Plasma is positioning itself as a new generation, stablecoin-centric EVM Layer-1 designed to solve a problem that most blockchains still treat as secondary: efficient, scalable, and predictable settlement for stablecoin-based finance. As Plasma enters its mainnet beta phase, the launch brings direct attention to the role of the XPL token, which sits at the core of network security, economic alignment, and long-term ecosystem growth.

At its foundation, Plasma is built as a purpose-driven Layer-1 rather than a generalist chain. While many EVM networks attempt to support every possible use case, Plasma focuses on stablecoin settlement as its primary function. This design choice has important implications. Stablecoins dominate on-chain transaction volume globally, especially in payments, remittances, treasury management, and decentralized finance. By optimizing the base layer specifically for stablecoin flows, Plasma aims to deliver lower fees, faster finality, and more consistent execution costs than multi-purpose chains. This specialization is where XPL gains its strategic relevance, as it becomes the mechanism that secures and coordinates this stablecoin-heavy environment.

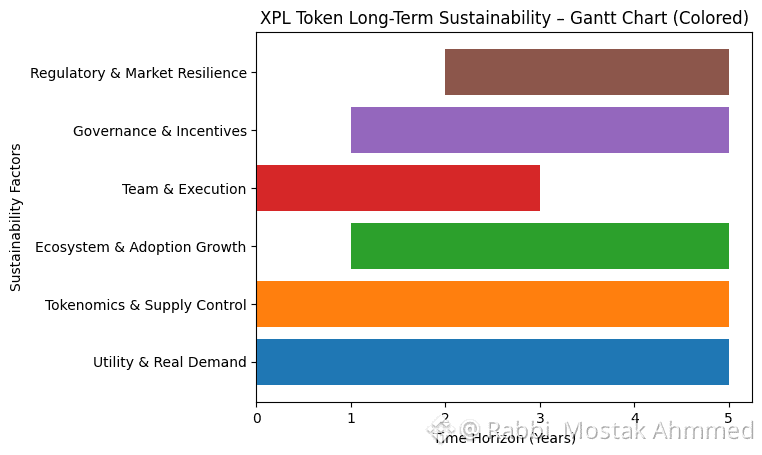

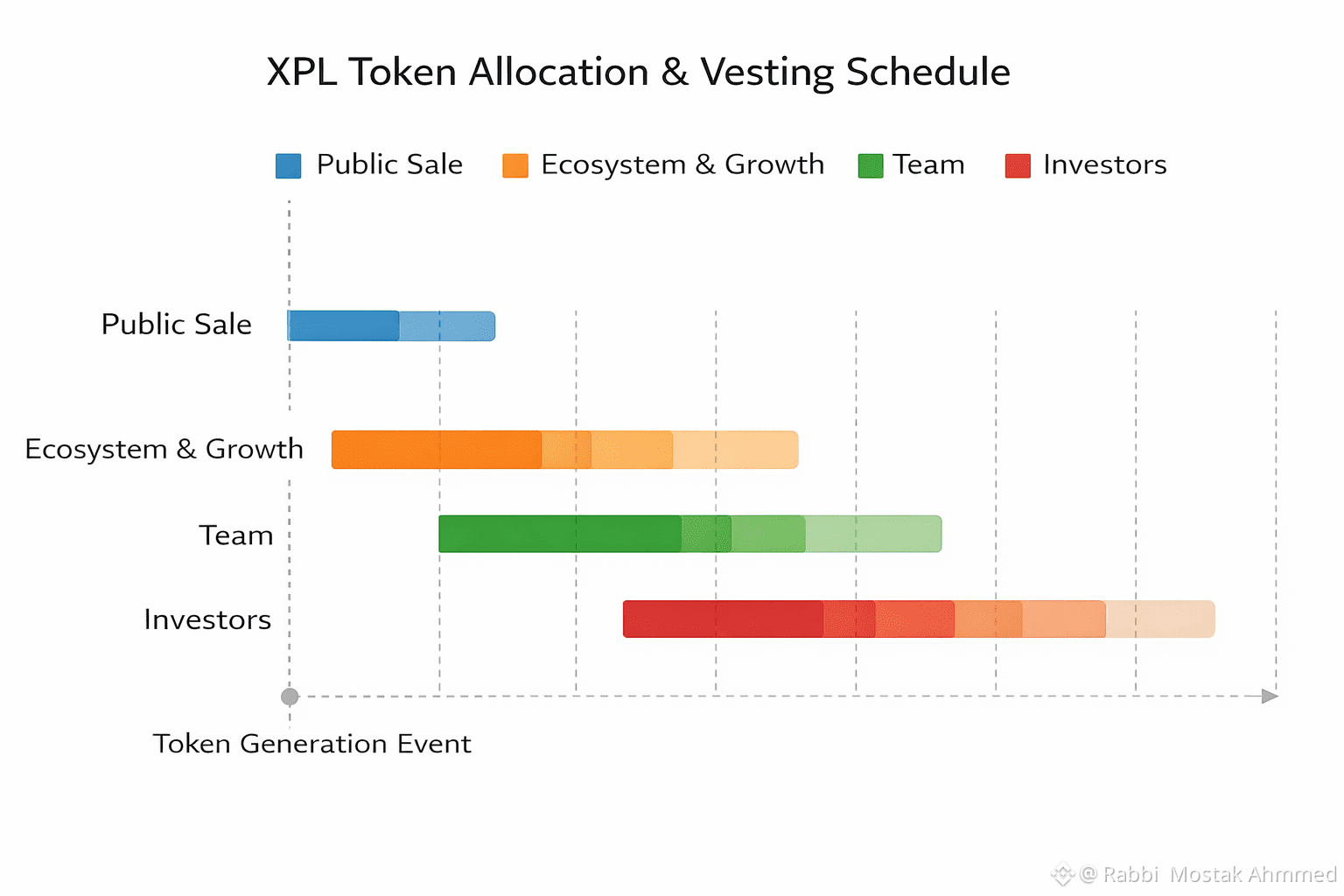

The mainnet beta marks the transition of Plasma from theory to live economic activity. Validators now secure the network using XPL, aligning token holders with the performance and reliability of the chain. In contrast to chains where native tokens are loosely connected to real usage, Plasma’s model ties XPL directly to stablecoin throughput. As stablecoin transactions increase, demand for blockspace and validator participation grows, reinforcing the utility of XPL within the protocol. This creates a clearer value loop between network usage and token demand.

Because Plasma is fully EVM-compatible, developers can deploy existing smart contracts with minimal changes. This is a critical advantage for XPL adoption. DeFi protocols, payment rails, and institutional applications that already rely on Ethereum tooling can migrate or expand to Plasma while benefiting from a settlement layer tuned for stablecoins. XPL plays a central role here by covering gas fees, validator incentives, and governance participation. Over time, this positions XPL not merely as a speculative asset, but as an operational token required for meaningful participation in the ecosystem.

Another defining aspect of Plasma’s design is its appeal to regulated and semi-regulated use cases. Stablecoins are increasingly used by fintech firms, exchanges, and payment providers that require predictable performance and compliance-friendly infrastructure. Plasma’s architecture is designed to support these needs at the protocol level. As adoption grows among such actors, XPL benefits from increased network stickiness, since validators, infrastructure providers, and long-term participants are incentivized to accumulate and stake the token rather than trade it short-term.

From a broader market perspective, Plasma enters mainnet beta at a time when stablecoin volumes often exceed those of native crypto assets in real economic usage. This macro trend strengthens the narrative around XPL as exposure to stablecoin infrastructure rather than general blockchain experimentation. Instead of competing head-to-head with high-throughput chains chasing speculative activity, Plasma positions XPL as a backbone asset for on-chain dollars and similar instruments.

In summary, Plasma’s mainnet beta is not simply a technical milestone. It is the first real test of a stablecoin-centric Layer-1 operating under live conditions. The XPL token is fundamental to this vision, enabling security, coordination, and economic sustainability. If Plasma succeeds in becoming a preferred settlement layer for stablecoins, XPL stands to evolve into a utility-driven asset anchored in one of the most active segments of blockchain finance.