$BITCOIN just fell nearly $4,000 in minutes, and most people are trying to explain it using charts alone. That’s the mistake.

To understand moves like this, you have to follow the flows, not the candles.

During the drop, activity spiked at the same time across major venues — Binance, Coinbase, ETF wallets, Wintermute, and OTC routes. When multiple liquidity sources activate simultaneously, it’s rarely coincidence.

🧩 What Actually Happened

It was late Sunday, when market liquidity is thin

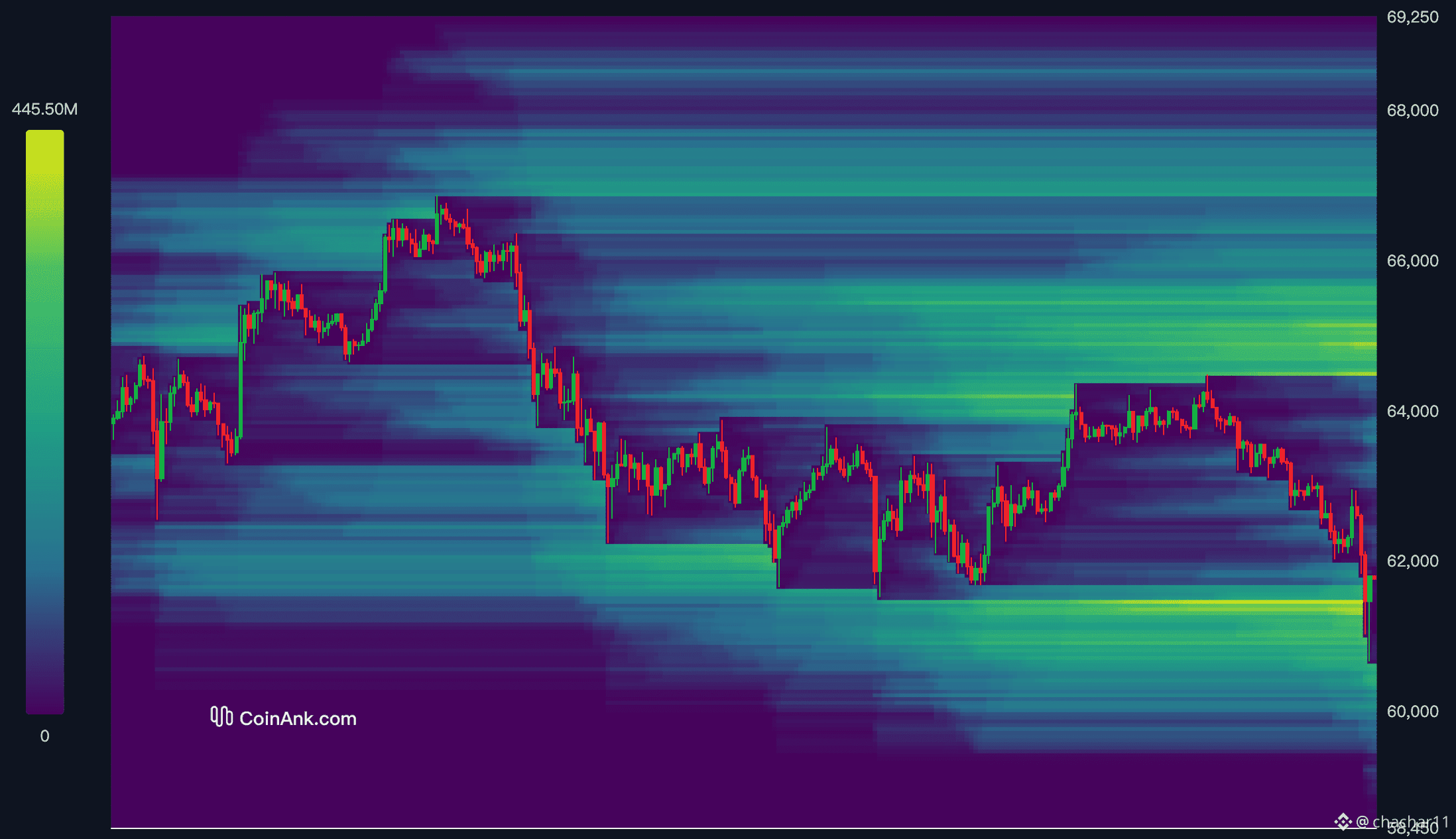

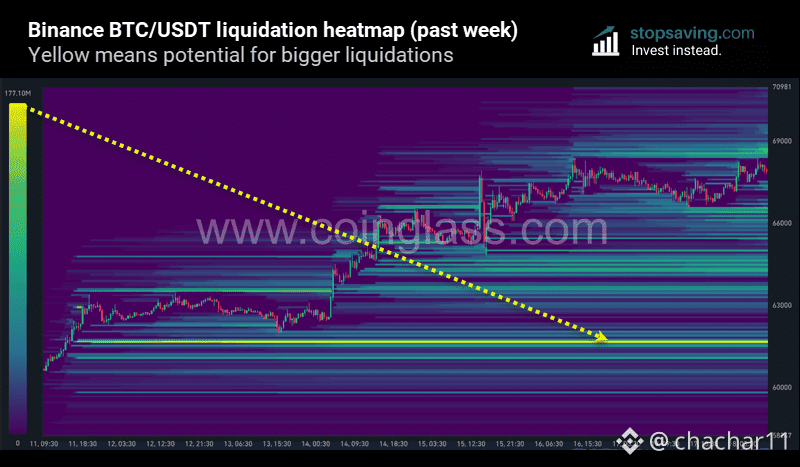

Leverage was crowded on one side

Funding rates were stretched

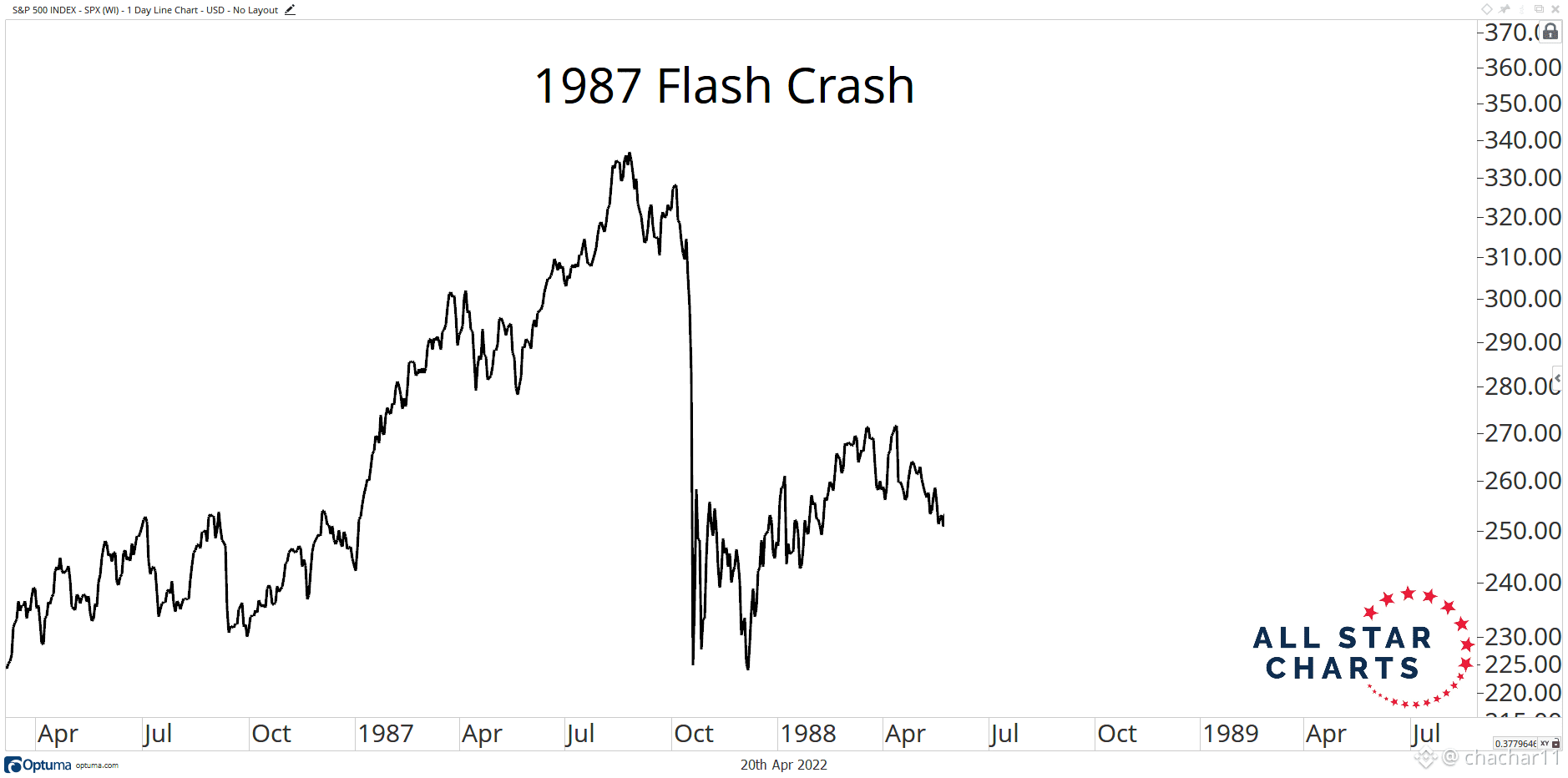

Price was pushed aggressively to trigger liquidations

Once fresh longs were forced out, selling pressure intensified. On-chain data clearly showed coordinated transfers to exchanges and OTC wallets, followed by heavy selling after liquidation levels were hit.

This wasn’t organic selling — it was a liquidity hunt.

🐋 How Big Players Execute

Large players don’t chase price. They move price to the liquidity, force liquidations, then offload size into the volatility they created themselves.

Sources suggest short exposure was built quietly, likely through indirect or hidden wallet structures.

Bitcoin doesn’t move like this because of headlines.

It moves when leverage stacks up and someone with serious capital decides it’s time to reset the market.

📌 What to Watch Going Forward

Funding rates

Open interest

On-chain flows

Price shows emotion.

Data shows intent.

🖼️ Image for This Article

Use a strong visual that reinforces the narrative:

#bitcoin

#WhaleAlert

#CryptoMarket