In crypto land it is easy to get caught up in the next hype coin or trend that promises quick gains. But some projects don’t chase short-term buzz. They build deeper, solving real problems that matter for the future of finance. One of those projects is Dusk, a Layer-1 blockchain that launched back in 2018 with a very specific goal — to bring regulated financial infrastructure onto the blockchain without cutting corners on privacy or compliance. In a world where most blockchains were designed for public transparency and speculative assets, Dusk bet on being useful for institutions, regulated markets, and real-world assets. So far that bet looks meaningful and long term.

This article is about why Dusk is different, what makes it valuable, how it works, where it fits in the world of finance and crypto, and why it might matter not just for traders but for real financial markets.

The Problem With Today’s Blockchains and Traditional Finance

Most popular blockchains like Bitcoin or Ethereum were not built with regulated finance in mind. They are open ledgers where all transactions are visible to everyone. That can be great for transparency in public cryptocurrencies, but it is a deal breaker for banks, securities markets, and tokenized bonds or stocks. Traditional finance requires privacy, auditability, compliance with laws like KYC (Know Your Customer), AML (Anti-Money Laundering), MiFID II, MiCA, and GDPR, and predictable settlement finality.

Imagine a stock exchange where everyone could see every trade in real time. Or a bank where your entire balance history is publicly visible. That’s not acceptable in regulated financial systems. And until now, that has blocked institutional adoption of decentralized technology.

This is where Dusk steps in. It is not built for memes, quick DeFi yield farming or NFT hype. It is built from the ground up to solve the gap between blockchain technology and regulated financial markets. It is about real world assets, real settlement, real compliance, and real privacy.

What Dusk Is and What It Aims to Do

At its core, Dusk is a Layer-1 blockchain designed for regulated, privacy-focused financial infrastructure. The founders saw early on that financial markets would not adopt public blockchains unless those networks could protect privacy and meet real regulatory demands. So instead of copying an existing model, they built something custom — a platform that institutions can use without breaking laws or exposing sensitive data.

Dusk combines advanced zero-knowledge proof (ZKP) cryptography with a built-in compliance framework. This means you can prove that transactions are valid without revealing actual transaction details like amounts or account balances. At the same time, regulators or auditors can still gain the information they need through compliant disclosure mechanisms when necessary.

This balance between privacy and compliance is rare in blockchain. Most privacy-focused chains either hide everything (making regulators nervous) or expose everything (making institutions nervous). Dusk finds a middle ground: privacy where it matters and transparency where it’s legally required.

Built From Scratch for Regulated Markets

One of the strongest points in Dusk’s favor is that it was built from scratch with real financial infrastructure needs at its center. It is not just another blockchain with a privacy add-on. The architecture is modular and designed to handle clearing, settlement, issuance, and trading of regulated assets in a way that confident institutions can trust.

It uses advanced cryptography and specialized transaction models that let users choose between private and public transactions. This means banks, brokers, or asset managers can use the blockchain without exposing sensitive information to the public. Yet at the same time there are audit tools for compliance officers or regulators who need oversight.

This is not theoretical. There are multiple technologies at work here:

Zero-knowledge proofs that hide transaction details but still prove correctness.

Confidential smart contracts that protect data while enabling complex financial logic.

Selective disclosure rules so authorized parties can review what is needed for compliance.

A specialized settlement layer and execution layer that separate transaction execution from regulatory checks.

The project also introduces standards like the XSC confidential security contract, which lets tokenized securities be issued and traded in a compliant, private way. That means things like bonds and equity tokens could exist on the blockchain much like they do in traditional finance, but with better efficiency and auditability.

Why Privacy, Compliance, and Real-World Assets Matter

Privacy is more than just a buzzword. For institutions and everyday people, privacy is essential. When you make a bank payment, people do not expect their entire transaction history to be public — and they should not have to. Institutional markets, security token offerings (STOs), and regulated DeFi all require privacy while still obeying disclosure rules. Dusk aims to solve both these needs simultaneously.

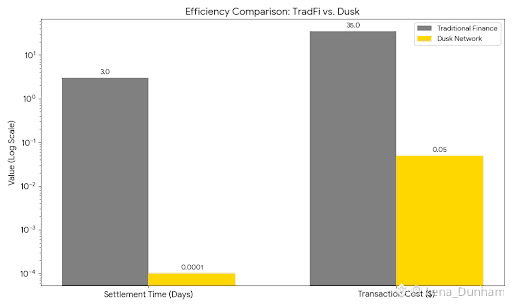

In traditional finance, settlement can take days, involve intermediaries, and create inefficiencies that cost time and money. Dusk’s blockchain offers instant or near-instant settlement, automated compliance, and the ability to outlaw traditional intermediaries because the blockchain itself handles trust and verification in a cryptographically secure way.

This vision does not just help crypto traders or developers. It could change how financial infrastructure works. It could bring securities trading to anyone’s wallet, reduce settlement times from days to seconds, and remove costly intermediaries that have dominated finance for decades.

Strong Partnerships and Real Progress

Dusk is not just theory — it has real momentum and partnerships supporting its growth. The project has relationships with established financial entities in Europe and beyond. For example, it has connections with stock exchanges like NPEX in the Netherlands, where blockchain solutions are being explored for regulated markets.

The network architecture is already being rolled out in testnets and preparations for mainnet. Mainnet launch will mark a major milestone where the first permanent blocks go live, and developers can start building real use cases on the live chain.

Also worth noting: Dusk has been listed on major exchanges, including Binance.US, giving the DUSK token broader access for traders and institutions in regulated markets. This expands liquidity and gives easier access to the token that powers transactions and staking on the network.

What This Means for the Future

There is a long road between building technology and it becoming widely adopted by banks and governments. But Dusk’s focus on regulation, compliance, and privacy positions it well if tokenization of assets becomes mainstream. Whether tokenized bonds, real-world asset trading, regulated DeFi, or institutional settlement, Dusk is building the foundation for that world.

This is not a “flip-to-moon” crypto narrative. It is a story about infrastructure, standards, and bridging two worlds that speak very different languages — traditional finance and decentralized blockchain systems. Dusk is one of the few projects trying to speak both languages fluently. That approach might not make headlines every day, but it might mean real adoption and lasting relevance.

Final Thoughts

Dusk shows how blockchain technology can evolve to meet the needs of regulated markets without losing what makes decentralized systems powerful. By balancing privacy with compliance, and by enabling tokenized assets in a way institutions can trust and regulators can audit, Dusk is building something that could genuinely shift how financial markets operate in the digital age.

For anyone interested in the future of finance — where blockchain and traditional markets intersect — Dusk is a project worth watching. It may not chase every trend, but it is building toward something that could last.