As of January 18, 2026, the cryptocurrency market is showing a resilient "sideways-to-bullish" trend. While both Bitcoin and Solana ended 2025 on a slightly bearish note compared to mid-year peaks, the first few weeks of 2026 have seen a significant return of buying interest and neutral-to-positive sentiment.

Bitcoin (BTC) Analysis:

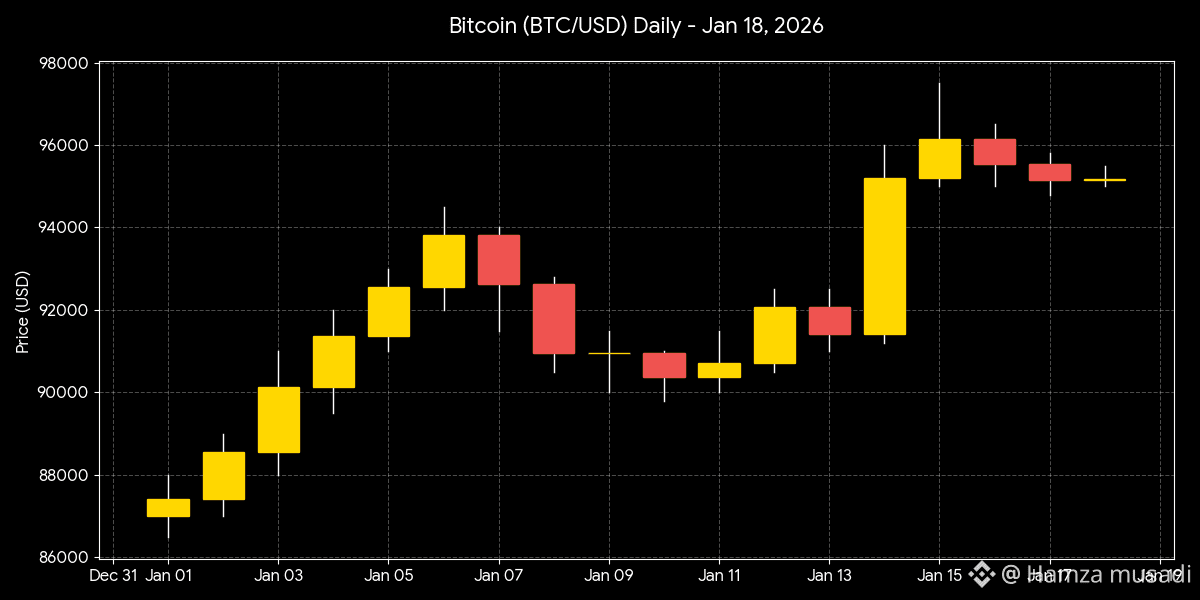

Bitcoin is currently consolidating at a high altitude as it attempts to break the psychological barrier of $100,000.

Market Position:

BTC is trading around $95,182. After a mid-month surge to $97,500, the price has stabilized. Its market cap sits at approximately **$1.9T**.

Key Drivers:

Institutional adoption remains the primary engine. Wealth advisors are increasingly integrating BTC into standard client portfolios (averaging 1-4% allocations). However, analysts are closely watching "quantum computing risks" and long-term tech scrutiny which has caused some minor institutional rebalancing.

Technical Levels:

Support:

Strong support is found at $90,000 and $94,500.

Resistance:

Immediate resistance at $96,800. A breakout above $98,000 is seen as the final hurdle before a run to six figures.

Solana (SOL) Analysis:

Solana continues to act as the "high-performance" alternative to Ethereum, benefiting from a thriving ecosystem of decentralized apps and meme coin activity.

Market Position:

SOL is trading at $142.77. It has shown impressive recovery since the start of the year (up ~14%), outperforming several other Layer-1 competitors in the short term.

Key Drivers:

A recent blockchain upgrade has improved network stability and throughput, silencing previous concerns about outages. The ecosystem's ability to maintain high volume despite market fluctuations has cemented its status as a top-tier breakout candidate for 2026.

Technical Levels:

Support:

Firm support at $135.

Resistance:

The price is currently testing resistance near $145–$148. A successful breach here could lead to a swift move toward $160.