Ninjas in Pyjamas parent company NIP Group mines 151.4 Bitcoin ($14.2M) in its first three months of operations:

In a groundbreaking announcement on January 15, 2026, NIP Group Inc. (NASDAQ: NIPG), the parent organization of the legendary esports brand Ninjas in Pyjamas, revealed that its newly formed digital infrastructure division has officially become a heavyweight in the global Bitcoin mining sector.

During its first three months of operation—spanning from September to November 2025 the company successfully mined 151.4 Bitcoin (BTC). At current market valuations, this output is worth approximately $14.2 million, signaling a massive successful pivot for a company historically rooted in competitive gaming and entertainment.

From Gaming Desks to Mining Rigs: The Strategic Shift

The decision to enter the cryptocurrency mining space was first unveiled in July 2025, when NIP Group announced its "Digital Computing Division." The move was designed to diversify the company's revenue streams, moving beyond the often-volatile sponsorship and tournament prize models that dominate the esports industry.

Why Bitcoin Mining?

For NIP Group, the logic was twofold:

1. Revenue Stability: Bitcoin mining provides a predictable, recurring revenue stream that is independent of game meta shifts or esports viewership cycles.

2. Infrastructure Synergy: The high-performance computing (HPC) required for large-scale mining shares the same technical DNA as the infrastructure needed for next-generation gaming and AI workloads.

By January 2026, NIP Group's operational hash rate reached 9.66 EH/s (exahashes per second).5 This capacity instantly catapulted the company into the top 20 largest publicly traded Bitcoin miners in the United States and established it as the dominant leader in the Middle East and North Africa (MENA) region.

Operational Milestones: Scaling at Speed

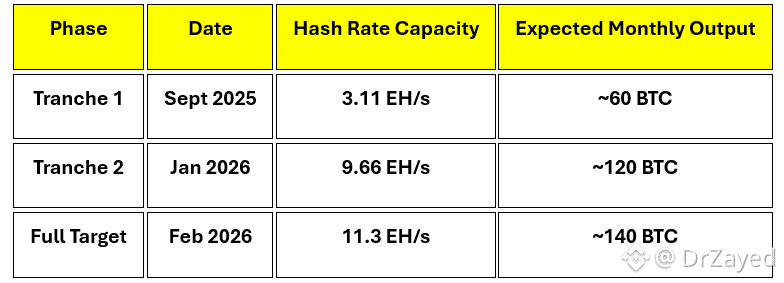

The speed at which NIP Group deployed its mining infrastructure is virtually unprecedented in the sector. Below is a breakdown of their rapid scaling timeline:

Deployment Phases and Capacity

As of mid-January 2026, Co-CEO Hicham Chahine confirmed that the final tranches of mining hardware are currently being brought online. Once the full 11.3 EH/s capacity is operational, the company expects to generate roughly $13.5 million per month in Bitcoin revenue, assuming current market conditions remain stable.

Financial Impact: Balancing Loss with Innovation

While the mining operation has been a resounding success, NIP Group’s broader financial picture for 2025 remained complex. In its H1 2025 report, the company reported a $136.3 million net loss, largely due to non-cash goodwill and intangible asset impairments related to Ninjas in Pyjamas' market value.

However, the Bitcoin mining results represent a "second growth engine" that is already beginning to shore up the balance sheet.

• Asset Growth: The 151.4 BTC mined adds a significant liquid asset to the company's treasury.

• Operational Validation: The $14.2M generated in just 90 days validates the "low-risk pathway" management promised shareholders during the initial acquisition of mining machines from Apex Cyber Capital and other partners.

The Abu Dhabi Connection

NIP Group’s mining success is deeply tied to its headquarters in Abu Dhabi.10 Working under the Abu Dhabi Investment Office (ADIO) partnership framework, the company has leveraged the UAE’s focus on becoming a global hub for AI, blockchain, and digital infrastructure.

Under the leadership of Carl Agren, COO of Mining and Digital Assets (and former CEO of Phoenix Technology), the company has positioned its data centers to be "AI-ready." This means that while they are currently mining Bitcoin, the infrastructure can be repurposed for AI training and high-performance computing if market conditions shift—a flexibility that most "pure-play" miners lack.

The Future: A Hybrid Entertainment Powerhouse

As we move further into 2026, NIP Group is no longer viewed simply as an "esports team." It has evolved into a next-gen digital infrastructure company.

The company's strategy involves:

• Staking the Treasury: Holding a portion of mined Bitcoin to benefit from long-term appreciation.

• Operational Funding: Selling Bitcoin when necessary to fund the expansion of its esports teams, live events, and influencer networks.

• AI Integration: Utilizing their massive compute power to develop AI-driven fan engagement tools and immersive gaming experiences.

Conclusion

The mining of 151.4 BTC is more than just a financial win; it is a proof-of-concept for the entire esports industry. NIP Group has demonstrated that by leveraging the technical expertise of gaming, organizations can build sustainable, high-revenue infrastructure that survives the "esports winter.