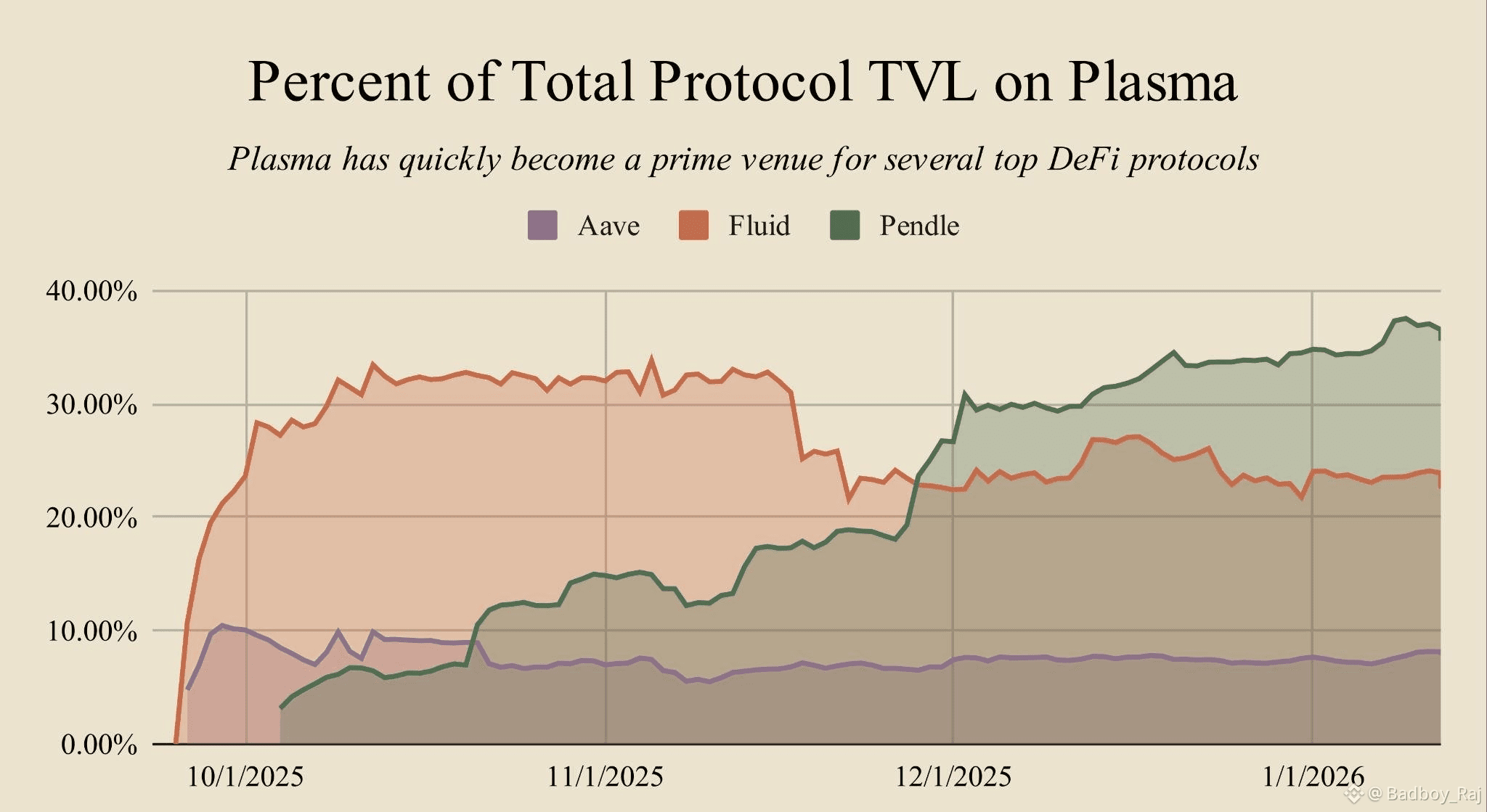

Looking at recent data across Aave, Fluid and Pendle one thing is clear, Plasma is no longer an "alternative venue", it’s turning into core infrastructure.

Looking at recent data across Aave, Fluid and Pendle one thing is clear, Plasma is no longer an "alternative venue", it’s turning into core infrastructure.

Here’s what stands out 👇

1) Protocol migration is real:

➥ Pendle leads the shift: ~35–37% of its total TVL now lives on Plasma. From near zero to dominant in a few months.

➥ Fluid saw a sharp early surge (>30%), corrected, and stabilized around 23–25%, still a meaningful footprint.

➥ Aave remains conservative but consistent, holding 7–10% of total TVL on Plasma.

Different strategies but same signal, Plasma matters.

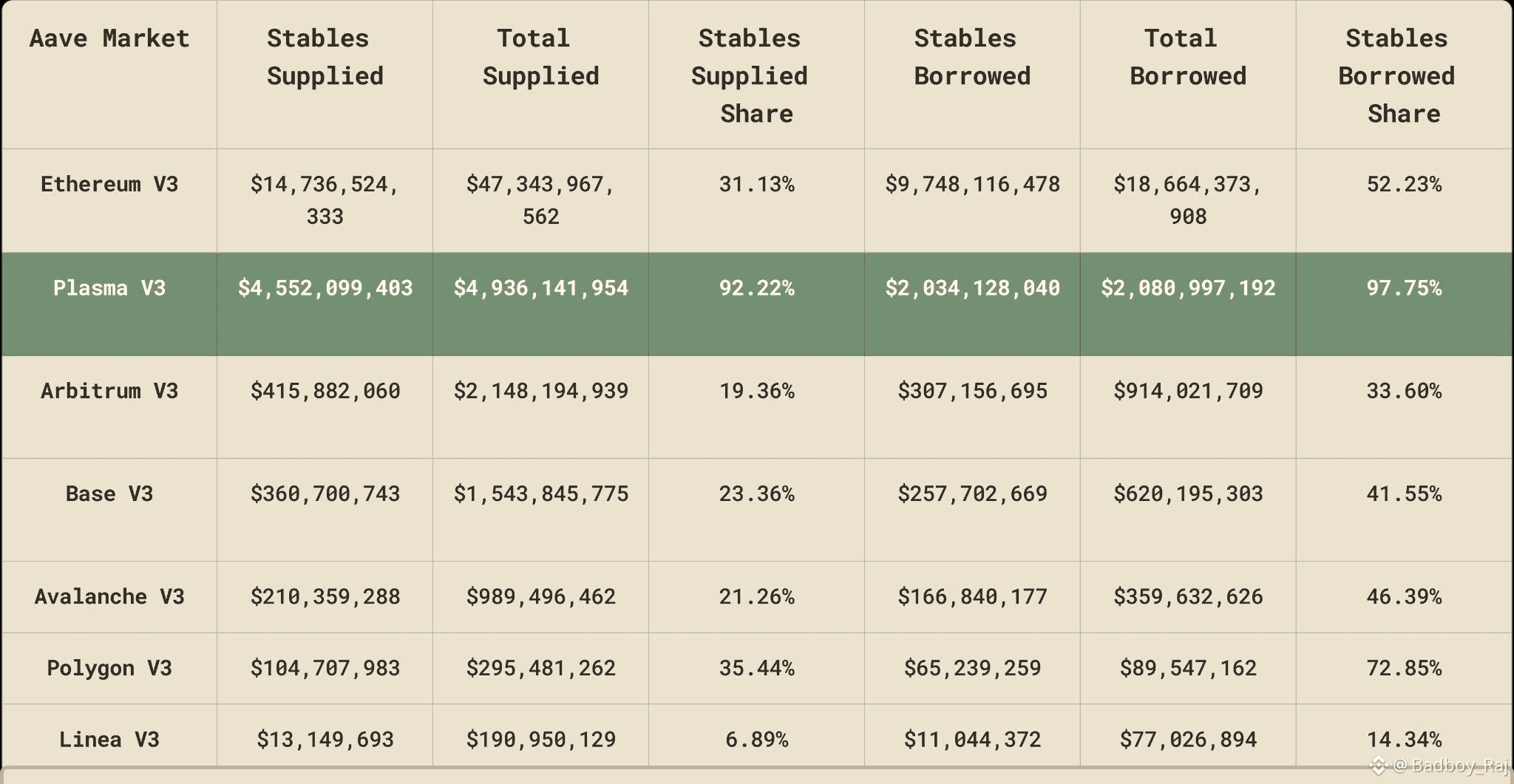

2) Plasma = stablecoin capital efficiency On Aave V3, Plasma is emerging as a stablecoin-native market:

2) Plasma = stablecoin capital efficiency On Aave V3, Plasma is emerging as a stablecoin-native market:

➥ 92%+ of supplied assets are stables.

➥ ~98% of borrowed assets are stables.

➥ ~$4.9B supplied, ~$2.08B borrowed → strong utilization.

That makes Plasma the 2nd largest Aave V3 market by supply in this comparison, ahead of Arbitrum, Base, and Polygon.

3) What this really means Plasma isn’t competing on hype or raw volume alone. It’s winning where DeFi actually compounds:

➥ Stablecoin liquidity.

➥ High utilization.

➥ Yield-heavy primitives (Pendle).

➥ Blue-chip lending (Aave).

TL;DR: Plasma is becoming the stablecoin and yield backbone for serious DeFi capital, not a side chain, but a pillar.