Two traders spot a head and shoulders on BTC. One shorts the neckline break and banks 22%. The other enters early, gets stopped out on a fake breakdown.

The difference? Patience and confirmation.

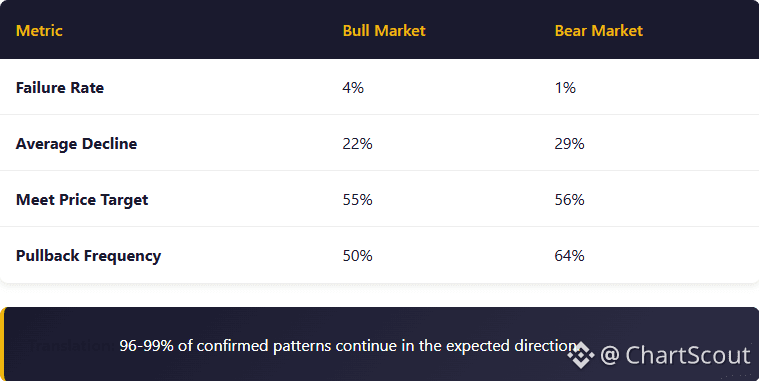

Based on Thomas Bulkowski's research of 814 patterns, the head and shoulders has a 96-99% success rate AFTER neckline break. Here's how to trade it properly.

What Is Head and Shoulders?

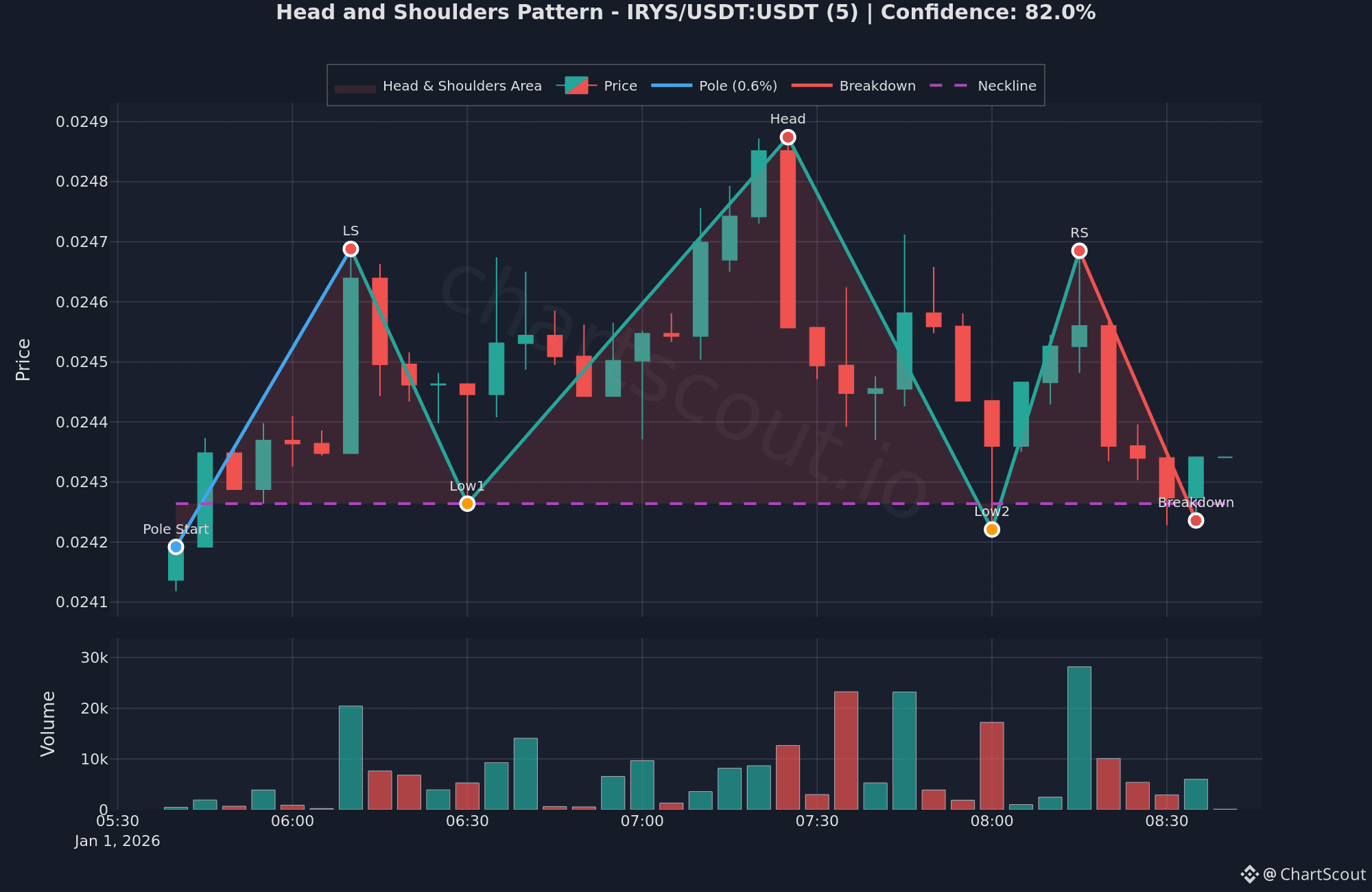

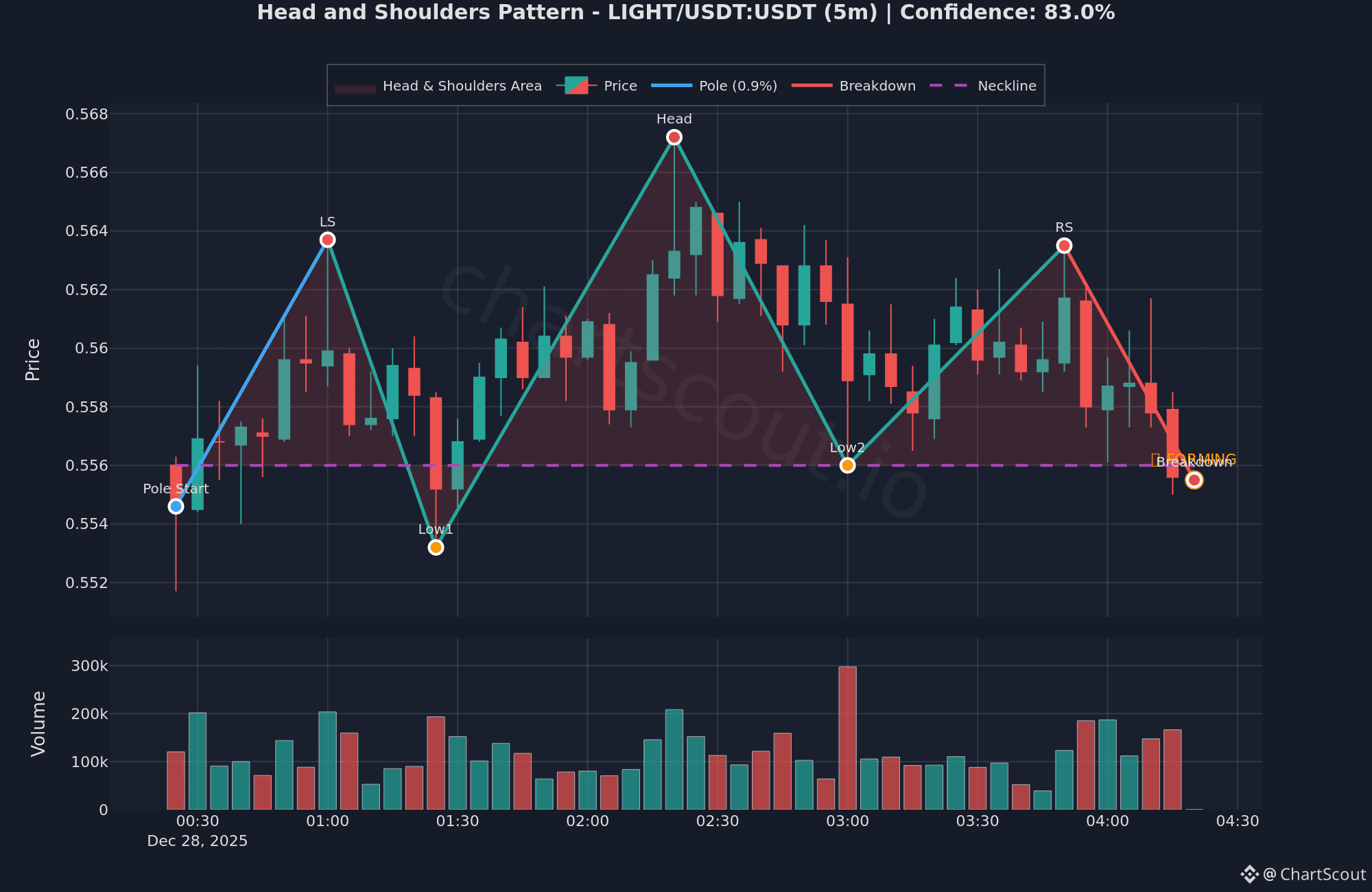

A bearish reversal pattern with three peaks:

Left Shoulder: First rally and pullback

Head: Higher rally (the peak), then decline

Right Shoulder: Lower rally that fails to match the head

Connect the two lows between peaks = Neckline

When price breaks below the neckline, the reversal is confirmed.

The Statistics (Bulkowski's Research)

Volume: Your Confirmation Signal

The "real tip-off" according to experts:

Left Shoulder: Highest volume

Head: Moderate volume

Right Shoulder: LOWEST volume

This declining volume shows buying pressure fading. If the right shoulder has equal or higher volume than the head, be cautious.

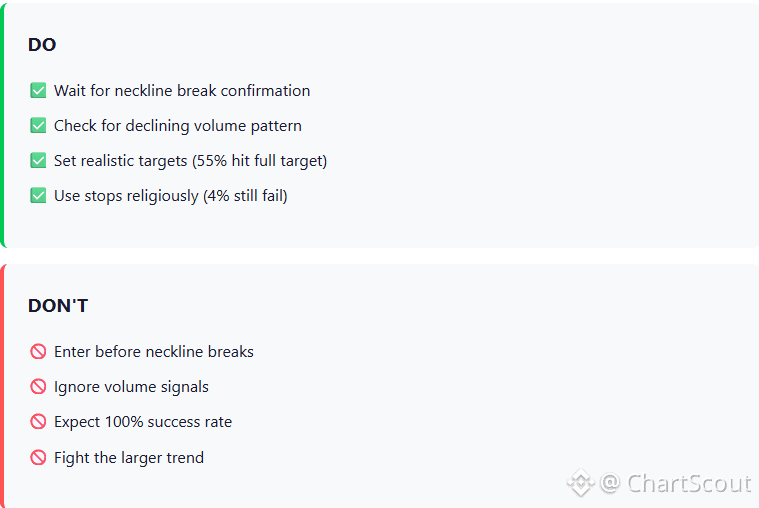

Trading Strategy

Entry Options

Conservative EntryEnter on neckline break close

Higher probability

Clear invalidation point

Pullback Entry

Wait for retest of neckline (occurs 50-64% of the time)

Better risk/reward

Takes patience

Price Target

Measure distance from head to neckline

Project that distance DOWN from breakout point

55% of patterns reach this target

Stop Loss

Standard: Above right shoulder

Aggressive: Just above neckline

Conservative: Above head

Critical Rules

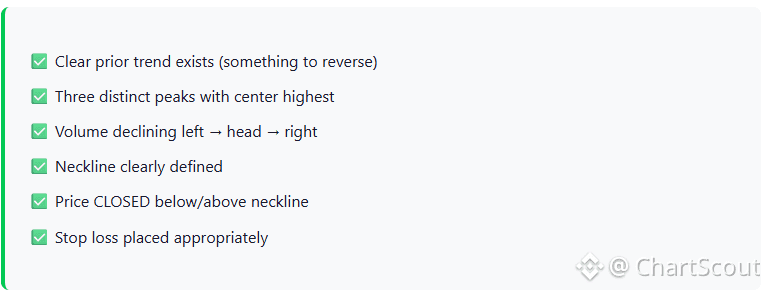

Quick Checklist

Before trading any H&S pattern:

📚Want the Full Deep-Dive?

This is the condensed version. For the complete guide with all statistics, expert quotes from Bulkowski and Martin Pring, advanced strategies, and more real examples, check out our extended article:

chartscout.io/head-and-shoulders-pattern

This article is for educational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk. Always do your own research.