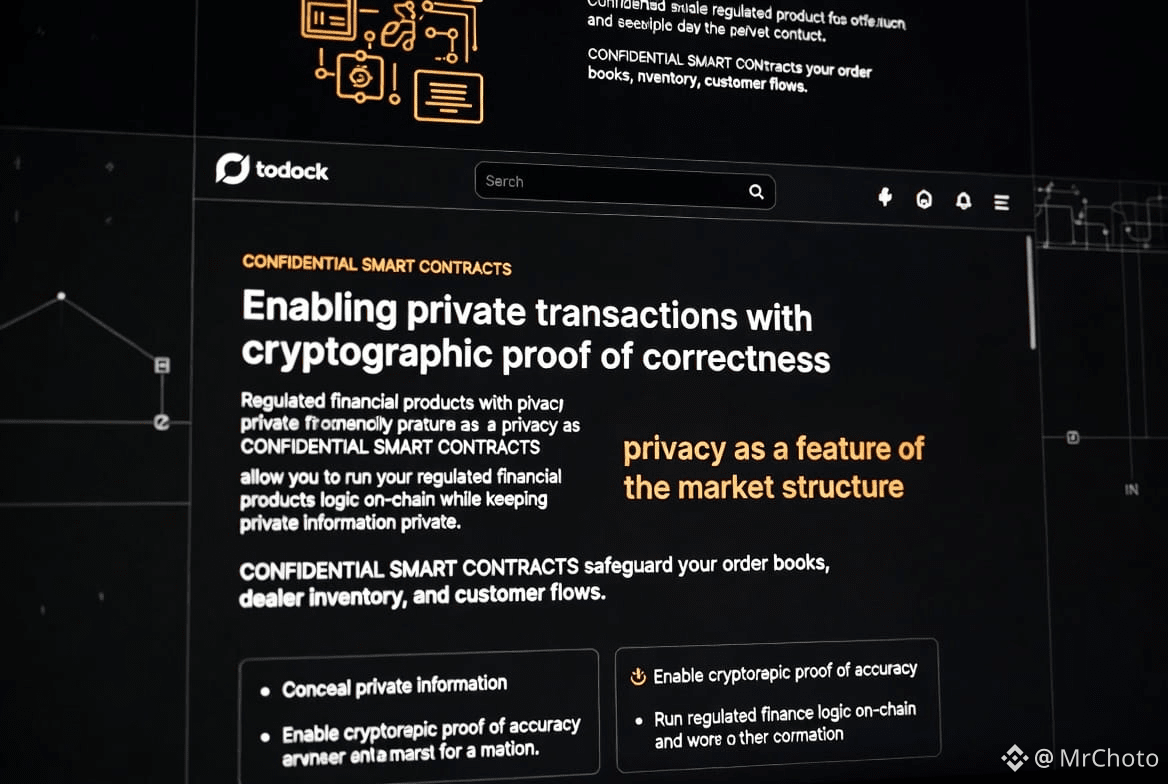

Dusk's strategy is based on what it refers to as "confidential smart contracts," which are made to conceal private transaction information while still enabling cryptographic proof of accuracy. The practical benefit is that you can execute regulated finance logic on-chain without disclosing to the public internet any balance, trade size, identification attribute, or counterpart relationship. Privacy is more than just a matter of taste. It's market structure for institutions. Order books, dealer inventory, and customer flows are safeguarded in traditional finance for a purpose. The market itself deteriorates and market participants alter their behavior if everything is visible.

However, privacy is insufficient on its own. Dusk's attempt to explicitly incorporate identity and compliance into token standards and transaction flows embodies the "regulated tokenization" component. Digital identity and compliance-aware security token systems have been described by Dusk (typically discussed under its RWA/security token storyline). Investors should focus on the direction rather than the branding: issuers must be able to control who can hold the asset, when it can be transferred, and how reporting can be fulfilled.

In my opinion, the most compelling aspect of Dusk's tale is not theoretical. It's the people they are supporting. As the first business to obtain a DLT-TSS license under European regulation for a completely tokenized securities market, Dusk announced collaboration with 21X in April 2025. Whether a person is optimistic or pessimistic about Dusk as a token is important since it indicates that the project is attempting to connect with the world of regulated issuance and trading rather than vying for the attention of retail DeFi.

Additionally, Dusk emphasized that this is more than just a "crypto integration" by citing its collaboration with NPEX, a Dutch exchange ecosystem. With allusions to MTF, Broker, ECSP, and eventual DLT-TSS positioning, it is framed around regulated market infrastructure and license alignment. Chasing liquidity incentives is not the same as adopting these parts if they are genuine and persistent.

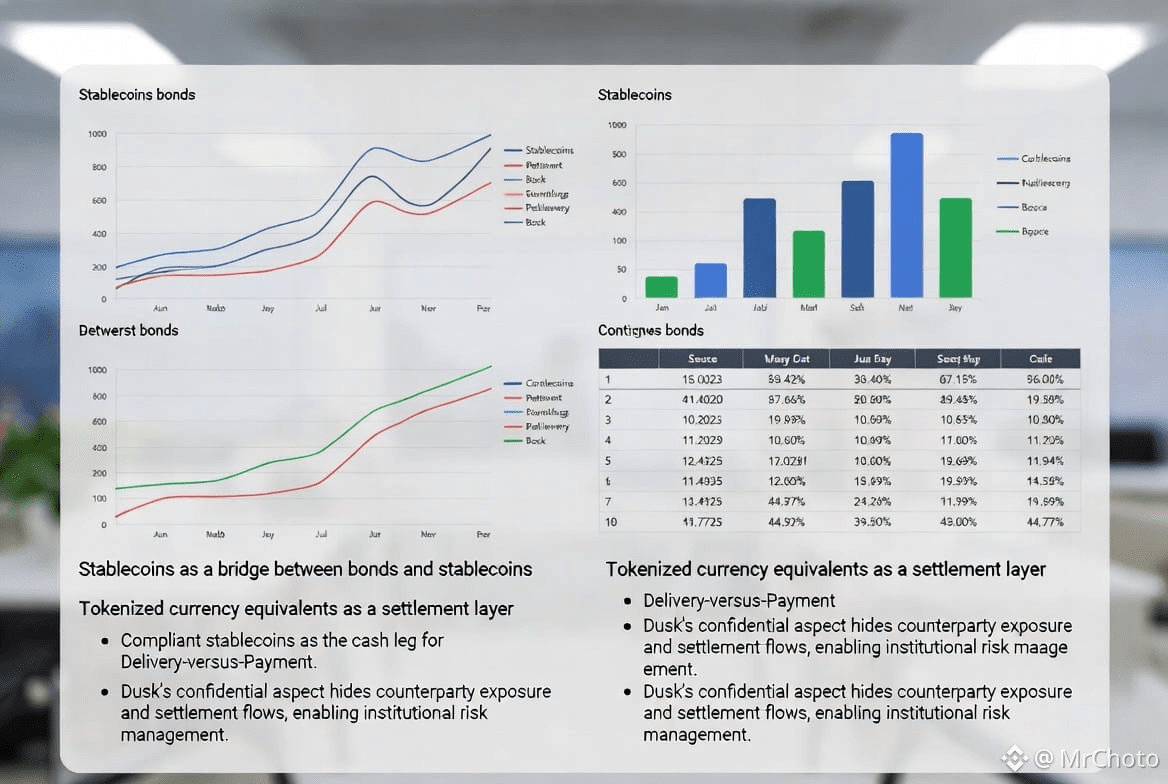

What role do stablecoins play in "bonds to stablecoins"?

Payments, remittances, and cryptocurrency rails are frequently handled as a different universe when it comes to stablecoins. Stablecoins, also known as tokenized currency equivalents, serve as the settlement layer for all other tokens in a controlled tokenization roadmap. Compliant stablecoins are the "cash leg" that enables Delivery-versus-Payment at scale if tokenized bonds and tokenized stocks are the instruments. This is where the confidentially aspect of Dusk becomes more crucial than most people realize. Hiding counterparty exposure and settlement flows is an essential component of risk management in institutional settlement.

Tokenized bonds are "regulated value," and stablecoins are "regulated movement," according to a helpful mental model. Tokenization is essentially a demo without the movement layer. It turns tokenization into a market.

Data integrity is an additional layer in this situation. Reference data, prices, information about company events, and verified reporting are essential to regulated markets. With a focus on "regulatory grade financial information," Dusk and NPEX announced their implementation of Chainlink interoperability and data infrastructure in late 2025. This type of integration points to a move toward institutional standards: tokenization that can be priced, confirmed, reported, and audited using reliable data streams, not just tokenization.

As 2026 approaches, traders and investors may see that the RWA narrative has developed. Tokenized treasuries in a few DeFi pools are no longer the exclusive option. Regulated market venues, licensing policies, and compliant issuance pipelines are becoming more and more important. The distinctive aspect of dusk is its later hour. This is significant because transparency in capital markets is regulated rather than unrestricted.

This is a slower game, which is both the signal and the risk, in my opinion. The pace of regulated tokenization is slower than that of memes. It necessitates infrastructure dependability, institutional trust, and legal alignment. If Dusk is successful, it will appear as a steady rise of actual issuers, real settlement activity, and real market participants rather than as an abrupt explosion. If it doesn't work, it will probably fail quietly because institutions won't accept it and money will move to other places.

However, the most long-lasting adoption appears to be moving in the direction of establishing rails where bonds, stocks, and cash-like stablecoin settlement can coexist under compliance conditions. Additionally, longevity in cryptocurrency is so uncommon that it's important to pay attention when a project decides to take the dull route. @Dusk