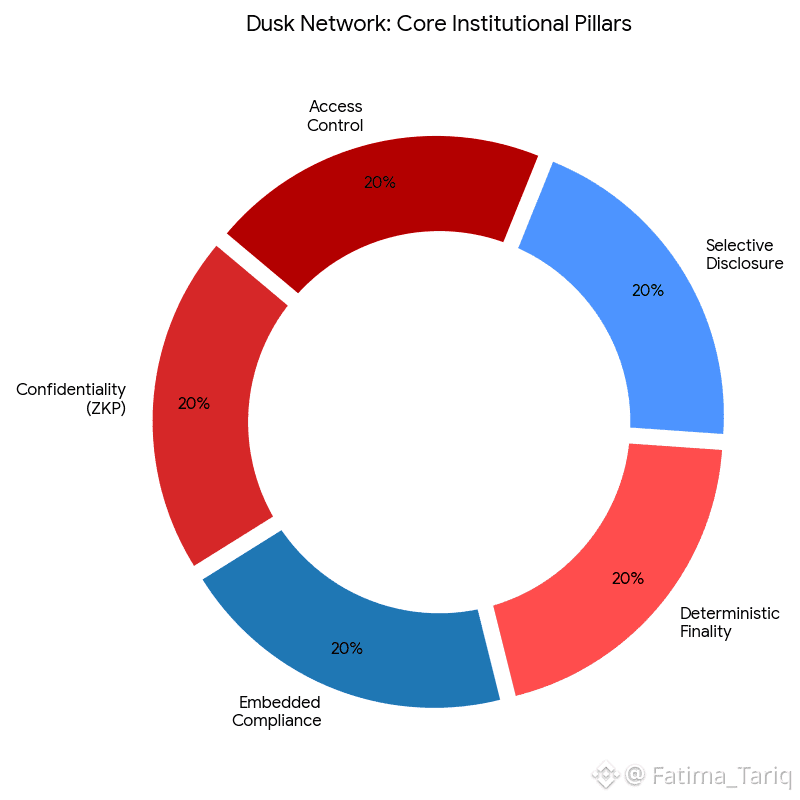

If you’ve spent any time in crypto, you’ve probably noticed the disconnect. Markets reward speed, hype, and narrative momentum. Real finance, on the other hand, cares about very different things: settlement finality, auditability, access control, confidentiality, and regulatory compliance. This mismatch is why so much “institutional adoption” rhetoric feels empty. Institutions aren’t anti-innovation—they’re anti-exposure. Most public blockchains are built to reveal everything by default, while regulated finance is built to disclose only what’s necessary.That’s the gap Dusk Network has been targeting from the start. And it’s why Dusk tends to resurface whenever the conversation shifts away from memecoin cycles and toward tokenized real-world assets and regulated on-chain markets. Dusk’s positioning is narrow but deliberate: a privacy-first Layer 1 designed specifically for financial applications, where confidentiality and compliance coexist by design. Not privacy as an escape hatch—but privacy as core infrastructure for regulated value transfer.Why does that matter? Consider a simple institutional use case. A fund needs to rebalance positions in tokenized securities. On a standard public chain, every transaction becomes a signal. Competitors can infer strategy, counterparties can front-run, and flows can be mapped in real time. In traditional finance, this information is protected because leakage has real economic consequences. Now extend that logic to corporate bonds, equities, private placements, invoices, or structured products. Once these assets move on-chain, privacy isn’t a “nice to have.” It’s mandatory.Dusk’s core thesis is that financial markets require selective disclosure. Transactions should remain confidential, while still being provably compliant. This is where zero-knowledge proofs (ZKPs) become essential. ZKPs allow participants to prove that a transaction is valid—that rules were followed, permissions checked, balances sufficient—without revealing sensitive data like identities, amounts, or counterparties. Dusk has built its architecture around this idea, focusing on confidential smart contracts and privacy-preserving validation as first-class features.What makes Dusk feel genuinely institutional-grade is its treatment of compliance. Most blockchains launch permissionless and attempt to bolt compliance on later through front-end restrictions, blacklists, or off-chain monitoring. Institutions dislike this because it’s fragile. Regulators dislike it because enforcement becomes indirect.

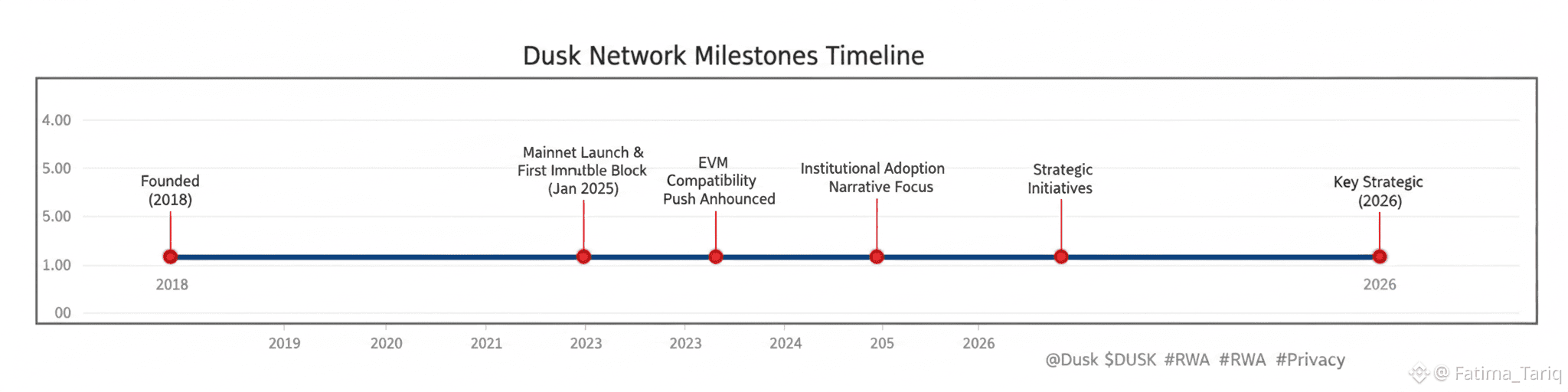

Dusk takes the opposite approach: rules are embedded directly into the infrastructure, while user data remains protected by default. That’s far closer to how regulated financial systems are actually built.From a maturity standpoint, Dusk isn’t a newcomer chasing the latest narrative. Founded in 2018, it has spent years refining a thesis centered on regulated financial infrastructure. A key milestone came in 2025, when the network entered mainnet operations and produced its first immutable block on January 7, 2025. For markets, that date matters. It marks the transition from roadmap to reality—and projects are often re-rated when execution replaces promise.On the technical side, Dusk emphasizes fast settlement and deterministic finality. Its proof-of-stake, committee-based consensus design aims to deliver predictable outcomes once a block is ratified, avoiding the uncertainty of probabilistic confirmations. This kind of design language is deeply finance-native. Traditional markets are built around certainty and finality, not “likely confirmed” states.Interoperability also plays a critical role. No matter how elegant a system is, liquidity and developer tooling exert gravity. That’s why Dusk’s work toward EVM compatibility—often referred to as DuskEVM—has drawn attention.The goal is to let developers reuse familiar Ethereum tooling while adding privacy and compliance primitives that Ethereum itself lacks.

If this layer matures, it significantly lowers adoption friction for builders targeting regulated markets.There’s also a structural point traders often underestimate: regulated assets aren’t just tokens, they’re workflows. KYC and AML checks, transfer restrictions, investor eligibility, reporting obligations, corporate actions, and dispute handling all need to be expressible in code.If a blockchain can’t natively support these constraints, institutions won’t use it. Dusk’s entire value proposition is built around solving this problem—making privacy-preserving compliance usable, not theoretical.So the real investor question remains: does any of this translate into token value?The bullish case is straightforward. If tokenized real-world assets and regulated on-chain finance continue to grow, the market will need settlement layers that support confidentiality without breaking compliance. That’s a short list. Dusk is betting that when on-chain finance becomes serious, it won’t run on chains optimized for memes, NFTs, or experimental DeFi.The skeptical case is valid too. This is a long-cycle market. Institutional adoption doesn’t move at crypto speed. Regulation evolves slowly, integrations take time, and success often favors ecosystems with the strongest relationships—not just the best technology. Competition in privacy and RWA infrastructure is real, and not every asset class will require full confidentiality.The cleanest way to think about Dusk is this: it isn’t trying to win retail DeFi. It’s trying to become the settlement and smart contract layer for compliant markets where privacy is non-negotiable. That’s a narrower target—but if it works, it creates durable, sticky usage rather than fleeting hype.That’s what makes Dusk interesting heading into 2026. It isn’t selling a fantasy version of finance. It’s building toward the regulated, rule-heavy, operationally boring version of finance that actually moves trillions—while still preserving what crypto promised from the beginning: programmable markets, global settlement, and open access, without turning everyone’s financial life into public data.