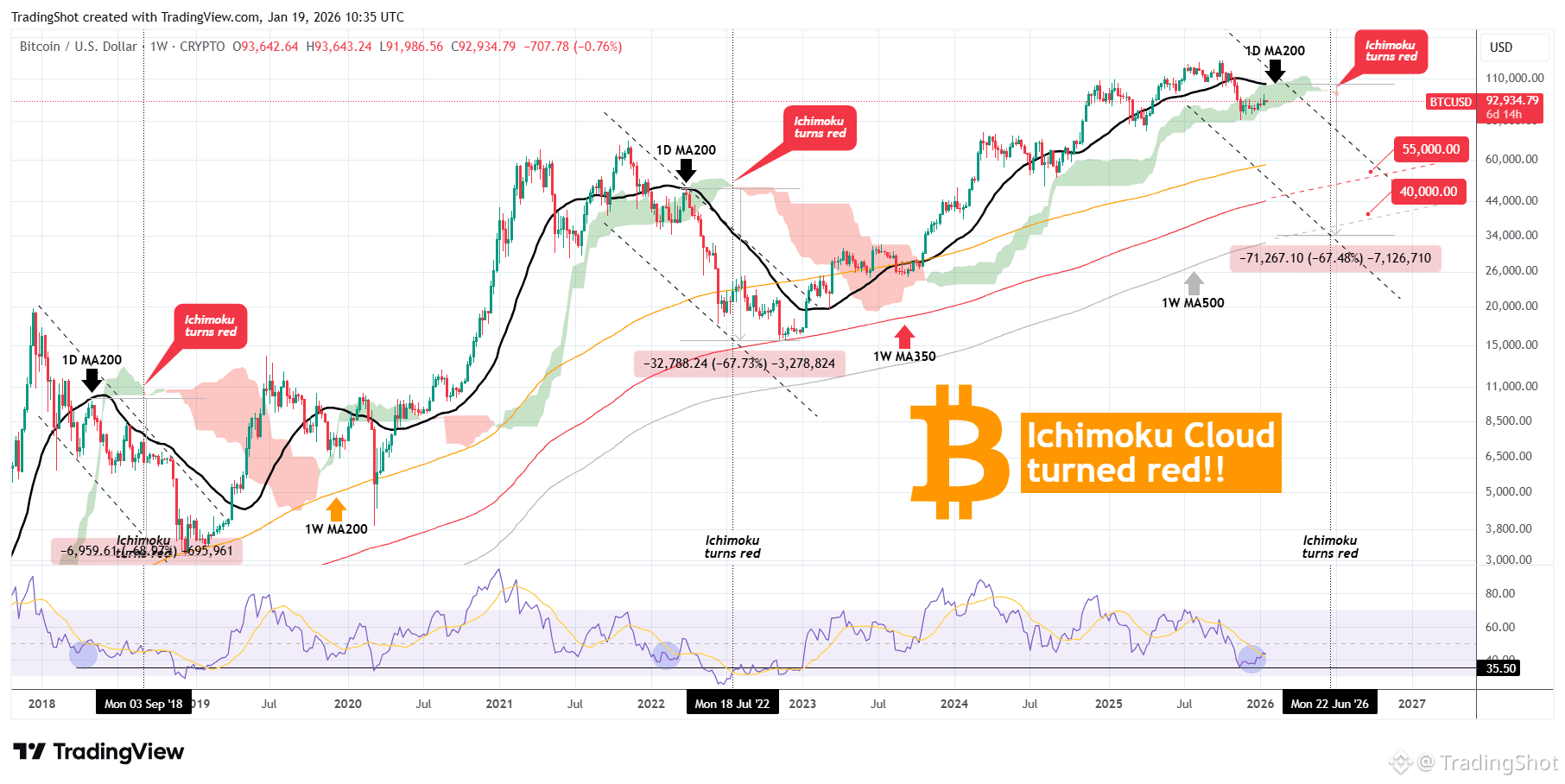

Bitcoin (BTCUSD) has turned its 1W Ichimoku Cloud red following an impressive run of more than 2 straight years of green. Historically, every time this development took place, the market was already on a Bear Cycle.

Technically this is the latest signal to confirm the 2026 Bear Cycle and the last times it took place, BTC bottomed at -68% (on all cases) from the following High rejection on the 1D MA200 (black trend-line). Based on the current position of the 1D MA200 a -68% decline would have the market test $35k.

Since however BTC bottomed on its 1W MA350 (red trend-line) during its last Bear Cycle, we should be expecting to hit it again. Based on its current trajectory, that should take place on $55000 at least. And given the fact that since 2018, every Bear Cycle bottom is a +150 MA lower on 1W (2018 bottom on 1W MA200, 2022 bottom on 1W MA350), we can assume that the 1W MA500 (grey trend-line) could get hit. That creates a potential fair bottom zone within $55000 - $40000, for use of optimistic - pessimistic scenarios.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!