Picture a blockchain that doesn’t just keep up—it adapts, shifts, and grows with the wild pace of finance. That’s Dusk Network. While most chains are busy wrestling with their own complexity, Dusk quietly built something new: a system that actually welcomes change. Developers and big institutions are starting to notice, because Dusk’s modular approach isn’t just a technical detail—it’s a real answer to the scaling headaches that plague crypto.

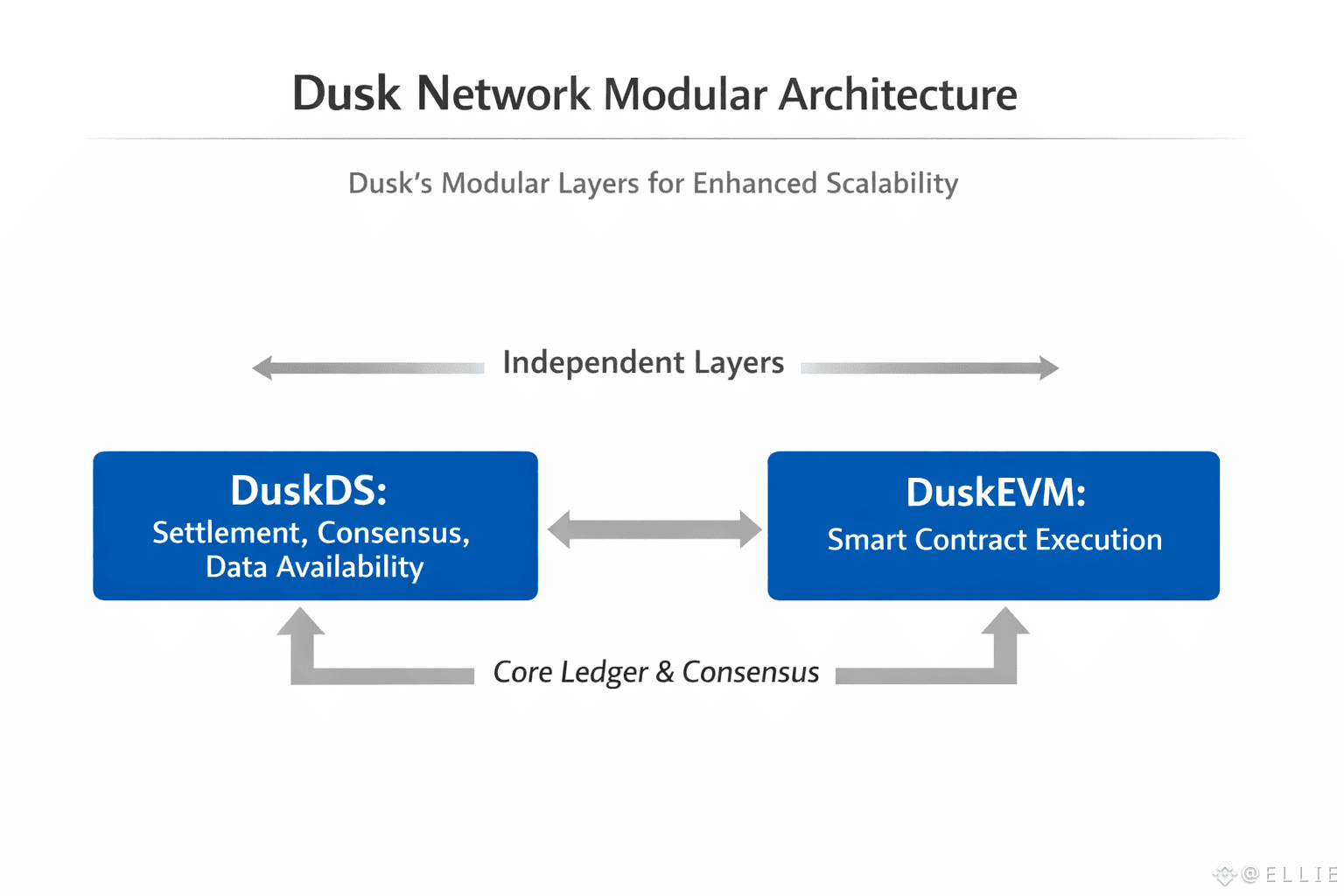

Dusk Network launched in 2018, and right from the start, it aimed at the tough world of regulated finance. What sets Dusk apart is its modular design. Instead of cramming everything together, Dusk splits its core functions apart. At the center, you’ve got DuskDS—the main engine for settling transactions, reaching consensus, and making sure data is available when and where it’s needed. DuskDS handles block finalization, transaction ordering, and keeps the whole system honest. By isolating this piece, Dusk avoids the usual domino effect where a single update can wreck the whole chain. Upgrades happen without drama, and the network keeps running smooth as the market evolves.

On top of that sits DuskEVM, which is basically an Ethereum-compatible playground for smart contracts. Developers can push out new apps and features here, knowing they’re not putting the underlying ledger at risk. For banks and other big players, this means less risk: updates to smart contracts don’t threaten the core, and the whole thing stays solid. It’s a model that’s built for the long haul—fast, stable, and ready for the kind of pressure only finance can throw at it.

Dusk’s consensus system is another big piece of the puzzle. It runs on Proof-of-Stake but adds something called Succinct Attestation, which locks in blocks quickly and with certainty. No more waiting around, hoping confirmations go your way. Transactions settle fast, which is exactly what you need for things like high-frequency trading or instant clearing. The result? Dusk hits that sweet spot between being decentralized and being efficient, so sudden spikes in activity don’t bring everything grinding to a halt.

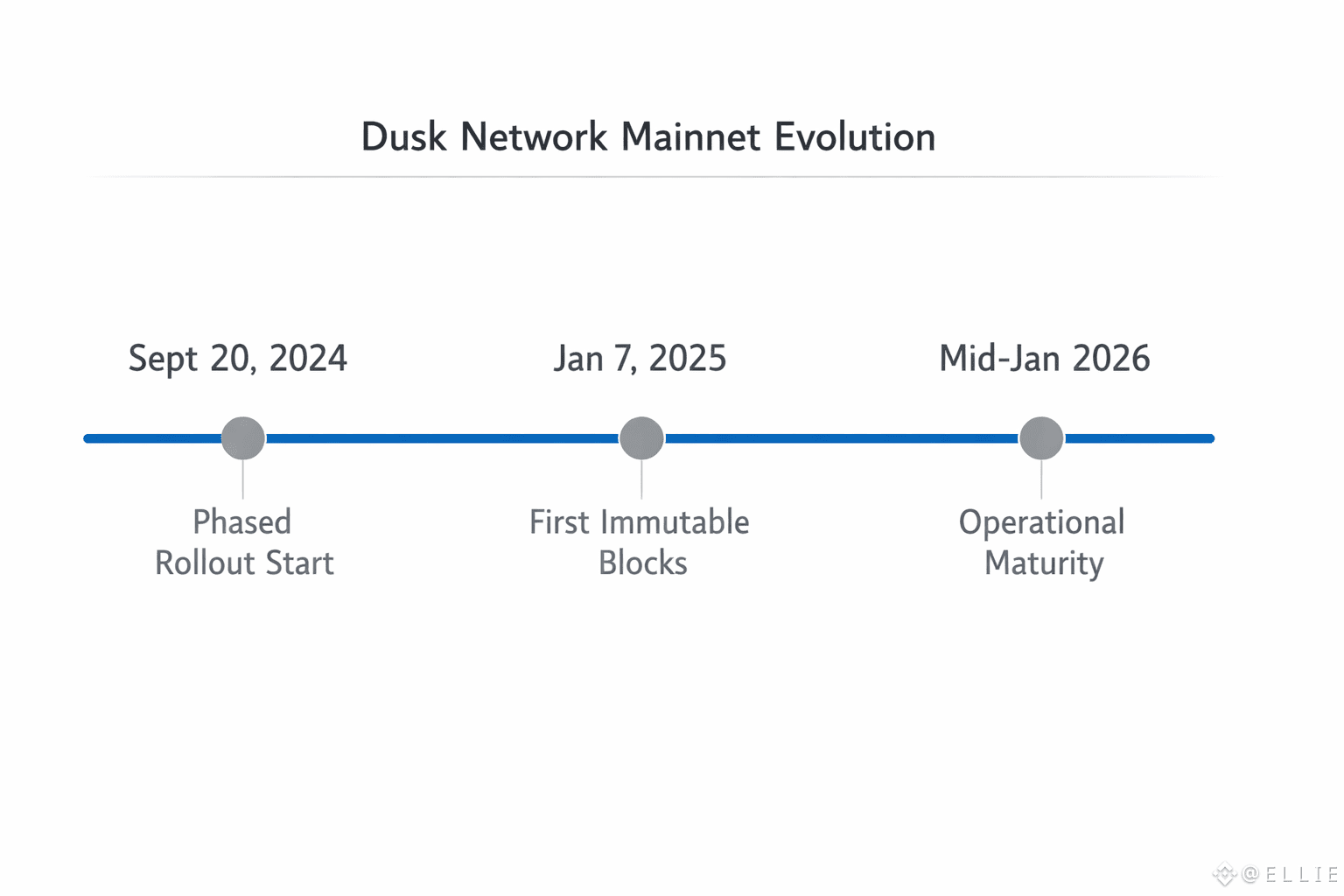

Rolling out the mainnet wasn’t rushed. Dusk took its time. After a phased launch that started in September 2024, the network hit its first permanent blocks by January 7, 2025. By early 2026, everything’s running like clockwork. Withdrawals, for example, settle back to DuskDS in about 15 minutes—quick, but with enough of a pause to make sure everything’s final. That speed comes straight from the modular design, where layers talk to each other directly instead of getting stuck in traffic.

On the economic side, Dusk keeps things tight. The DUSK token is what powers the network, with about 487 million in circulation as of January 2026, capped at 1 billion. That helps control inflation and keeps the token’s value tied to real use. Staking isn’t just for show—it rewards people for helping secure the network. As more financial activity moves on-chain, especially for things like tokenized assets, demand for DUSK ramps up. The system’s built so that real growth—especially from institutions—pushes up demand for both transactions and governance.

Dusk isn’t just theory. Its partnerships prove the tech works in the real world. Working with NPEX and Cordial Systems, Dusk is actually helping move a stock exchange on-chain, making regulated assets native to blockchain. This isn’t just another case of blockchain-for-blockchain’s-sake. By connecting traditional finance with modular crypto infrastructure, Dusk is building bridges, not silos. These collaborations show that Dusk’s architecture delivers: modularity isn’t just a buzzword here—it’s the engine behind real-world finance going digital.