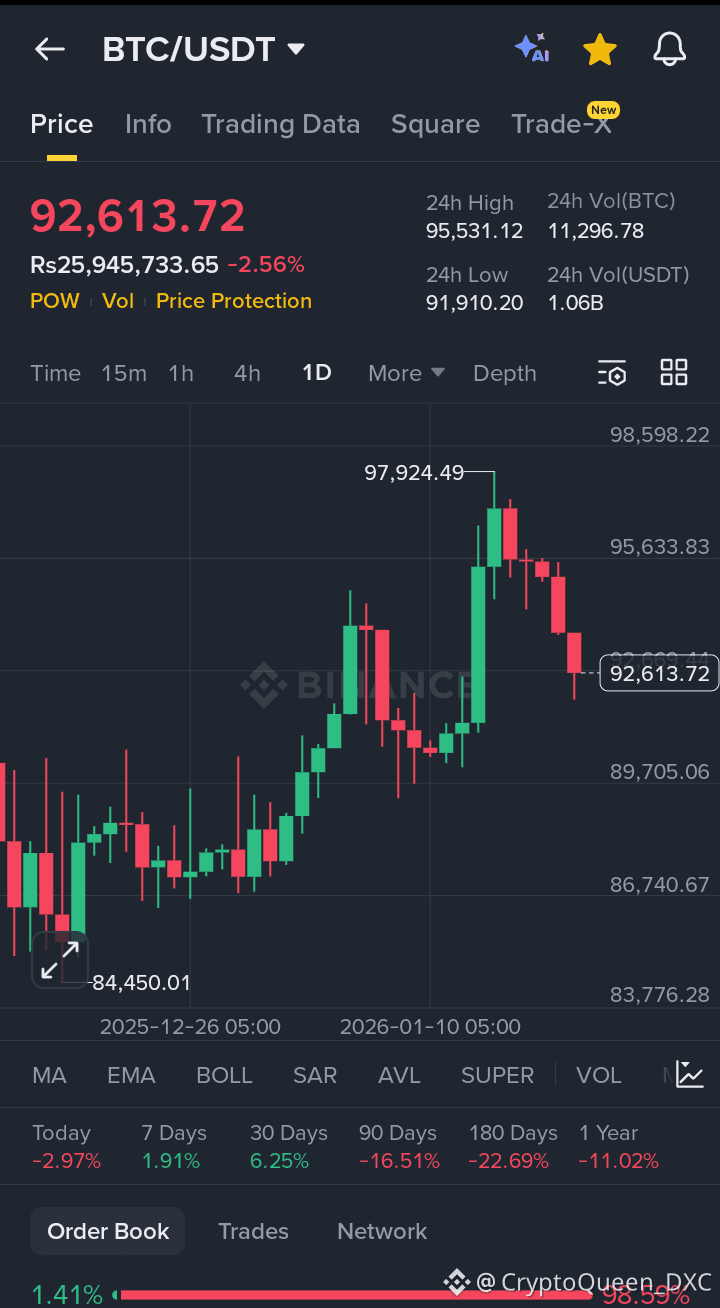

The sudden dip in Bitcoin (BTC) to $92,613.72 is primarily driven by a "risk-off" mood in global markets triggered by significant geopolitical and trade tensions.

Main Reasons for the Dip

New Tariff Threats: President #TRUMP announced plans to impose sweeping 10% to 25% #Tariffs on eight European countries (including Germany, France, and the UK) over a dispute regarding #Greenland . This heightened macro uncertainty caused investors to move money out of "risk" assets like Bitcoin and into "safe havens" like gold.

Massive Liquidations: The sharp price drop from approximately $95,500 to $91,935 in just two hours triggered over $525 million in forced liquidations of leveraged "long" positions. This created a "cascading effect" where selling triggered more selling.

Global Market Slide: The news didn't just hit crypto; US and European stock futures also slumped, with the Nasdaq 100 retreating as much as 1%.

January Seasonality: Analysts note that mid-January is historically a volatile period as large institutions rebalance portfolios and "shake out" over-leveraged traders after the holiday period.

Current Market Context

The "Fear" Level: While the dip feels sharp (down roughly 2.5% in 24 hours), Bitcoin has stabilized near $92,600.

Support Zone: The price is currently testing a critical psychological level. Maintaining sentiment and price above $92,000 is considered vital for keeping the broader bullish structure intact