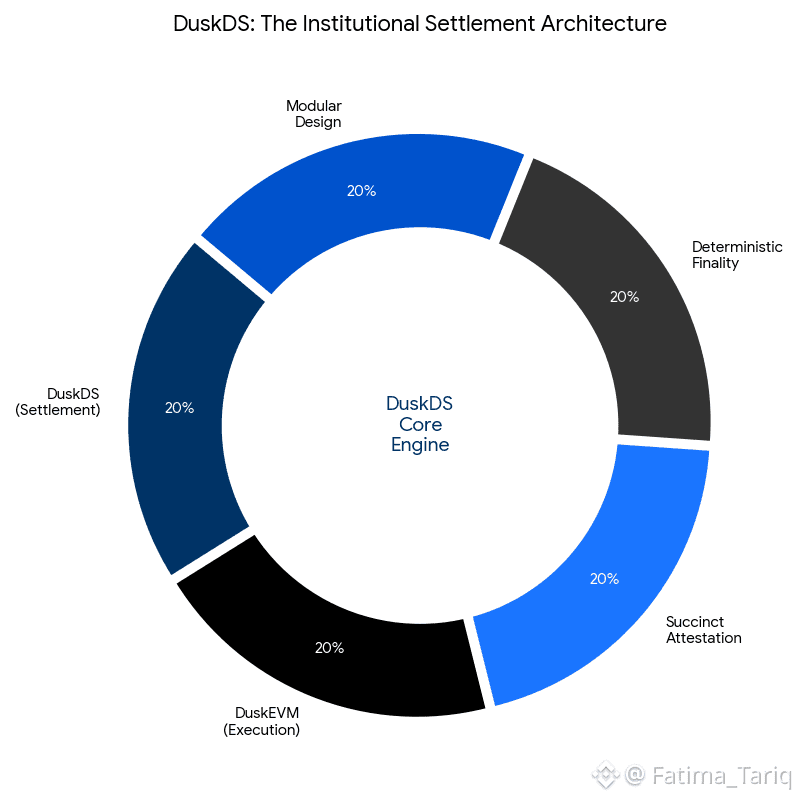

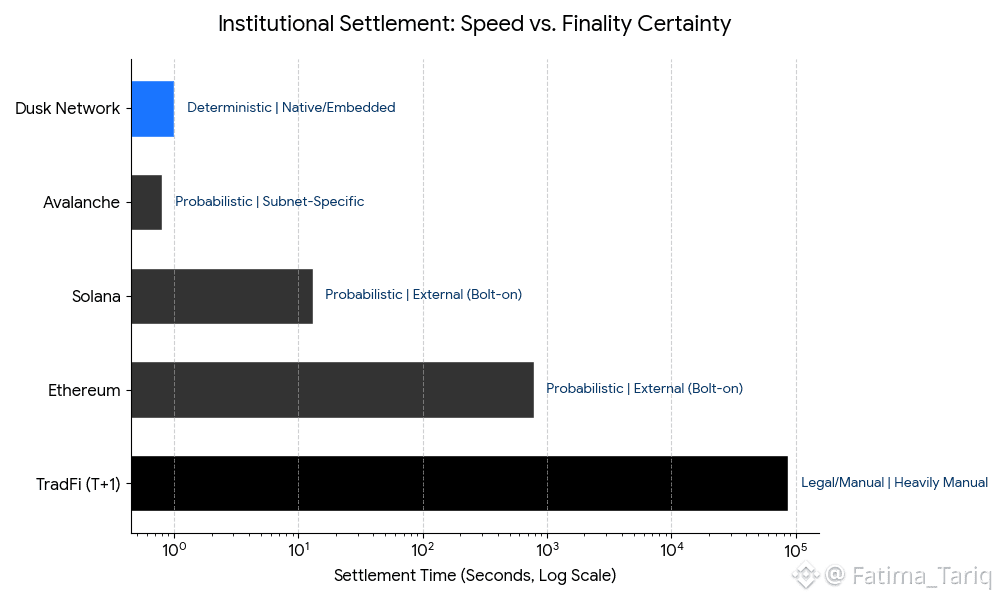

Once you understand Dusk Network properly, it stops looking like “just another Layer 1” and starts looking more like a settlement system that happens to use blockchain rails. That distinction matters. Settlement architecture determines everything downstream—finality guarantees, withdrawal timing, market structure, and whether serious financial activity can operate on-chain without breaking during periods of volatility.Dusk is deliberately modular by design. Rather than forcing a single layer to handle execution, settlement, and security simultaneously, the network separates concerns. At the base sits DuskDS, which functions as the settlement, consensus, and data availability layer. This is the layer that determines canonical truth: transaction ordering, block finality, and network security. Above it lives DuskEVM, an Ethereum-compatible execution environment where smart contracts run. This separation allows developers to deploy familiar EVM-style applications without burdening the settlement layer with execution complexity. In Dusk’s own framing, DuskDS is the “core” that provides security and finality for everything built on top.For traders and investors, the most important question isn’t branding—it’s consensus behavior. DuskDS operates under a Proof-of-Stake model, but its defining feature is an emphasis on fast, deterministic finality rather than probabilistic confirmations. Dusk refers to its approach as Succinct Attestation, a consensus mechanism designed to deliver rapid, final settlement. This matters in practice. Deterministic finality allows predictable withdrawal rules, bridge finalization, and custody workflows. On chains with probabilistic settlement, confirmation risk becomes a real trading cost—especially under stress. Predictability is invisible when things work and painfully obvious when they don’t.

This is where DuskDS becomes more than just a backend. It is explicitly designed as a clean settlement layer for tokenized finance, built to support privacy and compliance constraints without compromising finality. Dusk’s broader thesis aligns with regulated markets and real-world assets, where institutions prioritize consistent settlement guarantees over raw throughput or experimental features.Dusk announced a mainnet launch target of September 20, 2024, followed by a phased rollout. According to Dusk’s own timeline, the network produced its first immutable blocks on January 7, 2025. This distinction matters. Dusk’s mainnet was not a single “flip-the-switch” event, but a gradual transition into a production environment—something that aligns more closely with how real financial infrastructure is deployed.As of today, CoinMarketCap reports roughly $98.6 million in 24-hour trading volume for DUSK across spot markets. This serves as a liquidity proxy rather than a quality signal. As always, traders should examine exchange concentration, venue mix, and wash trading risk rather than relying on headline volume alone. Coinglass data shows derivatives volume significantly exceeding spot volume in recent sessions, indicating that leverage plays a meaningful role in current DUSK price dynamics.Dusk is not a TVL-driven DeFi ecosystem in the conventional sense. Major aggregators do not track Dusk as a DeFi chain with a standardized TVL dashboard comparable to Ethereum L2s or Solana. DefiLlama references Dusk primarily in fundraising data rather than as an active DeFi settlement chain. The honest takeaway is that there is no widely accepted, aggregator-verified TVL metric for Dusk today. Any number cited without a reputable dashboard should be treated as low-confidence. More importantly, TVL is not the correct north-star metric for Dusk—the relevant signal will be whether regulated market activity begins settling on its infrastructure.

According to Dusk’s own bridging documentation, withdrawals between DuskEVM and DuskDS become finalizable after a finalization period and require an additional transaction to complete. In practice, this means withdrawals can take up to roughly 15 minutes. For traders, this introduces a real time cost. Dusk is not designed for instant arbitrage between environments, and bridge latency should be treated as a risk factor during volatile market conditions.DuskDS itself is not a yield-generating engine. It is settlement infrastructure. Returns come primarily from two sources: staking economics (compensation for providing security under a PoS model) and long-term demand for blockspace and settlement as on-chain financial activity grows. Unlike hype-driven ecosystems, Dusk’s long-term value proposition is explicitly tied to institutional usage—tokenized assets, compliant privacy-preserving settlement, and execution environments suitable for regulated finance.DuskDS functions as a risk management layer disguised as blockchain architecture. Its primary controls include deterministic finality, modular separation between settlement and execution, and privacy-compliant design choices that reduce regulatory exposure compared to fully anonymous systems. That said, market-facing risks remain familiar: liquidity fragmentation, bridge delays, exchange concentration, and leverage-driven volatility. Today, DUSK should be viewed as a liquid token market—not yet as a fully matured, fee-generating settlement network.The cleanest way to think about DuskDS is this: it isn’t trying to win crypto by being loud. It’s trying to win by being boring in the exact ways settlement systems must be boring. Finality should be predictable. Withdrawals should have known bounds. Execution should be modular. If Dusk succeeds, it will resemble financial plumbing more than a speculative playground—something traders eventually stop noticing because it simply clears, settles, and works.