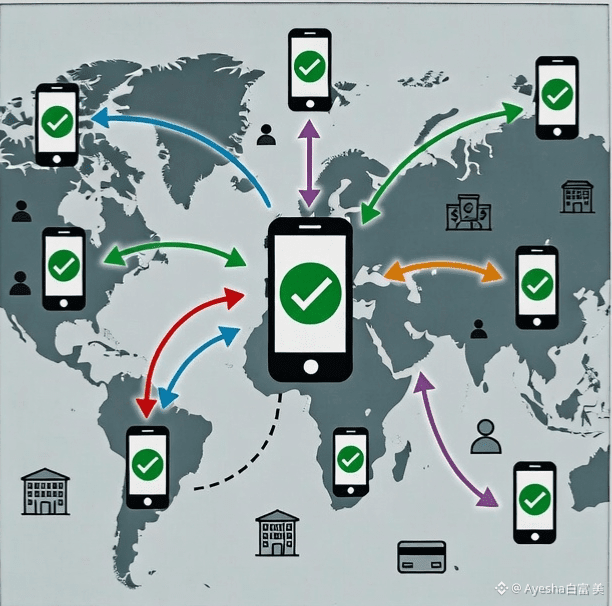

Traditional banking has long been a system built on gates and gatekeepers. To open an account, send money across borders, or even protect your savings from erosion, you often need approval—from banks, regulators, or intermediaries who charge fees and impose delays. For billions of people, especially in regions facing high inflation or strict capital controls, this creates real barriers to financial stability. But a new approach is emerging that removes those gates entirely. It's called permissionless banking, and Plasma XPL is at the forefront of bringing it to life.At its core, permissionless banking means anyone can access financial tools without asking for permission. No ID verification hurdles, no geographic restrictions, no waiting for approval. Plasma, a dedicated Layer 1 blockchain optimized for stablecoin transactions, makes this possible. Its native token, XPL, powers the network, while the Plasma One mobile app serves as the simple entry point—turning your smartphone into a powerful, borderless financial hub.

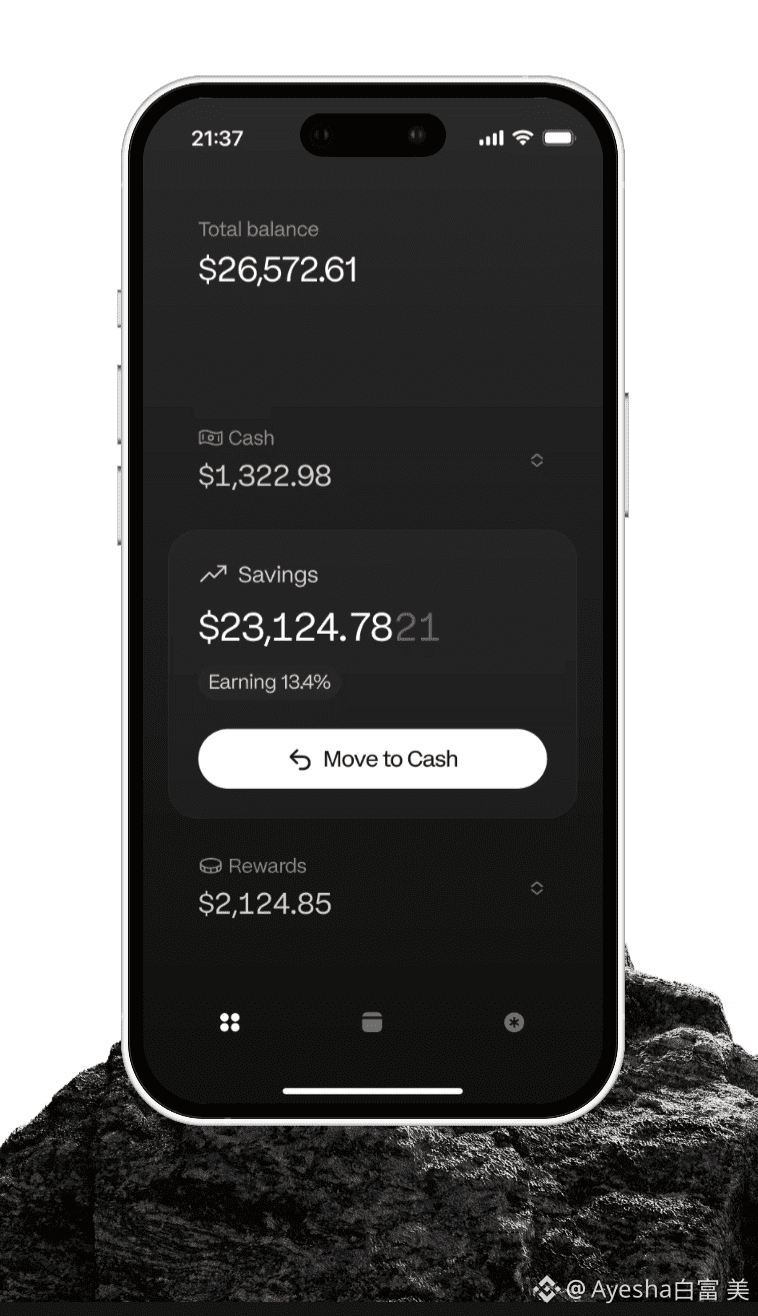

Imagine holding your savings in stable dollars like USDT, shielded from local currency volatility. With Plasma One, you can acquire stablecoins easily and start earning competitive yield right away—often double-digit returns—without complex setups or long lockups. This isn't speculative trading; it's straightforward saving with real growth potential, made accessible through an intuitive app interface.Insert visual here: Simple illustration or chart comparing local currency inflation vs. stablecoin value over time – reinforces the protection and yield benefit without needing heavy data.Sending money globally becomes equally seamless. Traditional remittances can take days and cost 7-10% in fees, eating into what families receive. Plasma flips this by enabling instant, zero-fee USDT transfers. Whether supporting loved ones abroad or getting paid for freelance work, the funds arrive immediately, intact, and ready to use.

The app even includes practical everyday features, like virtual cards for online spending and cashback rewards paid in XPL. These tools bridge the gap between decentralized finance and real-world needs, without requiring deep technical knowledge.

What sets Plasma apart is its underlying infrastructure. Built as a Layer 1 specifically for stable payments, it handles massive liquidity with speed and efficiency that general-purpose chains often struggle to match. XPL plays a central role here—not as mere speculation, but as the token that governs the network, distributes rewards, and incentivizes participation. As adoption grows for actual payments and savings, the token's utility strengthens naturally.

In places where inflation rapidly diminishes purchasing power, tools like Plasma One offer a practical hedge. Switching to stable dollars and earning yield provides a way to preserve and grow value that traditional options often can't match.

This shift represents more than technology—it's about expanding financial opportunity. Permissionless systems like Plasma are helping move blockchain from niche experimentation to everyday infrastructure, creating a fairer landscape where location or background doesn't limit access.If you're curious about experiencing this firsthand, downloading Plasma One is a low-friction way to explore. Start small, see how it feels to send a transfer or earn on stable holdings. The future of finance is becoming more open, and projects like Plasma XPL are leading the way.Have you explored permissionless tools yet, or do you have questions about how they work in practice? Share your thoughts below—I'd love to hear your perspective.