The pattern is familiar. A fast rise. A sudden flood of attention. A temporary spike in activity. And then everything collapses when the momentum disappears. It happens again and again because many teams chase the type of growth that looks impressive in charts but has no long term support behind it.

Dusk has chosen a very different path. They do not follow short lived hype cycles. They do not inflate numbers for quick attention. They do not force expansion at a speed the ecosystem cannot support. If you study their journey closely you see a consistent pattern. Every decision is slow, measured and intentional. Dusk knows exactly what kind of world they are building for and they understand that unsustainable growth would hurt them more than it would help.

Dusk operates in a part of the industry where mistakes have real consequences. They are building for regulated financial markets, not for meme waves or temporary speculation. Real world finance demands stability. It demands predictable behavior. It demands technology that behaves the same way every day regardless of market volatility. No regulated institution will adopt a chain that rises too fast and breaks under pressure. Dusk understands this better than most teams. Their entire design philosophy is built around the idea that real adoption happens slowly and grows through trust, not through hype.

When you look at the history of Dusk you can see how serious they are about stability. Nothing is rushed. Every update is tested deeply. Every feature goes through careful review. Every partnership is chosen with a long term view. They avoid shortcuts because shortcuts create uncertainty. Shortcuts might create attention but they damage trust. Dusk would rather move slowly and make sure the foundations of the network are strong enough to support the type of financial activity that regulated markets require.

One of the clearest examples of this approach is DuskEVM. Many chains build an EVM environment by copying existing templates and launching quickly. Dusk did the opposite. They spent years researching, designing and building an execution layer that supports privacy, compliance and institutional needs at the same time. That type of engineering cannot be rushed. It requires patience and it requires a mindset that values long term durability over fast expansion.

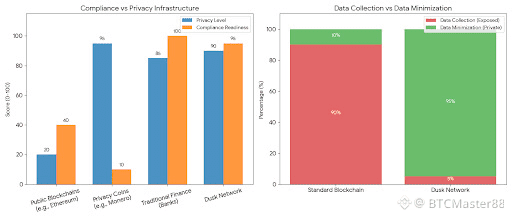

The same philosophy applies to the Hedger privacy engine. This system allows assets to remain confidential while still meeting the requirements of regulators. Balancing privacy with compliance is extremely complex. Most chains lean too far in one direction or the other. Dusk took the time to find the middle path because they know regulated finance will demand both. If they had tried to grow too fast the quality of this technology would never have reached the level it has today.

Another reason Dusk avoids unsustainable growth is the type of partners they work with. Their ecosystem is full of financial institutions, regulatory bodies and real world asset platforms. These partners do not care about hype driven growth. They care about networks that can handle serious economic activity. They want predictable settlement. They want legal clarity. They want systems that can operate for decades without major disruptions. Dusk works closely with them because they share the same priorities. Growing too fast would weaken that relationship.

When you observe the larger crypto market you can see why the approach of Dusk is rare. Many teams optimize for quick metrics because those metrics attract short term investors. But fast growth often creates instability. It leads to increased risk. It creates pressure to maintain high activity levels artificially. And once the hype slows down the network usually collapses under its own weight. Dusk understood early that this cycle is destructive and that it does not align with their purpose.

True adoption is slow. Sustainable ecosystems take time. Regulated markets move with caution. Institutions do not jump in because a token is trending for a week. They move when the technology has proven its reliability over a long period. Dusk has positioned itself for this type of adoption. They are not interested in being the loudest project in the room. They want to be the project that financial markets rely on when they need a blockchain that works consistently and securely.

Europe in particular has shaped the culture of Dusk. The regulatory environment in Europe is one of the strictest in the world. MiCA has created a new standard for digital asset compliance and not every chain can operate within that framework. Dusk was designed with these rules in mind from the beginning. This naturally forces them to avoid unsustainable patterns because the regulatory world punishes instability. Compliance focused ecosystems grow through accuracy, discipline and reliability. Dusk embraces these values deeply.

Some people may look at Dusk and think they are moving slowly. In reality they are moving correctly. Slow growth is not a weakness. It is proof that every new participant is someone who understands the vision and plans to stay long term. It is proof that liquidity is entering the ecosystem naturally instead of being forced through temporary incentives. It is proof that the community is forming around real usage instead of speculation. This is the type of foundation that survives every market cycle.

There is also a technical reason behind their pace. Networks that target regulated markets must prove they can operate at scale without breaking. If a chain suddenly grows too fast it may reveal weaknesses in performance, execution or security. Dusk refuses to take that risk. They build capacity first. They strengthen the infrastructure before trying to grow the user base. They ensure that every component of the chain can handle high volume activity before encouraging larger adoption.

This strategy is becoming more important in 2026. Tokenization is moving from theory into reality. Companies are launching real asset pilots. Markets are exploring blockchain settlement. Governments are creating rules for digital securities. This is exactly the moment Dusk has been preparing for. And their slow and sustainable growth model is the reason they are ready. They did the difficult work during years when the market was distracted by hype. Now when the world needs compliance friendly blockchain infrastructure Dusk is already ahead.

If you look closely at their recent announcements you can feel the maturity of their development. They are expanding but with measured control. They are adding partners who align with long term institutional goals. They are strengthening the privacy engine and preparing DuskEVM for advanced financial applications. They are doing all of this without trying to inflate metrics or chase fast publicity. This is what long lasting ecosystems look like. They grow quietly but they grow correctly.

In the future when people study the history of regulated blockchain infrastructure they will see that the winners were not the fastest to grow. The winners were the ones who grew in the direction that mattered. They were the ones who respected regulation. They were the ones who built trust over time. They were the ones who delivered technology that financial markets could rely on without fear. Dusk fits perfectly into this category.

This is why Dusk avoids unsustainable growth. Not because they lack ambition but because they understand the responsibility of what they are building. They know that real world finance cannot rely on unstable systems. They know that institutional adoption requires stability and predictability. They know that the next decade of blockchain will be shaped by projects that choose strong foundations over temporary excitement. Dusk has always been one of those projects.

Their focus on sustainability is not a marketing decision. It is a strategic one. It is a long term vision. It is the reason Dusk stands out in a market full of temporary noise. And it is the reason they are positioned to become one of the most important infrastructures in regulated crypto.