INTRO:

The cryptocurrency landscape has rapidly evolved, with stablecoins emerging as a critical component for facilitating global transactions and providing a stable digital asset. However, existing blockchain networks often face challenges in providing efficient, cost-effective, and scalable solutions for high-frequency stablecoin transfers. Issues like high transaction fees on networks such as Ethereum, centralization concerns with others like Tron, and a general lack of specialized functionality for stablecoins hinder their full potential as a global settlement layer. Billions of dollars are spent annually on transaction fees for stablecoin transfers, indicating a clear need for a more optimized infrastructure.

SOLUTION:

Plasma is a Layer 1 blockchain specifically engineered to address these problems by focusing on stablecoin infrastructure and payments. It is designed to be a Bitcoin sidechain, optimizing stablecoin transactions, particularly USDT, by leveraging Bitcoin's security while providing rapid, low-cost, and high-throughput transfers. Plasma aims to become the settlement layer for the global dollar economy by treating USDT and other fiat-backed tokens as its primary workload.

Key Features of Plasma Include

Zero-fee USDT transfers: Plasma utilizes a delay-based prioritization system, allowing users who are willing to wait longer to transfer USDT without fees. This is a significant draw for high-frequency users and aims to attract stablecoin flows.

Bitcoin-anchored security: Plasma anchors its state to Bitcoin, inheriting its robust security while overcoming its speed limitations.

EVM compatibility: Built with Reth, an Ethereum-compatible execution engine, Plasma allows developers to deploy existing Ethereum smart contracts without modification, fostering a familiar environment for dApp development.

High throughput: Plasma utilizes a custom Byzantine Fault Tolerant (BFT) consensus mechanism called PlasmaBFT, inspired by HotStuff, which enables thousands of transactions per second (TPS) with rapid finality.

Evidence:

Plasma has demonstrated significant progress and garnered considerable support:

Funding and Backers: Plasma successfully closed a $24 million funding round led by Framework Ventures and Bitfinex/USD₮0. Its backers include notable figures like Paolo Ardoino (CEO of Tether/CTO of Bitfinex) and Peter Thiel.

Partnerships: Plasma has announced partnerships with major DeFi protocols like Aave, Curve Finance, Ethena Labs, Fluid, Wildcat, and Maple Finance. It has also partnered with Elliptic for compliance solutions.

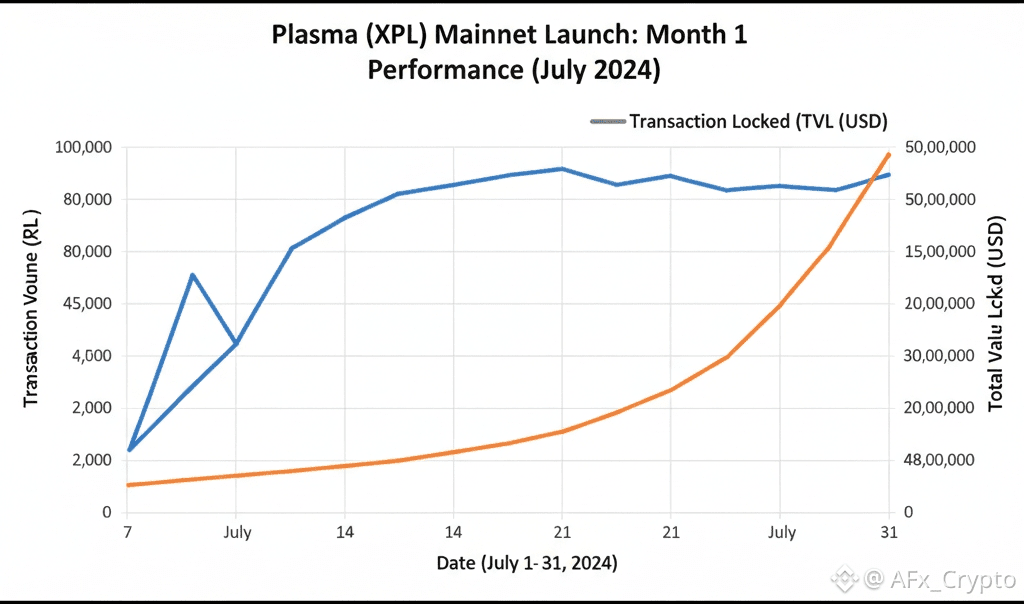

Market Adoption: Plasma saw a remarkable initial uptake, attracting $5.6 billion in deposits within one week of its September 2025 mainnet launch. It became the 8th largest blockchain by stablecoin liquidity at its mainnet beta launch, with over $2 billion in stablecoin total value locked (TVL). In February 2025, the Binance Earn product on Plasma committed $1 billion before its mainnet beta launch. Plasma's mainnet processed 75 million transactions within its first month, accumulating over 2.2 million users.

Market Angle

Plasma directly targets the multi-trillion-dollar opportunity in payments, remittances, and on-chain settlement, aiming to become the gravitational hub for USDT flows. Stablecoins, particularly USDT, have already surpassed traditional payment processors like Visa and Mastercard in on-chain settlement volume, highlighting the immense market potential. Plasma's strategy focuses on attracting flows by offering free stablecoin transfers, then monetizing through higher-value services like DeFi, foreign exchange, and merchant settlement. The XPL token, Plasma's native cryptocurrency, serves as the gas token, staking asset, and reward token for validators, deriving value from network adoption and its monetary premium.

Conclusion

Plasma positions itself as a critical infrastructure for the future of payments by offering a specialized blockchain optimized for stablecoins. By prioritizing zero-fee USDT transfers, leveraging Bitcoin's security, and ensuring EVM compatibility, Plasma aims to tackle the inefficiencies of current stablecoin transaction methods. Its strong partnerships and initial market adoption indicate a promising trajectory. If successful in establishing itself as the primary settlement layer for stablecoins, Plasma could significantly reshape the competitive landscape of the trillion-dollar payment market and become a central hub connecting Bitcoin, stablecoins, and the compliant financial world.