Lessons from the Market: The "Never Short" Strategy Faces a Reality Check

Trading is 10% skills and 90% discipline. Today, on January 19, 2026, on-chain data from Hyperinsight gave us a look into the high-stakes world of Ethereum trading

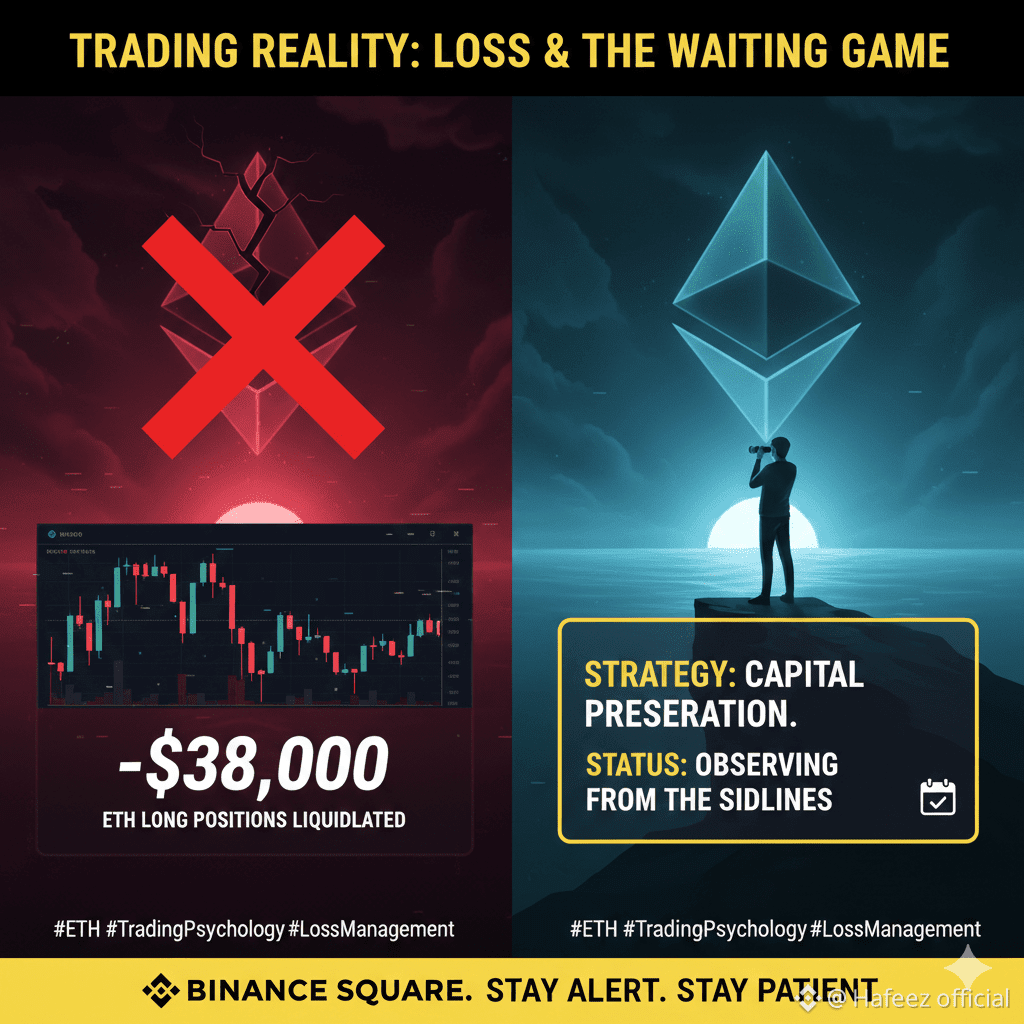

The Story: A $38,000 Setback

A well-known trader, ironically named 'Never Short' (Wallet: 0xe5416), has just closed two Ethereum

$ETH long positions with a total loss of $38,000.

What Happened?

Despite the "bullish" bias in the name, the market's recent volatility caught the trader on the wrong side of the trend.

After taking the hit, the trader has completely exited the market.

Current Status: Observing from the Sidelines 🔭

Currently, 'Never Short' holds zero positions. This is a classic example of "Capital Preservation"—sometimes the best trade is no trade at all.

My Takeaway for You:

Don't Marry Your Bias: Even if your name is "Never Short," you must be flexible when the chart shows a different story.

Know When to Step Back: Taking a loss is part of the game. Stepping back to "observe" rather than "revenge trade" is what separates professionals from gamblers.

Are you currently Long or Short on $ETH ? Let’s discuss the next move below! 👇