Markets are not only chasing speed anymore. They are chasing legitimacy, precision, and infrastructure that can survive scrutiny. In 2026, the real competitive edge for blockchains is not merely throughput, it is the ability to host financial activity that regulators can examine, institutions can trust, and users can still experience with privacy intact. That is the niche Dusk is deliberately building for.

Dusk was founded in 2018 with a focused premise: create a layer 1 network for regulated and privacy centric financial infrastructure. This is not the typical retail narrative of quick speculation or maximal attention. It is a long range engineering commitment to the problems that appear only when serious capital, compliance obligations, and audit demands converge.

Today, the conversation around blockchain adoption is evolving. Tokenization is moving from theory to implementation. Financial firms are exploring onchain settlement. Funds want programmable distribution with predictable rules. At the same time, governments are intensifying oversight, and enterprises will not deploy systems that cannot satisfy reporting requirements. The network that can reconcile privacy with accountability is positioned to capture a meaningful part of this transition.

The core tension: confidentiality versus accountability

Traditional finance depends on selective disclosure. Banks do not publish every client position publicly, yet they can still prove solvency to auditors. Trading firms do not reveal strategies, yet they meet market conduct rules. Institutions need privacy as a functional requirement, not a luxury. In most public chains, the default transparency is absolute. This is useful for open verification, but it becomes problematic when you need confidentiality, client protection, and competitive discretion.

The usual workaround has been fragmented: private databases with partial onchain anchoring, permissioned networks with limited composability, or complicated middleware that introduces operational risk. Dusk approaches the issue from the base layer, designing privacy and auditability together rather than treating them as competing features.

This matters because regulation is not only about surveillance. Regulation is about clear frameworks, enforceable rights, and reliable accountability mechanisms. A blockchain intended for regulated markets must support lawful supervision without turning every participant into a publicly doxxed spreadsheet.

Modular architecture as a strategic choice

Dusk’s modular architecture is one of its most practical advantages. Modular design in blockchain is often discussed as a performance and scalability narrative, but it has another major benefit: governance over complexity. When financial infrastructure evolves, requirements shift. Standards change, reporting methods are refined, and compliance tooling becomes more sophisticated. A modular stack is easier to adapt than a rigid monolith.

From an institutional standpoint, modularity is not just an engineering aesthetic. It is a risk management method. Systems that can swap components, improve cryptographic primitives, or update execution environments without destabilizing the core ledger can move with the market instead of being forced into expensive migrations.

That flexibility creates room for multiple product lanes on the same base: issuance, settlement, collateral workflows, identity aware DeFi, and tokenized real world assets. The point is not to chase every narrative, but to make the underlying rails capable of supporting a range of compliant financial applications.

Compliant DeFi is not an oxymoron

There is a widespread misconception that DeFi must be either fully anonymous or fully restricted. Reality is more nuanced. Financial applications can be open while still enforcing policy constraints. They can allow global access while applying rules to specific asset types. They can enable onchain liquidity while remaining compatible with obligations like reporting, permissioning, or suitability checks.

Compliant DeFi is essentially a design discipline. It requires smart contracts that integrate verification logic, disclosure pathways, and policy enforcement without destroying the user experience. The most important innovation here is not simply building more protocols, but building protocols that can be used by firms that operate under strict legal and operational mandates.

Dusk’s positioning makes sense in this context because it does not try to pretend regulation will disappear. It assumes regulation is a permanent parameter and builds technical and structural solutions to work within it. That assumption is what makes it credible for institutional grade environments.

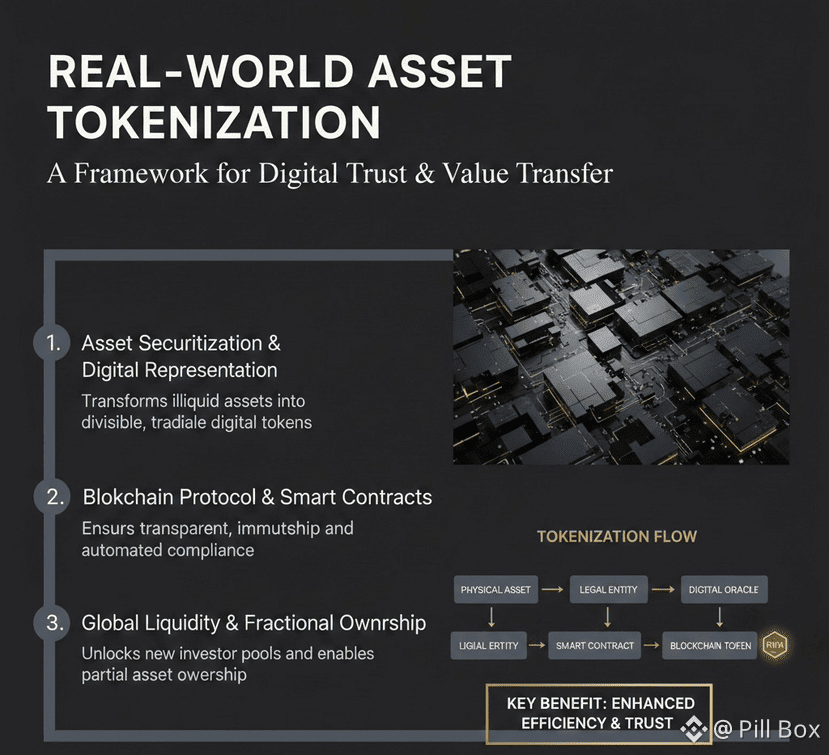

Tokenized real world assets need more than minting

Tokenization has become a headline term, but the real work begins after the token is created. Issuance is the starting point. The lifecycle is the challenge.

Real world assets have rules: transfer restrictions, settlement conditions, redemption logic, investor eligibility, corporate actions, and reporting. The more regulated the asset, the more complex the compliance perimeter becomes. A functional tokenization network needs to handle these constraints without manual processes that defeat the point of automation.

A privacy capable, audit friendly chain can support tokenized assets in a way that resembles professional finance rather than hobbyist experimentation. Institutions want to tokenize not because they love novelty, but because they want streamlined operations, faster settlement, and programmable compliance. If the chain cannot provide confidentiality and structured oversight, tokenization becomes a reputational liability.

Dusk is built for that exact intersection.

Privacy with auditability: the required duality

The strongest thesis behind Dusk is the refusal to accept a false binary. Privacy and auditability are not mutually exclusive. In mature markets, they are complementary. The goal is controlled transparency: disclose what is necessary, to the right parties, at the right time, with cryptographic assurance.

Auditability is not merely a dashboard. It is an ability to validate that rules were followed. It is the capacity to demonstrate integrity without exposing sensitive information to the entire world. When finance goes onchain at scale, this duality becomes non negotiable. Institutions will not commit meaningful volume to systems that cannot replicate the selective disclosure norms of legacy finance, while also improving settlement reliability.

Dusk’s design philosophy aligns with the direction of institutional adoption: confidentiality by default, accountability by design.

Why this matters globally

A compliant and privacy centric layer 1 is not only relevant to one region. Regulatory frameworks differ, but the shared trend is clear: more oversight, more consumer protection rules, and more pressure for transparent operational control. From Europe to Asia to the Americas, regulated entities require audit trails, risk controls, and data handling discipline.

Dusk offers a global narrative because it targets infrastructure, not a local market shortcut. A well designed financial chain can support cross border issuance, multi jurisdiction participation, and programmable enforcement. The winners in this category will be networks that can handle the diversity of regulatory expectations without breaking composability or user experience.

Global finance also demands resilience. Institutions care about uptime, predictable finality, and consistent rule execution. If the network is aiming for the serious financial tier, it must demonstrate stability as well as innovation. Dusk’s long term focus is positioned to appeal to builders and allocators who are tired of hype cycles and want infrastructure that can mature.

What to watch as the ecosystem evolves

If you are tracking Dusk’s progress, the most important signals are not superficial announcements. The meaningful indicators are structural.

1. The maturity of institutional integrations

Partnerships are common across crypto, but integrations that actually support regulated workflows are rarer. Watch for deployments where compliance logic is embedded, not bolted on.

2. Real asset issuance and lifecycle tooling

Any chain can host a token. Fewer can support the operational reality around it. Asset servicing, transfer policy, disclosures, and settlement workflows are where the real value is.

3. Developer traction in compliance oriented applications

A network becomes credible when builders choose it for practical reasons. If Dusk attracts teams building issuance platforms, compliant liquidity venues, and financial primitives designed for supervision, that is strong validation.

4. Evidence of privacy plus accountability at scale

The theory is elegant, but the market will reward demonstrated capability. Production grade performance with confidentiality features is a high bar. If Dusk clears it, it strengthens the entire thesis.

Closing perspective

The crypto industry is gradually splitting into categories. Some chains will remain retail centric arenas for experimentation and memetic speculation. Others will evolve into infrastructure layers for real financial coordination. Dusk is competing in the second category, where trust, compliance, and privacy are decisive.

The key idea is simple: institutions will not onboard onto systems that expose every transaction to the world, and regulators will not tolerate systems that cannot prove policy compliance. A layer 1 that can satisfy both sides has a rare advantage.